Get the free rev proc 2003 68 form

Show details

Rev. Proc. 2003 68 SECTION 1. PURPOSE This revenue procedure provides guidance on the valuation of stock options solely for purposes of 280G and 4999 of the Internal Revenue Code.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rev proc 2003 68 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 2003 68 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 2003 68 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rev proc 2003 68. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

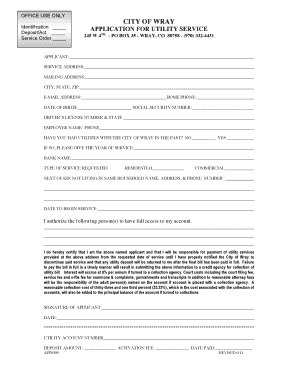

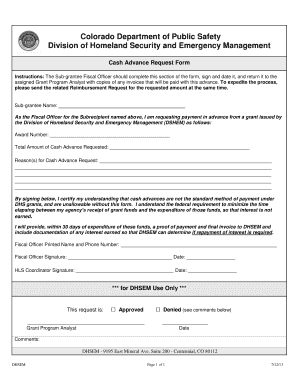

How to fill out rev proc 2003 68

01

Rev Proc 2003-68 provides guidelines on how to fill out Form 2848, Power of Attorney and Declaration of Representative. This form is used by taxpayers who want to authorize someone else to act on their behalf in tax matters.

02

To fill out rev proc 2003-68, start by obtaining the form from the IRS website or by visiting a local IRS office.

03

Fill in the taxpayer's personal information, including their name, social security number, and mailing address.

04

Provide information about the representative who will be acting on the taxpayer's behalf, including their name, address, and contact details.

05

Indicate the specific tax matters the representative will be authorized to handle by checking the appropriate boxes on the form. This may include filing tax returns, responding to IRS inquiries, or making payment arrangements.

06

Both the taxpayer and the representative must sign and date the form.

07

Make a copy of the completed form for your records before mailing it to the appropriate IRS address, as indicated in the instructions.

08

Rev Proc 2003-68 is intended for individuals or businesses who wish to legally appoint someone to handle their tax matters. It is particularly useful for taxpayers who may not be able to personally manage their tax obligations.

09

This includes individuals who are incapacitated, undergoing medical treatments, or simply prefer to have a qualified representative handle their tax affairs.

10

It is important to note that rev proc 2003-68 does not grant unlimited power of attorney. The authorized representative's actions are still subject to certain limitations and restrictions outlined in the form. It is always recommended to consult with a tax professional or attorney before completing the form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rev proc 68 form?

Rev proc 68 form is a tax form used by taxpayers to request tax relief or establish certain accounting methods.

Who is required to file rev proc 68 form?

Taxpayers who want to request tax relief or establish certain accounting methods are required to file rev proc 68 form.

How to fill out rev proc 68 form?

Rev proc 68 form can be filled out by providing the necessary taxpayer information, specifying the requested relief or accounting method, and attaching any required documentation.

What is the purpose of rev proc 68 form?

The purpose of rev proc 68 form is to allow taxpayers to request tax relief or establish certain accounting methods as provided by the Internal Revenue Service (IRS).

What information must be reported on rev proc 68 form?

Information such as taxpayer identification, requested relief or accounting method, and supporting documentation must be reported on rev proc 68 form.

When is the deadline to file rev proc 68 form in 2023?

The deadline to file rev proc 68 form in 2023 is typically specified by the IRS and may vary. It is important to check the official IRS guidelines or consult a tax professional for the specific deadline.

What is the penalty for the late filing of rev proc 68 form?

The specific penalty for the late filing of rev proc 68 form can vary depending on the circumstances and will be determined by the IRS. It is advisable to consult the official IRS guidelines or seek professional advice for accurate penalty information.

How can I modify rev proc 2003 68 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including rev proc 2003 68, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send rev proc 2003 68 for eSignature?

When you're ready to share your rev proc 2003 68, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in rev proc 2003 68?

The editing procedure is simple with pdfFiller. Open your rev proc 2003 68 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Fill out your rev proc 2003 68 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.