Get the free state farm release form

Show details

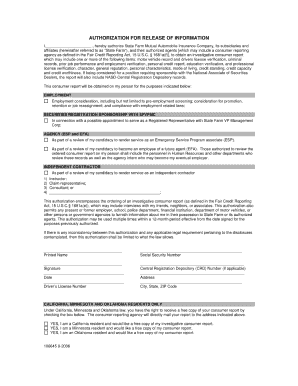

This document is used by State Farm Insurance Companies to obtain consumer reports for employment decisions regarding Canadian applicants. It outlines the authorization of the applicant to release

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state farm property damage release form

Edit your release of credits state farm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state farm release of credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state farm authorization for release of information form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state farm release of information form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state farm forms

How to fill out state farm property damage:

01

Gather all necessary information about the incident, such as date, time, and location.

02

Provide details about the property that was damaged, including its address and a description of the damage.

03

Fill in your personal information, including your name, contact information, and policy number.

04

Document any other parties involved in the incident, such as witnesses or other individuals responsible for the damage.

05

Describe how the damage occurred and provide any supporting documentation, such as photos or videos.

06

Estimate the cost of repairs or replacement for the damaged property.

07

Submit the completed form to State Farm, either online or through mail, according to their submission guidelines.

Who needs state farm property damage:

01

Homeowners who experience damage to their property, such as from a natural disaster or vandalism.

02

Renters who need to report property damage in their rented space.

03

Commercial property owners who need to file a claim for damage to their buildings or assets.

Fill

state farm authorization for release of information

: Try Risk Free

People Also Ask about state farm authorization for release

Is State Farm good at paying home claims?

With a century of experience and an “Excellent” financial strength rating from AM Best, State Farm can reliably pay out claims.

Why does State Farm deny so many claims?

Is State Farm Known for Denying Claims? While U.S. News & World Report has included State Farm on its “Best Car Insurance Companies” list, the company still denies countless legitimate claims yearly. That's because State Farm is focused on protecting its bottom line. Paying claims takes away from company profits.

Can I have the 1 800 number to State Farm?

Rather than considering the actual condition of the lost or destroyed personal property, State Farm uses a standard estimating system known as the “Depreciation Guide.” State Farm's guidelines calculate depreciation based on age and an “average quality” designation; physical condition at the time of the loss is

What are the two main reasons for denying a claim?

Here are the top 5 reasons why claims are denied, and how you can avoid these situations. Pre-certification or Authorization Was Required, but Not Obtained. Claim Form Errors: Patient Data or Diagnosis / Procedure Codes. Claim Was Filed After Insurer's Deadline. Insufficient Medical Necessity. Use of Out-of-Network Provider.

Why insurance claims are rejected?

Omissions or inaccuracies in your insurance application The insurer can reject your claim if they have reason to believe you didn't take reasonable care to answer all the questions on the application truthfully and accurately. A common example is failure to disclose a pre-existing medical condition.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify state farm release form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your state farm release form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete state farm release form online?

Filling out and eSigning state farm release form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit state farm release form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign state farm release form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is state farm authorization for?

State Farm authorization is a form used to grant permission for State Farm to obtain and share specific personal or health-related information regarding an insured individual.

Who is required to file state farm authorization for?

The insured individual or their authorized representative is typically required to file the State Farm authorization.

How to fill out state farm authorization for?

To fill out the State Farm authorization, the individual should provide necessary personal information, details about the specific information being shared, and sign the form to confirm consent.

What is the purpose of state farm authorization for?

The purpose of State Farm authorization is to ensure that the insurance company can legally access required information to process claims, provide services, and facilitate communication with relevant parties.

What information must be reported on state farm authorization for?

The information that must be reported on the State Farm authorization includes the insured's name, policy number, the type of information being authorized for release, and the signature of the individual granting permission.

Fill out your state farm release form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Farm Release Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.