Get the free fnb loan application form pdf

Show details

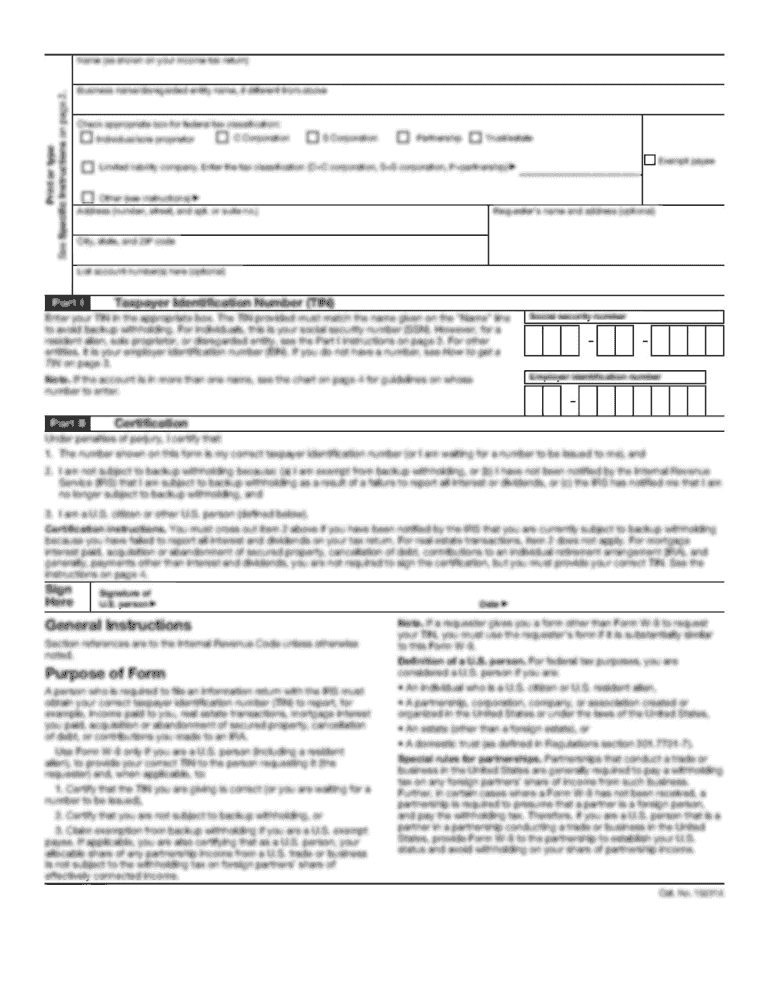

Top-up Debt Protection Plan Application Form Complete the application form below and fax back to 011 352 9904 Your Personal Details Title Full first names Surname Account No. ID No. Telephone (Home)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fnb loan application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fnb loan application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fnb loan application form pdf online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fnb business loan application form pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out fnb loan application form

How to fill out fnb business loan application:

01

Gather all necessary documents such as personal identification, financial statements, business plan, and collateral documents.

02

Complete the application form accurately and provide all required information.

03

Attach supporting documents as requested, ensuring they are properly labeled and organized.

04

Double-check all the information provided for accuracy and completeness.

05

Submit the completed application along with all required documents through the designated channels specified by FNB.

Who needs fnb business loan application:

01

Entrepreneurs looking to start a new business or expand an existing business may need the fnb business loan application to secure the necessary funds.

02

Small business owners who require additional capital to invest in their operations, purchase equipment or inventory, or cover other business expenses can benefit from the fnb business loan application.

03

Established companies that need financial assistance for business growth, hiring employees, or funding large projects may also need to complete the fnb business loan application.

Video instructions and help with filling out and completing fnb loan application form pdf

Instructions and Help about nedbank business loan application form pdf

Fill top up debt protection fnb : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

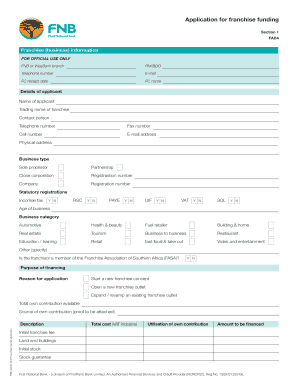

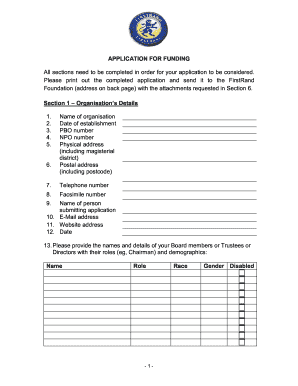

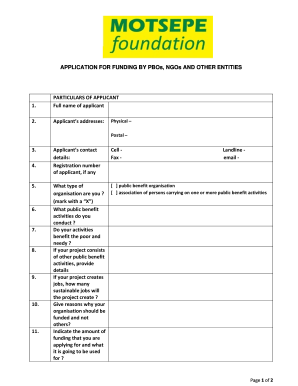

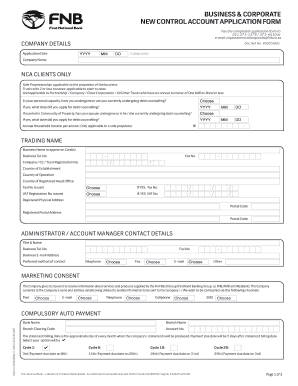

What is fnb business loan application?

FNB Business Loan Application refers to the process of applying for a business loan from First National Bank (FNB). FNB is a financial institution that offers various types of loans, including business loans, to support businesses in their financial needs. The application process typically involves submitting an application form, providing necessary financial documents, and meeting the eligibility criteria defined by FNB. The purpose of the loan could be to start a new business, expand an existing one, purchase equipment or inventory, or for other business-related expenses. The specific loan terms, interest rates, and repayment plans may vary depending on the borrower's creditworthiness and the requirements of FNB.

Who is required to file fnb business loan application?

The individual or entity interested in obtaining an FNB business loan is required to file the application. This could be a business owner, partner, or authorized representative of the business. The application typically involves providing information about the business, its financials, and the loan purpose. The specific requirements may vary depending on the policies and procedures of FNB (First National Bank), as well as the type and amount of loan being sought.

How to fill out fnb business loan application?

To fill out an FNB (First National Bank) business loan application, follow these steps:

1. Gather the necessary documents: Start by collecting all the required documents that FNB will likely need to assess your loan application. This can include items like your business plan, financial statements, tax returns, bank statements, and other supporting documents as specified by the bank.

2. Review the application form: Read through the entire loan application form carefully to understand the information and details FNB requires. Make sure you understand all the sections and the information needed to complete them.

3. Provide business information: Begin by entering your business details, such as the legal name, trading name (if different), contact information, business location, and website (if applicable). Include your business registration number and VAT number if applicable.

4. Provide financial information: Provide accurate financial information about your business. This can include annual revenue, net profit or loss, total assets, and liabilities. Fill in other details like the number of employees, business type, and industry.

5. Describe the loan purpose: Clearly state the purpose of the loan and how it will benefit your business. This could be for expanding operations, purchasing equipment, funding working capital, etc. Be specific and provide any supporting information to reinforce your case.

6. Detail collateral and security: If you are providing collateral or security for the loan, specify it in this section. Include the details of the assets being pledged and their estimated value.

7. Provide personal information: Enter personal details of the business owner(s) or applicant(s). This will include full names, contact information, identification numbers, marital status, and addresses.

8. Disclose liabilities and obligations: Provide information about existing liabilities, such as outstanding loans or debts. This helps the bank assess your ability to handle additional debt.

9. Provide references: FNB may ask for references, such as professional contacts or previous business relationships. Ensure to enter accurate contact information for these references.

10. Review and submit: Review all the entered information to ensure accuracy and completeness. Double-check all details before submitting the application. Some applications may require you to sign and submit a physical copy.

Remember, FNB's loan application process may vary, so it's always a good idea to check their specific requirements and instructions. Contact an FNB representative or visit their website to obtain any additional guidance that you may need.

What is the purpose of fnb business loan application?

The purpose of an FNB (First National Bank) business loan application is to request financial assistance from the bank for various business needs. This application enables business owners or entrepreneurs to outline their funding requirements, financial status, business plan, and other relevant information for the purpose of obtaining a loan. The loan may be used for business expansion, working capital, purchasing equipment, investing in infrastructure, or any other business-related purpose outlined in the application. The application is submitted to the bank for evaluation and, if approved, the loan is disbursed to the applicant to support their business activities.

What information must be reported on fnb business loan application?

When applying for an FNB (First National Bank) business loan, the following information is typically required:

1. Personal Information: This includes the applicant's name, contact information, social security number, and date of birth. Additionally, information about any co-applicants or co-signers may be required.

2. Business Information: Details about the business being financed, such as its name, legal structure (sole proprietorship, partnership, LLC, etc.), industry sector, and purpose of the loan.

3. Financial Statements: FNB usually requires both historical and projected financial statements. This may include income statements, balance sheets, cash flow statements, and tax returns for the business. Financial statements provide insights into the company's financial health and ability to repay the loan.

4. Collateral Details: If the loan requires collateral, the applicant must provide information about the assets being pledged, such as property, inventory, or equipment. This may include documents like property deeds, titles, or valuations.

5. Business Plan: A detailed description of the business plan, including market analysis, competition, sales forecasts, and strategies for growth or expansion.

6. Legal and Regulatory Information: Any relevant legal and regulatory documents, such as licenses, permits, or certifications required for the business.

7. Recent Bank Statements: Applicants are often requested to provide recent bank statements to evaluate their banking history and assess their ability to manage finances.

8. Debt and Credit Information: Information about existing loans or debts, credit history, and credit scores of both the business and individual owners.

9. Personal Guarantees: If required by FNB, personal guarantees from the business owners may be necessary. This ensures that the owners are personally liable for repaying the loan if the business fails to do so.

It's important to note that specific documentation requirements may vary depending on the type and size of the loan, the business's industry, and the bank's lending policies.

When is the deadline to file fnb business loan application in 2023?

Apologies, but I'm unable to provide you with an accurate deadline as I do not have access to specific information about FNB's business loan application deadlines for the year 2023. I recommend contacting FNB directly or visiting their official website for the most up-to-date information regarding their loan application deadlines.

What is the penalty for the late filing of fnb business loan application?

The penalty for the late filing of an FNB business loan application may vary depending on the specific terms and conditions set by FNB. It is best to directly contact FNB or refer to their loan application guidelines for accurate information on any potential penalties for late filing.

How do I make changes in fnb loan application form pdf?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your fnb business loan application form pdf to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my fnb home loan application form pdf in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your fnb start up business loans requirements and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit fnb small business loan requirements straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing fnb business loan form, you need to install and log in to the app.

Fill out your fnb loan application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fnb Home Loan Application Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to fnb bank loans form

Related to business loan application form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.