Get the free Form SS-4PR (Rev. February 1998) (Espanol). Solicitud de Numero de Identificacion Pa...

Show details

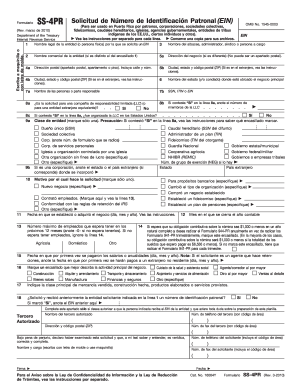

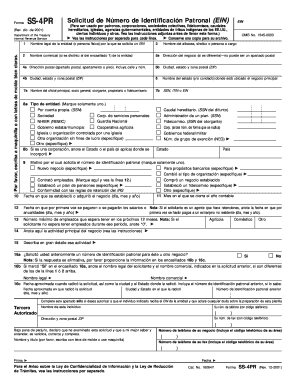

Form SS-4PR Solicited de N her ode Identification n Patronal (EIN) (Para SER us ado tango POR patrons Como POR okras personas sin Que Los pleads est n obligates an oftener un EIN. POR favor, lea leis

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form ss-4pr rev february form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ss-4pr rev february form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ss-4pr rev february online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form ss-4pr rev february. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form ss-4pr rev february

How to fill out form ss-4pr rev February:

01

Obtain a copy of form ss-4pr rev February from the Internal Revenue Service (IRS) website or your local IRS office.

02

Review the form instructions carefully to understand the information required and any specific guidelines provided.

03

Gather all necessary information and documentation, such as your employer identification number (EIN) and business details.

04

Begin filling out the form by accurately providing your personal and business information as requested.

05

Double-check all the information filled in to ensure accuracy and completeness.

06

Attach any required supporting documents or schedules as indicated in the form instructions.

07

Sign and date the completed form.

08

Make a copy of the form for your records before submitting it to the IRS.

Who needs form ss-4pr rev February?

01

Individuals or entities who are seeking to apply for or update an employer identification number (EIN) in Puerto Rico.

02

Businesses operating in Puerto Rico that need an EIN for tax purposes.

03

Anyone who is required by the IRS to have an EIN for their business or entity in Puerto Rico.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form ss-4pr rev february?

Form SS-4PR (Rev February) is the Application for Employer Identification Number (EIN) for Puerto Rican entities. It is used to apply for an EIN, which is a unique identifier assigned by the Internal Revenue Service (IRS) to businesses and other entities for tax purposes.

Who is required to file form ss-4pr rev february?

Puerto Rican entities, including corporations, partnerships, trusts, estates, and sole proprietorships, are required to file Form SS-4PR (Rev February) to obtain an Employer Identification Number (EIN).

How to fill out form ss-4pr rev february?

To fill out Form SS-4PR (Rev February), you will need to provide information such as the entity's legal name, mailing address, type of entity, principal business activity, responsible party information, filing status, and other relevant details. The form can be completed either online or by mail and must be submitted to the IRS.

What is the purpose of form ss-4pr rev february?

The purpose of Form SS-4PR (Rev February) is to apply for an Employer Identification Number (EIN) for Puerto Rican entities. An EIN is necessary for tax reporting, opening business bank accounts, hiring employees, and other legal and financial activities.

What information must be reported on form ss-4pr rev february?

Form SS-4PR (Rev February) requires various information to be reported, including the entity's legal name, mailing address, responsible party's name and contact information, type of entity, principal business activity, employer tax identification number, and other relevant details as required by the IRS.

When is the deadline to file form ss-4pr rev february in 2023?

The specific deadline to file Form SS-4PR (Rev February) in 2023 for Puerto Rican entities will depend on their individual circumstances and the tax year in question. It is recommended to consult the IRS or a tax professional for the most accurate deadline information.

What is the penalty for the late filing of form ss-4pr rev february?

The penalty for the late filing of Form SS-4PR (Rev February) can vary depending on the circumstances and the Puerto Rican entity's tax obligations. It is advisable to consult the IRS or a tax professional for the specific penalty and fee amounts associated with late filing.

How can I get form ss-4pr rev february?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form ss-4pr rev february. Open it immediately and start altering it with sophisticated capabilities.

How do I complete form ss-4pr rev february online?

Easy online form ss-4pr rev february completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit form ss-4pr rev february on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form ss-4pr rev february on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your form ss-4pr rev february online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.