Get the free Form 706-CE. Certification of Payment of Foreign Death Tax

Show details

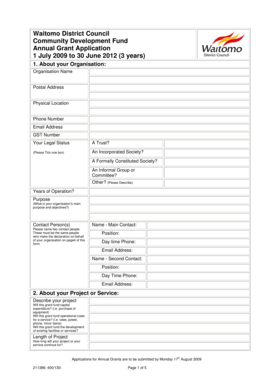

Form (Rev. November 1991) Department of the Treasury Internal Revenue Service 706CE Certificate of Payment of Foreign Death Tax For Paperwork Reduction Act Notice, see the back of this form. OMB No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 706-ce certification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 706-ce certification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 706-ce certification of online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 706-ce certification of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out form 706-ce certification of

Point by point instructions on how to fill out form 706-ce certification of and who needs it:

How to fill out form 706-ce certification of?

01

Begin by carefully reading the form instructions provided by the issuing authority.

02

Fill in your personal information accurately, including your name, address, and contact details, in the designated fields.

03

Specify the purpose or reason for obtaining the certification in the appropriate section.

04

Provide any required supporting documentation or evidence, such as copies of relevant licenses or qualifications.

05

Answer all the questions on the form truthfully and to the best of your knowledge.

06

Review the completed form for any errors or omissions before submitting it.

07

Sign and date the form, attesting to the accuracy of the information provided.

Who needs form 706-ce certification of?

01

Individuals who are seeking professional certifications or licenses in a specific field may need to submit form 706-ce certification of to demonstrate their eligibility.

02

Employers or organizations that require proof of a candidate's qualifications or competence in a particular area may request form 706-ce certification of.

03

Some regulatory bodies or government agencies may require form 706-ce certification of as part of their application or registration process for certain professions or activities, such as in the healthcare or financial sectors.

04

The specific requirements for needing form 706-ce certification of may vary depending on the industry, jurisdiction, or regulatory standards in place.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 706-ce certification of?

Form 706-CE certification is a certification of payment of estate tax.

Who is required to file form 706-ce certification of?

Personal representatives are required to file form 706-CE certification of.

How to fill out form 706-ce certification of?

To fill out form 706-CE certification of, you need to provide information about the estate, executor, deceased person, and the estate tax.

What is the purpose of form 706-ce certification of?

The purpose of form 706-CE certification is to certify that the estate tax has been paid.

What information must be reported on form 706-ce certification of?

Information about the estate, executor, deceased person, and the estate tax must be reported on form 706-CE certification.

When is the deadline to file form 706-ce certification of in 2023?

The deadline to file form 706-CE certification of in 2023 is April 15th.

What is the penalty for the late filing of form 706-ce certification of?

The penalty for late filing of form 706-CE certification is a percentage of the unpaid tax, with the minimum penalty being $205 or 100% of the unpaid tax, whichever is less.

How do I make edits in form 706-ce certification of without leaving Chrome?

form 706-ce certification of can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit form 706-ce certification of straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing form 706-ce certification of.

How can I fill out form 706-ce certification of on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 706-ce certification of. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 706-ce certification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.