UK HMRC NRL1 2010-2025 free printable template

Show details

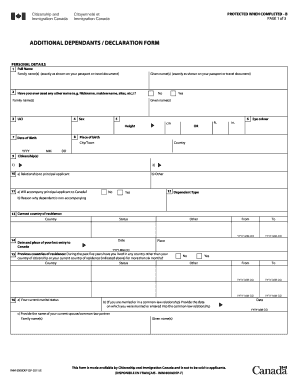

We will then write to tell them not to tax your rent as approval is not transferable. You do not need to fill in another NRL1 form. Before deductions After deductions Please tell us the reference number that was given to your letting agent when they registered with HMRC NA Tax allowance and relief You may be able to get the same tax allowances and reliefs as a UK resident if certain conditions apply. How to fill in this form It will help us if you fill in this form using capital letters....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nrl1 form pdf

Edit your nrl1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk hmrc nrl1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uk non resident application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nrl1 form hmrc. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

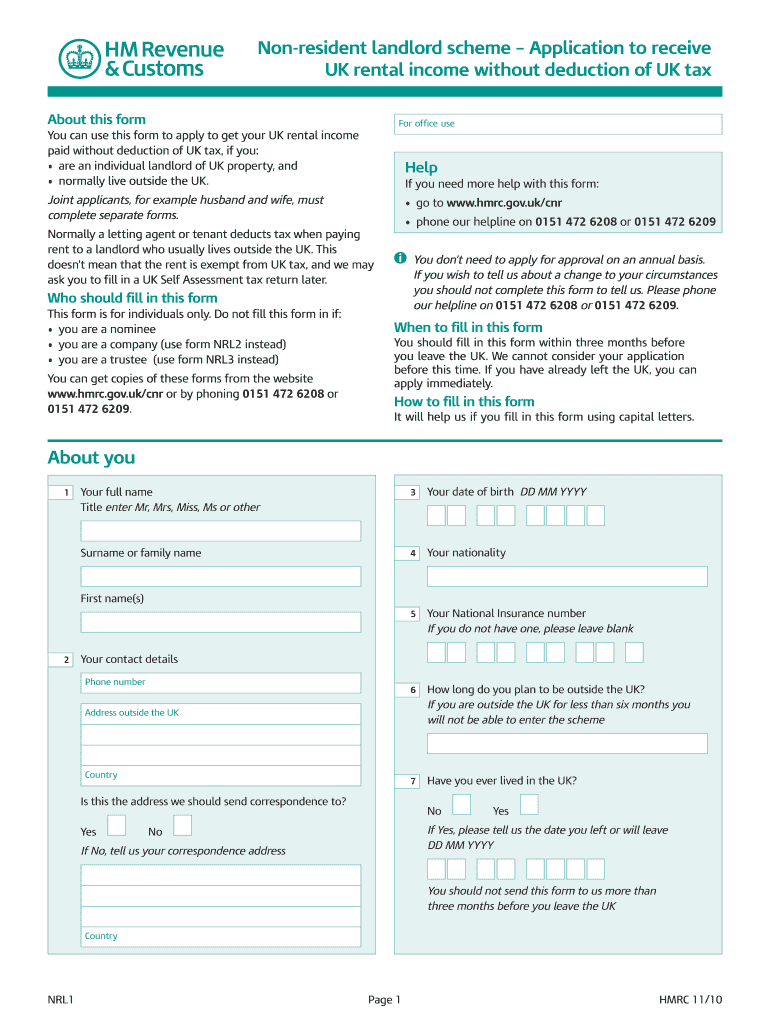

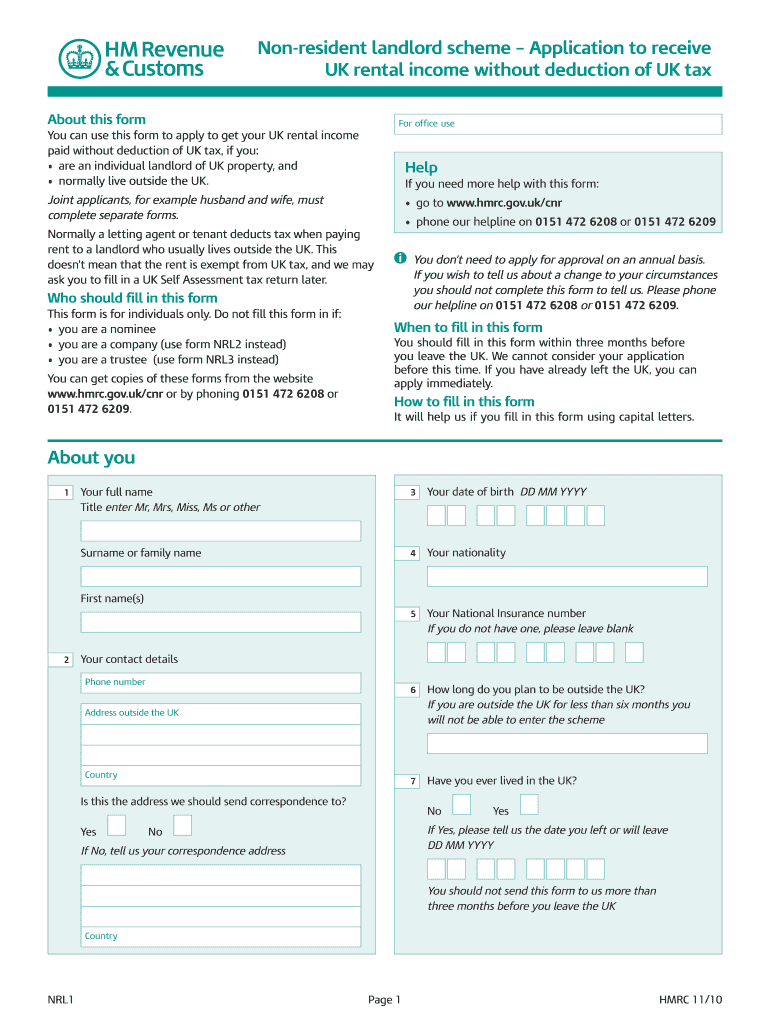

How to fill out hmrc nrl1 non resident landlord application form

How to fill out UK HMRC NRL1

01

Obtain the UK HMRC NRL1 form from the official HMRC website or through a financial advisor.

02

Fill in your personal details in the designated sections, including your name, address, and National Insurance number.

03

Provide information on your residency status and explain why you are applying for Non-Resident Landlord (NRL) status.

04

Complete the section regarding your rental income, including any deductions or allowances you are eligible for.

05

Indicate how you wish to receive your rental income (e.g., through your UK bank account or overseas account).

06

Check the form for accuracy, and ensure all required signatures and dates are included.

07

Submit the completed form to HMRC, either online through their portal or by mail.

Who needs UK HMRC NRL1?

01

Non-resident landlords who receive rental income from UK properties need to fill out the UK HMRC NRL1 form.

02

Foreign individuals or entities that own UK rental properties and wish to receive their rental income without tax deductions at source.

Fill

hmrc nrl1 application

: Try Risk Free

People Also Ask about hmrc nrl1 non resident application

What is a non-resident landlord in the UK?

A company is a 'non-resident landlord' if it receives income from renting UK property and either: its main office or business premises is outside the UK. it's incorporated outside the UK.

What is the tax rate for non-resident landlords in Ireland?

Where rents are paid directly by a tenant to a non-resident landlord, the tenant is obliged to deduct tax at the standard rate of income tax (currently 20%) from the payment. That means 80% of the rent is paid to the non-resident landlord and 20% is paid to the Irish Tax Authorities.

Do I have to register as a non resident landlord?

Non-resident landlords have an obligation to register with HMRC and are taxable in the UK on profits derived from UK property. Most non-resident landlords will prefer to seek and obtain HMRC approval in order to receive rental income without basic rate tax deducted.

What is a non resident landlord form?

The NRL1 form is for Non Resident Landlords who pay tax on rental income in the UK. As a non resident landlord you are still liable to pay UK tax on your rental income in the UK. Usually your letting agent or tenant has to deduct tax before you receive your rental payments.

What is the HMRC guidance for non resident landlords?

The Scheme allows non-resident landlords to apply to HMRC to have their UK rent paid to them gross. HMRC approves such applications on the understanding that the non-resident landlords will self assess at the end of the year to determine whether they have any liability on the rent.

How do I register for the non resident landlord scheme?

Letting agents should register with HMRC's Non-Resident Landlord Scheme within 30 days of the start of a tenancy. To do this, letting agents complete and file an NRL4i form. By July 5, agents should send a rent report to HMRC on a NRLY form and a NRL6 form to the landlord.

Do overseas landlords pay UK tax?

A landlord who lives abroad for more than 6 months of the year must pay tax on any income they get from renting out property in the UK. If the landlord is a company or trustee, the rules about their usual place of abode apply. The tax is collected using the Non-resident Landlord Scheme.

How much tax does a non-resident landlord pay in the UK?

Non-resident landlords should also file a UK Tax Return with HMRC at the end of each tax year to report taxable profit/loss.Income tax payable on UK property income. Income tax bandIncome tax rate£0 to £31,785Basic rate20%£31,786 to £150,000Higher rate40%Over £150,000Additional rate45%

What is a non-resident landlord?

What is the Non-Resident Landlord Scheme (NRLS)? The NRLS is a scheme to tax the UK rental income of persons who have a usual place of abode outside the UK – known as non-resident landlords. The NRLS imposes obligations on the tenant or the letting agent (if there is one).

What is a non-resident landlord UK?

A company is a 'non-resident landlord' if it receives income from renting UK property and either: its main office or business premises is outside the UK. it's incorporated outside the UK.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete hmrc nrl1 scheme online?

Easy online united kingdom nrl1 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in hmrc nrl1 non resident landlord?

The editing procedure is simple with pdfFiller. Open your non resident landlord application form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit non resident landlord scheme application on an iOS device?

Create, edit, and share nrl1 non resident from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is UK HMRC NRL1?

UK HMRC NRL1 is a form used by non-resident landlords in the UK to apply for approval to receive rental income without having tax deducted at source.

Who is required to file UK HMRC NRL1?

Non-resident landlords who receive rental income from UK properties and wish to have that income paid without tax deduction must file UK HMRC NRL1.

How to fill out UK HMRC NRL1?

To fill out UK HMRC NRL1, landlords must provide personal details, information about the property, and their bank account details, ensuring all sections are completed accurately.

What is the purpose of UK HMRC NRL1?

The purpose of UK HMRC NRL1 is to allow non-resident landlords to receive their rental income without tax deductions by obtaining HMRC's approval.

What information must be reported on UK HMRC NRL1?

The information that must be reported on UK HMRC NRL1 includes personal identification details, property address, rental income details, and bank account information for payment.

Fill out your UK HMRC NRL1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

nlr1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to hmrc nrl1 landlord application

Related to uk nrl1 application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.