OH OHIF 1 2014 free printable template

Show details

OFCE Use Only

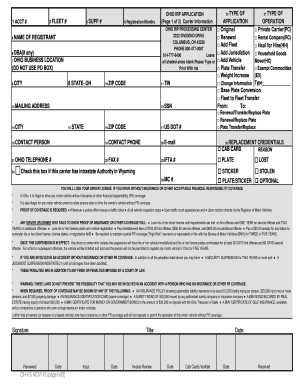

OHIO 1

Rev. 1/14P. O. Box 530

Columbus, OH 432160530

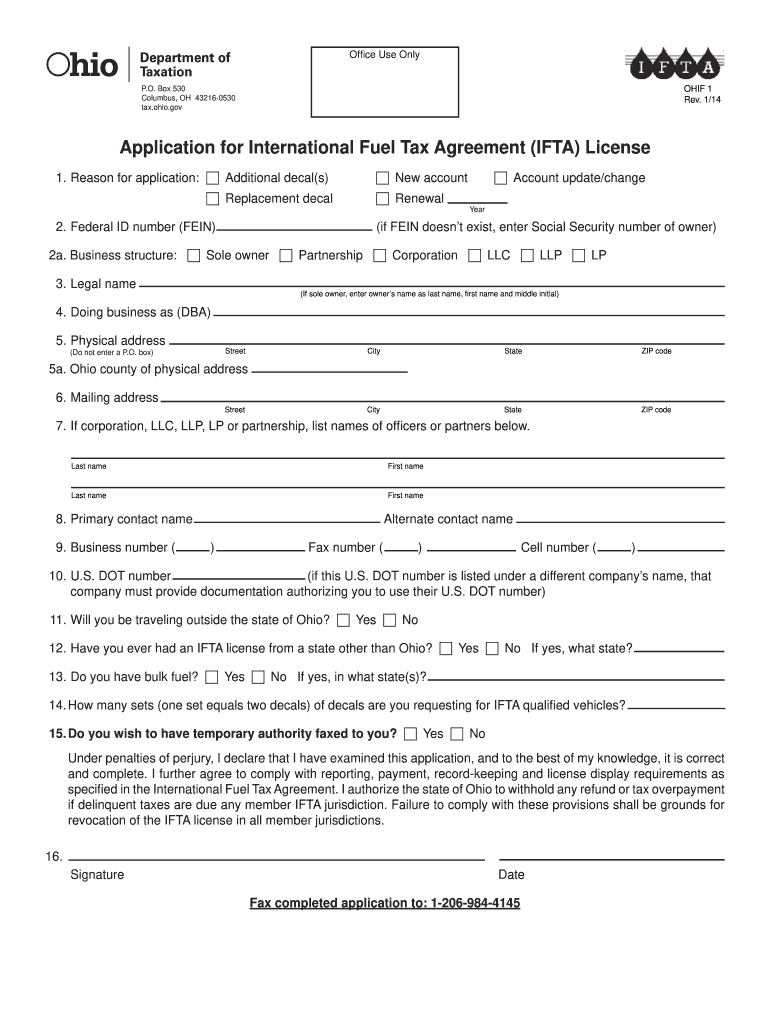

tax. Ohio.application for International Fuel Tax Agreement (IFTA) License

1. Reason for application:F Additional decal(s)

F Replacement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ohio ifta decal order form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio ifta decal order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio ifta decal order form online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ohio ifta renewal form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

OH OHIF 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ohio ifta decal order

To fill out Ohio IFTA decal order, follow these steps:

01

Obtain the Ohio IFTA decal order form from the official website or an authorized provider.

02

Fill in your business name, address, and contact information accurately.

03

Provide your IFTA license number or account number.

04

Indicate the quantity of Ohio IFTA decals you require.

05

Calculate the total cost of the decals based on the current pricing provided on the form.

06

Determine the payment method accepted by Ohio's tax authority and include the payment accordingly.

07

Review the completed form for any errors or missing information.

08

Make a copy of the filled-out form and keep it for your records.

09

Submit the completed Ohio IFTA decal order form and payment as instructed on the form.

Who needs Ohio IFTA decal order:

01

Motor carriers operating in Ohio who meet the criteria for IFTA (International Fuel Tax Agreement) reporting.

02

Companies or individuals responsible for maintaining an IFTA license and filing fuel tax reports.

03

Ohio-based carriers who regularly travel across state lines and operate qualifying vehicles weighing over 26,000 pounds or having three or more axles.

Video instructions and help with filling out and completing ohio ifta decal order form

Instructions and Help about ohio ifta forms

Fill 2019 ifta decal ohio : Try Risk Free

People Also Ask about ohio ifta decal order form

How do I get my IFTA sticker in Ohio?

Do I need a IFTA sticker in Ohio?

How do I contact the IFTA in Ohio?

How do I get my IFTA decals in Ohio?

What is IFTA Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ohio ifta decal order?

The Ohio International Fuel Tax Agreement (IFTA) decal order refers to the process of obtaining and displaying the IFTA decals on commercial motor vehicles operating in Ohio. The IFTA is an agreement between the lower 48 states of the United States and the Canadian provinces, which simplifies fuel tax reporting for carriers operating in multiple jurisdictions.

To order the Ohio IFTA decals, carriers need to complete an application form provided by the Ohio Department of Taxation. The application requires specific information about the carrier, such as their business name, address, contact information, and the number of qualified motor vehicles in their fleet.

Once the application is completed, it can be submitted to the Department of Taxation along with the appropriate fees. After the application is reviewed and approved, the Ohio IFTA decals will be issued to the carrier for display on their qualified motor vehicles.

The purpose of the IFTA decal is to provide proof that the carrier is registered and authorized to operate under the IFTA. It also serves as a means of identifying the jurisdiction in which the carrier is based. The decals must be displayed on the exterior sides of the motor vehicle, within six inches of the bottom-back edge of the cab's door or six inches below the IFTA identification number, whichever is lower.

Who is required to file ohio ifta decal order?

Motor carriers operating qualifying vehicles in Ohio are required to file an International Fuel Tax Agreement (IFTA) decal order. This includes commercial vehicles with a gross vehicle weight rating (GVWR) over 26,000 pounds, vehicles with three or more axles regardless of weight, and vehicles used in combination with a total GVWR over 26,000 pounds.

How to fill out ohio ifta decal order?

To fill out the Ohio IFTA Decal Order, follow these steps:

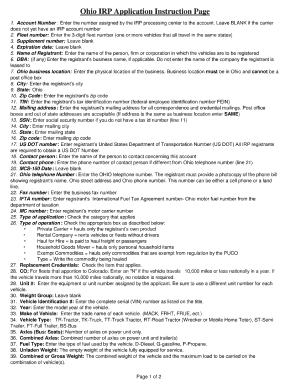

1. Visit the official website of the Ohio Department of Taxation.

2. Look for the section related to the IFTA (International Fuel Tax Agreement) and click on it.

3. Locate the IFTA Decal Order form. It is usually available as a PDF file.

4. Download and open the form on your computer.

5. Begin filling out the form by providing the required information. This typically includes:

- Account Number: Your Ohio IFTA account number.

- Business Name: The legal name of your business.

- Contact Person: The name of the person who can be contacted regarding the IFTA.

- Phone Number: A phone number where you can be reached during business hours.

- Fax Number: If applicable, provide a fax number where documents can be sent.

- Mailing Address: The address to which the decals will be mailed.

- City, State, and ZIP: Provide the corresponding information for the mailing address.

- Email Address: If available, provide an email address for communication purposes.

6. Check the appropriate box to indicate if the business is a fleet or a single vehicle.

7. Specify the number of decals needed for each jurisdiction listed. If additional jurisdictions are required, add them manually.

8. Sign and date the form.

9. Review all the information provided to ensure accuracy and completeness.

10. Make a copy of the completed form for your records.

11. Submit the form as directed on the website or the form itself. This may involve printing it out and mailing it or submitting it electronically, depending on the instructions.

Note: It is essential to check the Ohio Department of Taxation website for any specific instructions or updates on the process of ordering IFTA decals, as procedures might change from time to time.

What is the purpose of ohio ifta decal order?

The purpose of the Ohio IFTA (International Fuel Tax Agreement) decal order is to obtain the necessary decals that allow commercial motor vehicles to travel between participating jurisdictions within the IFTA without having to obtain multiple fuel tax permits. These decals display the designated member state and the vehicle's IFTA license number, which, in turn, verifies that the vehicle has paid the appropriate fuel taxes for the jurisdictions it travels through. The decal order ensures compliance with the IFTA regulations and simplifies the administrative process for motor carriers operating in Ohio.

What information must be reported on ohio ifta decal order?

When ordering an Ohio IFTA (International Fuel Tax Agreement) decal, you would typically need to report the following information:

1. Account Number: This is the unique identification number assigned to your IFTA account.

2. License Plate Number: The license plate number of the vehicle for which the IFTA decal is being ordered.

3. Fleet Number: If applicable, the fleet number associated with the vehicle.

4. Vehicle Identification Number (VIN): The VIN of the vehicle for which the IFTA decal is being ordered.

5. Registered Gross Weight: The maximum weight at which the vehicle is registered.

6. Fuel Type: The type of fuel used by the vehicle (e.g., diesel, gasoline, natural gas).

7. Base Jurisdiction: The state or province where your base or principal place of business is located.

8. Mailing/Billing Address: The address where the decal and any related invoices or correspondence should be sent.

9. Contact Information: Your name, phone number, and email address for any communication regarding the IFTA decal.

10. Authorized Signature: Your signature or an authorized representative's signature to confirm the accuracy of the information provided.

Please note that these requirements may vary, so it is best to consult the official Ohio IFTA guidelines or reach out to the appropriate state authority for the most accurate and up-to-date information.

What is the penalty for the late filing of ohio ifta decal order?

According to the Ohio Department of Taxation, the penalty for late filing of an Ohio IFTA decal order is $50 per month or fraction of a month, not to exceed $500.

How do I modify my ohio ifta decal order form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ohio ifta renewal form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute ohio ifta sticker renewal form online?

pdfFiller has made filling out and eSigning how to get ifta stickers ohio easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit ohio ifta excel in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing ohio ifta filing online form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Fill out your ohio ifta decal order online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Ifta Sticker Renewal Form is not the form you're looking for?Search for another form here.

Keywords relevant to what does the ifta form look like

Related to ohio ifta additional decals

If you believe that this page should be taken down, please follow our DMCA take down process

here

.