Get the free Individual Retirement Arrangement Information

Show details

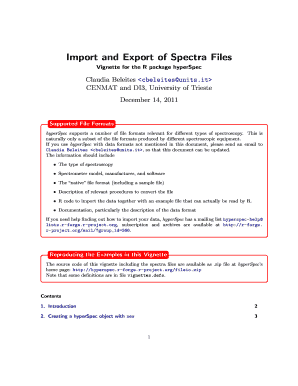

2828 VOID CORRECTED 1 Regular IRA contributions made in 1992 and 1993 for 1992 OMB No. 1545-0747 TRUSTEE'S or ISSUER'S name, street address, city, state, and ZIP code $2 Rollover IRA contributions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your individual retirement arrangement information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual retirement arrangement information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual retirement arrangement information online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual retirement arrangement information. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out individual retirement arrangement information

How to fill out individual retirement arrangement information:

01

Gather all necessary documents such as identification, proof of employment or income, and any existing retirement account information.

02

Complete the required forms accurately, providing personal details, including name, address, Social Security number, and date of birth.

03

Specify the type of individual retirement arrangement (IRA) you are applying for, whether it's a traditional IRA or a Roth IRA.

04

Provide information about your income, employment status, and any contributions or withdrawals you plan to make.

05

Indicate any beneficiaries you wish to designate for your IRA account.

06

Review the completed form for accuracy and sign it.

07

Submit the application and any required supporting documents to the designated IRA provider or financial institution.

Who needs individual retirement arrangement information?

01

Individuals who are planning for their retirement and want to take advantage of tax advantages and long-term savings options.

02

Any working individual who wants to supplement their employer-sponsored retirement plan or doesn't have access to one.

03

Those who want to save for retirement outside of their employer's retirement plan.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is individual retirement arrangement information?

Individual retirement arrangement information refers to the details and documentation related to an individual's retirement savings account, commonly known as an IRA. This includes contributions made, investment earnings, and withdrawals made from the account.

Who is required to file individual retirement arrangement information?

Individuals who have an IRA account are required to file individual retirement arrangement information. This includes both traditional and Roth IRA accounts. It is mandatory to report this information to the Internal Revenue Service (IRS) when filing taxes.

How to fill out individual retirement arrangement information?

To fill out individual retirement arrangement information, you need to gather all the necessary documents related to your IRA account. This includes Form 5498 provided by your IRA custodian, which reports contributions and rollovers made in the tax year. You may also need to report any distributions or conversions from your IRA using Form 1099-R.

What is the purpose of individual retirement arrangement information?

The purpose of individual retirement arrangement information is to ensure that individuals are correctly reporting their retirement savings contributions, earnings, and distributions to the IRS. This helps the IRS verify that individuals are complying with tax laws and regulations relating to IRAs.

What information must be reported on individual retirement arrangement information?

Individual retirement arrangement information must include details about the contributions made to the IRA during the tax year, any investment earnings or losses, and any distributions or conversions made from the account. The information reported should also include the account holder's personal details, such as name, address, and Social Security number.

When is the deadline to file individual retirement arrangement information in 2023?

The deadline to file individual retirement arrangement information in 2023 is typically April 15th. However, it's always recommended to check with the IRS or consult a tax professional to confirm the exact deadline, as it can vary depending on any changes in tax laws or regulations.

What is the penalty for the late filing of individual retirement arrangement information?

The penalty for the late filing of individual retirement arrangement information can vary depending on the circumstances. As of now, the penalty for late filing can be up to $50 per occurrence. It's important to file the information on time to avoid any penalties or additional fees.

How can I get individual retirement arrangement information?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific individual retirement arrangement information and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out individual retirement arrangement information using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign individual retirement arrangement information and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit individual retirement arrangement information on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as individual retirement arrangement information. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your individual retirement arrangement information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.