O. Box number of issuer's principal place of business or, if none, street address) State and ZIP code Telephone number of issuer's principal place of business Telephone number of Issuer's principal place of business (if applicable) DTC number (if applicable) Type of report(s) required (include any attachments if available) Attachments First Report (if the issuer is a qualified corporation) First report of any type (including amendments) Second (if the issuer is a small business) Third (if the issuer is both a qualified corporation and a small business) OMB Control Number.

(if applicable) Telephone number of issuer's principal place of business Telephone number(s) of issuer's principal place of business (if available) DTC number (if applicable) File number Type of report(s) required (include any attachments if available) Attachments First Report (if the issuer is a qualified corporation) First report of any type (including amendments) Second (if the issuer is a small business) Third (if the issuer is both a qualified corporation and a small business) OMB Control Number

(if applicable) Telephone number of issuer's principal place of business Telephone number(s) of issuer's principal place of business (if available) DTC number

(if applicable) File number Type of report(s) required (include any attachments if available) Attachments First Report (if the issuer is a qualified corporation) First report of any type (including amendments) Second (if the issuer is a small business) Third (if the issuer is both a qualified corporation and a small business) OMB Control Number

(if applicable) Telephone number of issuer's principal place of business Telephone number(s) of issuer's principal place of business (if available) DTC number (if applicable) File number

1. See page 3 of the Internal Revenue Manual for information about the reportable event and the required attachments. For example, a CCS is required if the issuer is a small business even if the primary place of business of the issuer is outside the state where the state issued the certificate of registration or has no resident commissioner of the state.

2. A CDS is not required if the issuer is a corporation, but the issuer is a corporation that does business in three or more states.

3.

Get the free form 8330

Show details

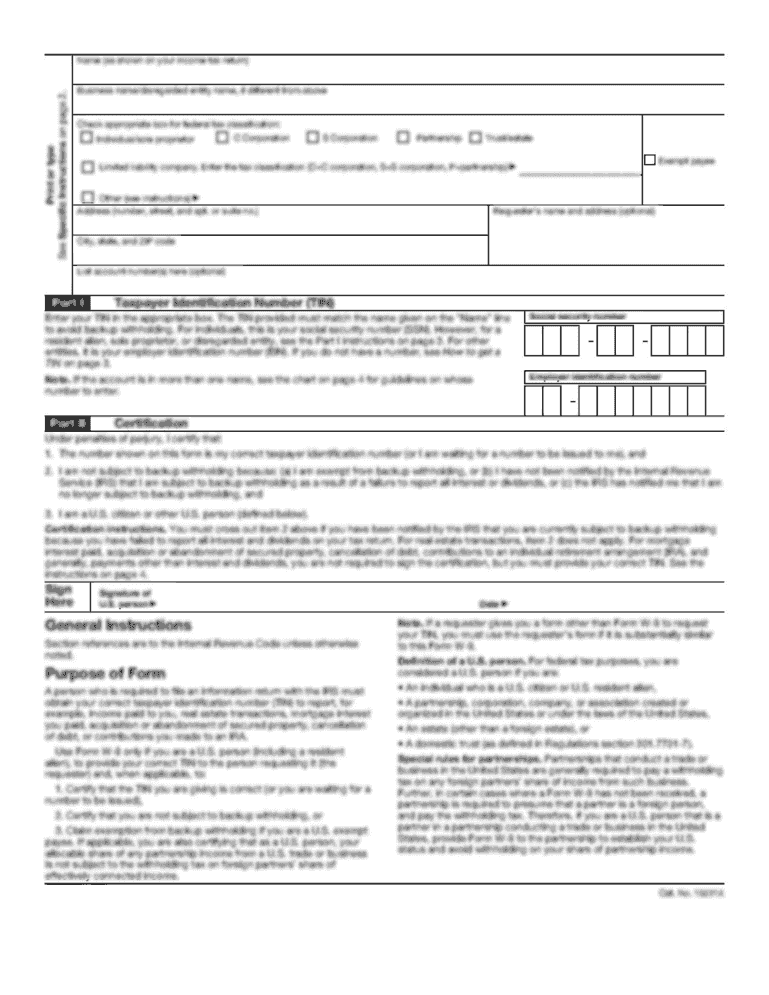

The penalty is 200 for each MCC required to be reported on Form 8330. The maximum penalty is 2 000. Include the total amount of the MCCs listed on the separate sheet s only on line 7 of the Form 8330. Do not report a reissued MCC on Form 8330. A reissued MCC is considered to be a continuation of the original MCC. If additional space is needed attach a separate sheet in the same format as lines 1 through 6 of Part II of this Form 8330. The return ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Fill form : Try Risk Free

Fill out your form 8330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.