Tax Code section 6662 applies to gifts from the estates. ETC section 2441(h)(5) does not apply.

See the text below as it pertains to the gifts.

26. (a) The provisions of Section 6662 with respect to gifts from the estates (or from trusts to the benefit of former spouses or widows) are hereby combined and read in conjunction with the other applicable rules and provisions of this chapter.

(b) With respect to a gift of property or the gift of a life annuity beginning after December 31, 2006, a determination is required as to the application of Section 2441(c)(4)(B)(ii) only if the property has been held for at least 5 years and the recipient was a covered life beneficiary under a group health plan, if any, for at least 5 years and no person was a covered life beneficiary under this plan while under the age of 62 at the time of the payment as evidenced by, (1) a certificate of income, loss, or death showing the date of the payment, (2) a certificate of life insurance of the value of the gift, or (3) a document described in Section 2441(b).

It's quite clear what is going on here: Section 2441(c) gives “Life Insurance” to people under 62 at the time of the death, so Section 2441(b) says “For any gift of property from the Estate, this section applies to the Gifts.” In other words, the “Death” applies to this “Gift, but not to Gifts from the Estate,” which means there is no death penalty on gifts in the Estate. Here is the relevant part of 26(b):

(b) For the purposes of this section, any death penalty under Section 2441, Section 2442, or Section 2441D may have no application to a gift of any property where a beneficiary under the plan at the time of the death is under the age of 62 and, (1) the property was in the estate with the beneficiary (or the beneficiary is within 2 years of reaching his/her 62nd birthday) as a beneficiary; or (2) the beneficiary is a covered life beneficiary as defined in subsection (a) below and the property was provided in connection with a group health plan.

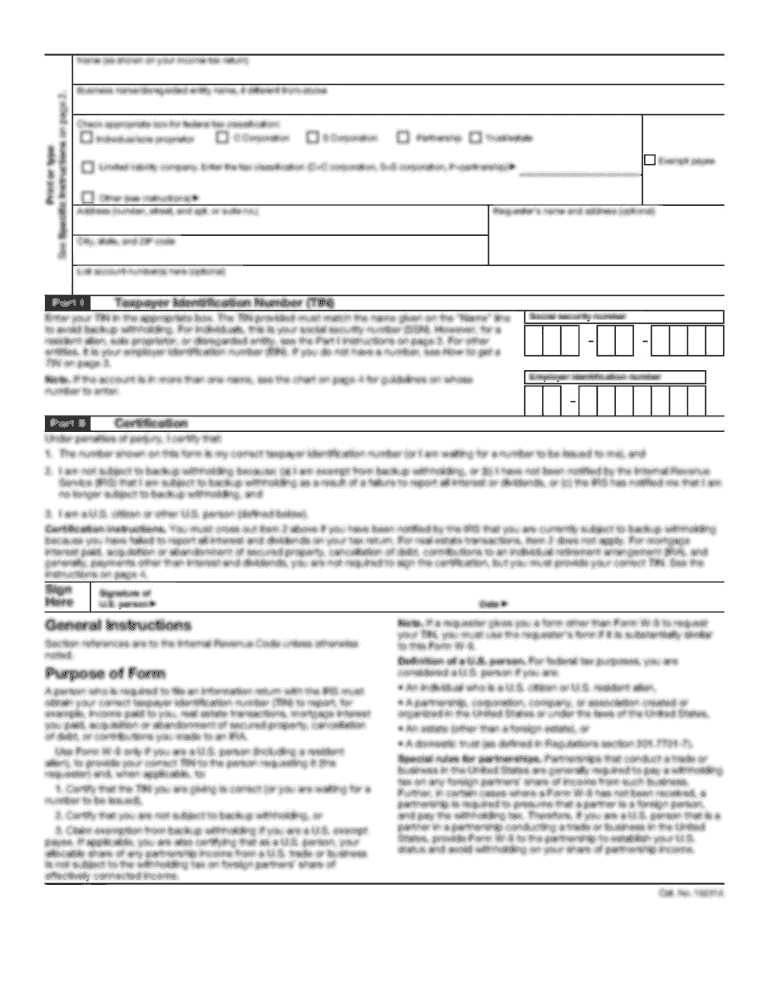

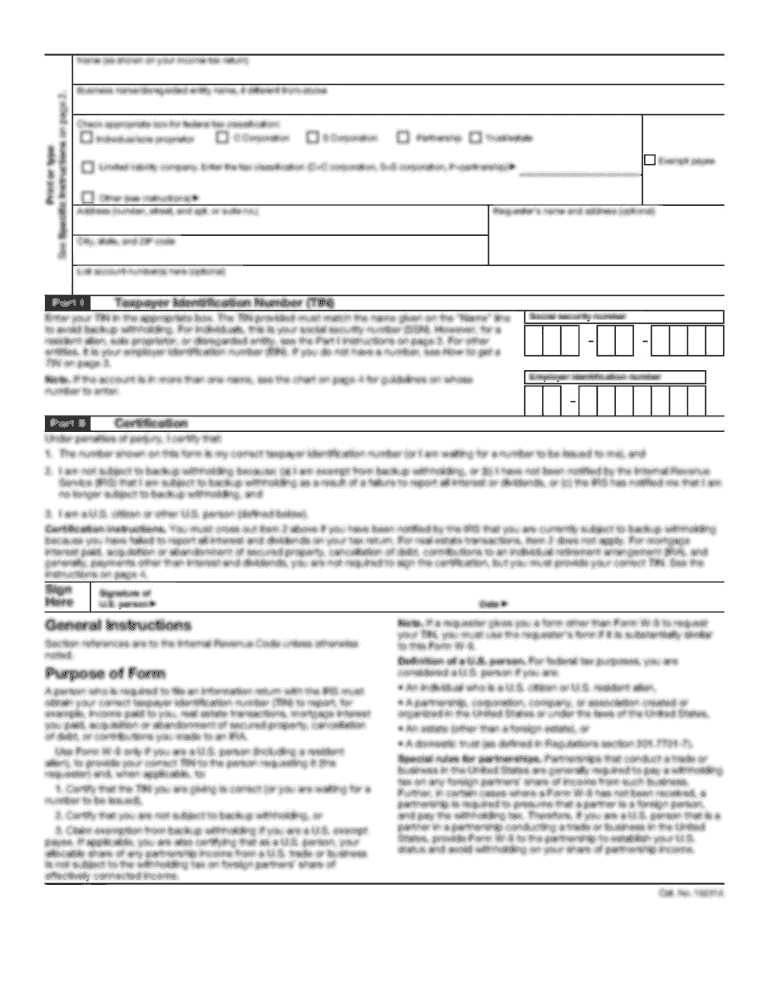

Get the free Form 8302 (Rev. December 2009) - Internal Revenue Service

Show details

Form 8302. (Rev. December 2009). Department of the Treasury. Internal Revenue Service. Electronic Deposit of Tax ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8302 rev december form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8302 rev december form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8302 rev december online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8302 rev december. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8302 rev december?

Form 8302 rev december is a tax form used by taxpayers to request the direct deposit of their tax refund into more than one account.

Who is required to file form 8302 rev december?

Taxpayers who want to split their tax refund into more than one account are required to file form 8302 rev december.

How to fill out form 8302 rev december?

To fill out form 8302 rev december, taxpayers need to provide their personal information, such as name, social security number, and address. They also need to provide the necessary account information for the direct deposit.

What is the purpose of form 8302 rev december?

The purpose of form 8302 rev december is to allow taxpayers to split their tax refund into multiple accounts for direct deposit.

What information must be reported on form 8302 rev december?

Taxpayers must report their personal information, including their name, social security number, and address. They also need to provide the account information for the direct deposit, such as the bank name, account number, and routing number.

When is the deadline to file form 8302 rev december in 2023?

The deadline to file form 8302 rev december in 2023 is typically April 15th, but it is always recommended to check with the IRS for any specific changes or updates to the deadline.

What is the penalty for the late filing of form 8302 rev december?

The penalty for the late filing of form 8302 rev december may vary depending on the specific circumstances. It is advised to consult the IRS guidelines or a tax professional for accurate information on late filing penalties.

How can I modify form 8302 rev december without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your form 8302 rev december into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out form 8302 rev december using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form 8302 rev december and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out form 8302 rev december on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 8302 rev december from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your form 8302 rev december online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.