Get the free TAX FORECLOSED PROPERTY POLICIES ... - Dallas County - dallascounty

Show details

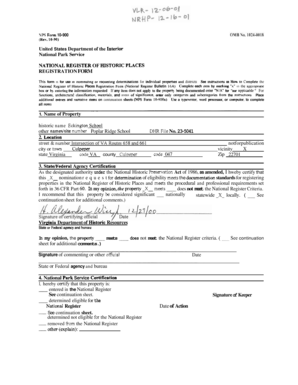

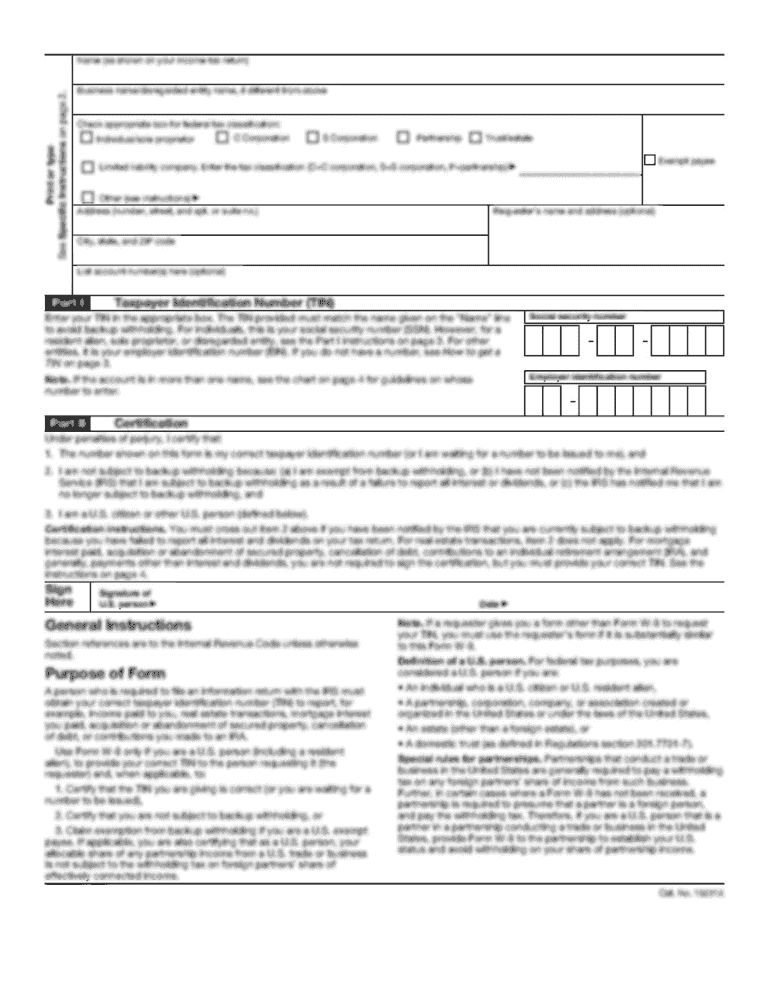

TAX FORECLOSED PROPERTY POLICIES & PROCEDURES COUNTY OF DALLAS Public Works Department- Property Division (Revised August 2011) COUNTY OF DALLAS: Properties with delinquent ad-valorem taxes are foreclosed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax foreclosed property policies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax foreclosed property policies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax foreclosed property policies online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax foreclosed property policies. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

How to fill out tax foreclosed property policies

To fill out tax foreclosed property policies, follow the steps below:

01

Obtain the necessary forms from your local tax office or government agency responsible for handling tax foreclosures.

02

Carefully read the instructions on the forms, ensuring you understand all the requirements and information needed.

03

Gather all relevant documents related to the foreclosed property, such as the deed, tax records, and any previous inspection reports.

04

Fill out the forms accurately, providing the requested information about the property, including its location, size, and any known issues or hazards.

05

Attach any supporting documents as required, such as photographs, appraisals, or valuation reports, to substantiate the information provided.

06

Review the completed forms and supporting documents to verify their accuracy and completeness.

07

Sign the forms and make copies for your records before submitting them to the appropriate tax office or government agency.

Tax foreclosed property policies may be needed by:

01

Investors or individuals interested in purchasing tax foreclosed properties at auction or through other methods.

02

Local governments or municipalities responsible for managing and selling tax foreclosed properties.

03

Real estate professionals, such as realtors or property managers, who deal with tax foreclosed properties on behalf of clients.

Overall, anyone involved in the acquisition, management, or sale of tax foreclosed properties may benefit from understanding and adhering to tax foreclosed property policies.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax foreclosed property policies?

Tax foreclosed property policies refer to the rules and regulations pertaining to properties that have been seized by the government due to non-payment of taxes. These policies outline the procedures for selling or auctioning off these properties to recover the unpaid taxes.

Who is required to file tax foreclosed property policies?

The individuals or entities that are required to file tax foreclosed property policies are the government agencies or departments responsible for the management and sale of tax foreclosed properties. This may vary depending on the jurisdiction and local laws.

How to fill out tax foreclosed property policies?

Filling out tax foreclosed property policies typically involves providing detailed information about the property, including its location, legal description, assessed value, and any outstanding taxes or liens. It may also require the submission of supporting documents such as property deeds and tax records. The specific process and forms to be filled out may vary depending on the jurisdiction.

What is the purpose of tax foreclosed property policies?

The purpose of tax foreclosed property policies is to establish clear guidelines and procedures for the management and sale of properties that have been confiscated due to unpaid taxes. These policies ensure transparency, fairness, and legal compliance in the process of disposing of tax foreclosed properties and recovering the outstanding taxes.

What information must be reported on tax foreclosed property policies?

The specific information required to be reported on tax foreclosed property policies may vary depending on the jurisdiction. However, common details that are typically included are the property's legal description, assessed value, outstanding taxes or liens, and any updates or changes made to the property during the foreclosure process. Supporting documents such as property deeds and tax records may also need to be attached.

When is the deadline to file tax foreclosed property policies in 2023?

The deadline to file tax foreclosed property policies in 2023 may vary depending on the jurisdiction and local laws. It is recommended to consult the relevant government agency or department responsible for tax foreclosed properties to obtain accurate information regarding the specific deadline.

What is the penalty for the late filing of tax foreclosed property policies?

The penalty for the late filing of tax foreclosed property policies may vary depending on the jurisdiction and local laws. It can include financial penalties, additional fees, or the disqualification of the property from being sold or auctioned off. It is important to comply with the filing deadlines to avoid any potential penalties or adverse consequences.

Can I create an electronic signature for signing my tax foreclosed property policies in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax foreclosed property policies and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out tax foreclosed property policies using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax foreclosed property policies. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit tax foreclosed property policies on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute tax foreclosed property policies from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your tax foreclosed property policies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.