Get the free Unclaimed Superannuation Form - Northern Territory Government

Show details

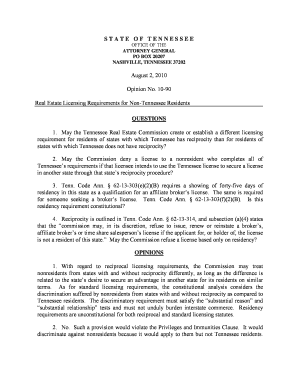

NTG-F18-V03 Unclaimed Superannuation Form Who should use this form? You should complete this form if you are a former employee of the Northern Territory public sector who ceased employment after 1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unclaimed superannuation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unclaimed superannuation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unclaimed superannuation form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unclaimed superannuation form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unclaimed superannuation form?

The unclaimed superannuation form is a document used to claim superannuation benefits that have been left unclaimed by a member. It allows individuals to request the release of their unclaimed superannuation funds.

Who is required to file unclaimed superannuation form?

Any individual who has unclaimed superannuation funds is required to file an unclaimed superannuation form. This includes current or former employees, self-employed individuals, and individuals who have multiple superannuation accounts.

How to fill out unclaimed superannuation form?

To fill out the unclaimed superannuation form, you need to provide personal details such as your name, contact information, TFN (Tax File Number), and details of your superannuation accounts. You may also need to provide proof of identity documents as required by the relevant authorities.

What is the purpose of unclaimed superannuation form?

The purpose of the unclaimed superannuation form is to help individuals claim their unclaimed superannuation funds. It ensures that individuals receive the benefits they are entitled to and helps them consolidate their superannuation accounts.

What information must be reported on unclaimed superannuation form?

The unclaimed superannuation form typically requires the reporting of personal details such as name, address, contact information, TFN (Tax File Number), details of superannuation accounts including the fund name, account number, and balance. Additional information may be required depending on the specific form and jurisdiction.

When is the deadline to file unclaimed superannuation form in 2023?

The deadline to file the unclaimed superannuation form in 2023 may vary depending on the jurisdiction and specific circumstances. It is recommended to refer to the relevant authorities or consult a financial advisor for accurate and up-to-date information.

What is the penalty for the late filing of unclaimed superannuation form?

The penalty for the late filing of the unclaimed superannuation form can vary depending on the jurisdiction and specific regulations. Penalties may include fines, interest charges, or other consequences as determined by the authorities. It is advisable to consult the relevant authorities or seek professional advice to understand the applicable penalties.

How do I modify my unclaimed superannuation form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your unclaimed superannuation form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send unclaimed superannuation form for eSignature?

Once you are ready to share your unclaimed superannuation form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get unclaimed superannuation form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the unclaimed superannuation form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Fill out your unclaimed superannuation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.