Get the free reportable transaction disclosure missouri form - irs

Show details

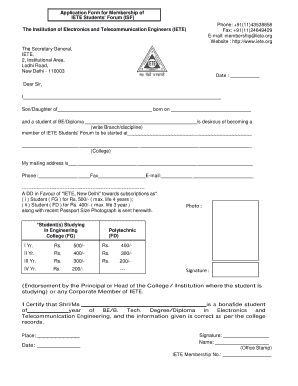

Form (March 2003) 8886 Reportable Transaction Disclosure Statement Attach to your tax return. See separate instructions. OMB No. 1545-1800 Attachment Sequence No. Identifying number Department of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your reportable transaction disclosure missouri form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reportable transaction disclosure missouri form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reportable transaction disclosure missouri online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reportable transaction disclosure missouri. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out reportable transaction disclosure missouri

Point by point, here is how to fill out the reportable transaction disclosure in Missouri:

01

Obtain the necessary form: The reportable transaction disclosure form can typically be found on the website of the Missouri Department of Revenue or obtained directly from the department.

02

Provide taxpayer information: Fill out the required fields on the form, including your full name, address, social security number, and/or taxpayer identification number. This information helps identify the individual or entity reporting the transaction.

03

Describe the transaction: Clearly describe the nature and details of the reportable transaction. Include the date of the transaction, the parties involved, and any relevant monetary amounts or assets exchanged.

04

Determine the reportable event category: Review the list of reportable transaction categories provided in the form's instructions. Select the appropriate category that best describes the transaction you are reporting. Examples of reportable events may include certain tax shelters, listed or confidential transactions, or other specific types of transactions identified by the IRS.

05

Provide additional details: If required, provide any additional information or explanations requested on the form. This may include supporting documentation, analysis, or clarifications regarding the reportable transaction.

06

Attach supporting documents: If applicable, provide any supporting documentation that helps validate or clarify the reportable transaction. This may include contracts, agreements, invoices, or other relevant documentation.

07

Review and sign the form: Carefully review all the information provided on the form to ensure accuracy and completeness. Once satisfied, sign and date the form, confirming the truthfulness and accuracy of the information provided.

Who needs reportable transaction disclosure in Missouri?

01

Taxpayers participating in transactions falling within the reportable event categories specified by the Missouri Department of Revenue.

02

Individuals or entities involved in transactions that meet the criteria for reportable events, as defined by the Internal Revenue Service (IRS) regulations.

03

Entities or individuals who engage in transactions that may have certain tax implications and are required to disclose these transactions to the Missouri Department of Revenue under state law.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is reportable transaction disclosure missouri?

Reportable Transaction Disclosure Missouri is a reporting requirement for certain transactions as specified by the Tax Department of Missouri. It is designed to ensure transparency and compliance with tax laws.

Who is required to file reportable transaction disclosure missouri?

Any taxpayer, including individuals, corporations, partnerships, or other entities, who has engaged in reportable transactions as defined by the Missouri Tax Department, must file the reportable transaction disclosure form.

How to fill out reportable transaction disclosure missouri?

To fill out the reportable transaction disclosure form, taxpayers should provide detailed information about the reportable transaction, including dates, amounts, parties involved, and any relevant supporting documentation. The form can be obtained from the Missouri Tax Department's website and must be submitted according to the specified instructions.

What is the purpose of reportable transaction disclosure missouri?

The purpose of reportable transaction disclosure Missouri is to identify potentially abusive or tax-evasive transactions and ensure compliance with tax laws. It helps the Tax Department of Missouri monitor and address tax avoidance strategies, maintain fairness in the tax system, and protect the state's revenue.

What information must be reported on reportable transaction disclosure missouri?

The reportable transaction disclosure Missouri requires taxpayers to provide detailed information about the transaction, including the nature of the transaction, identification of all parties involved, the amount or value of the transaction, and any other required information as specified by the Missouri Tax Department.

When is the deadline to file reportable transaction disclosure missouri in 2023?

The exact deadline to file the reportable transaction disclosure Missouri in 2023 will be determined by the Missouri Tax Department and communicated to taxpayers. It is advised to regularly check the department's website or contact them for the most up-to-date information.

What is the penalty for the late filing of reportable transaction disclosure missouri?

The penalty for late filing of reportable transaction disclosure Missouri is determined by the Missouri Tax Department and may vary depending on the severity and duration of the delay. It is important to comply with the filing deadline to avoid any potential penalties or fines. Taxpayers should consult the department's guidelines or seek professional advice for specific penalty details.

How do I edit reportable transaction disclosure missouri straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing reportable transaction disclosure missouri.

How do I fill out the reportable transaction disclosure missouri form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign reportable transaction disclosure missouri and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out reportable transaction disclosure missouri on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your reportable transaction disclosure missouri. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your reportable transaction disclosure missouri online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.