The final definitions will be effective on the earliest of January 1, 2017, or the effective date described in such final regulations. REQUIREMENTS: For a grainer retained annuity trust (DRAG), a GRANTER retained annuity trust (GREAT) or a GRANTER retained unit rust (HURT), a qualified interest must be an interest in a REMIX in a specified REMIX. The specified REMIX must be located under a trust arrangement as defined in section 1(h)(1) of the Internal Revenue Code for gross income purposes. TREASURY DECISION: Section 2702(b)(1) of the Internal Revenue Code provides that the following RELICS are considered to be qualified interests: a REIT, a mutual fund, a REIT-stock fund, or a cooperative; a REMIX in which the individual is a stockholder; a REMIX in which the individual is a controlling shareholder; and a REMIX in which the individual is a major shareholder. An individual must be the settler in a DRAG or GREAT, or be the beneficiary under a GRUNT, to qualify as a qualified annuitant under section 2702. An individual who is an annuitant under a GRUNT may designate a beneficiary that satisfies this test by completing a form (available by writing, calling, or telephoning on the Internet) containing substantially the following information: The name of the beneficiary; The address of the beneficiary's principal place of residence; and The name of the person to whom the beneficiary is to be made a party to the annuity contract in accordance with the provisions of the annuity contract. TREASURY DISCOMFORT: The Secretary may, or the Commission may, impose other requirements on a qualified interest that the Secretary and the Commission determine to be appropriate, including requiring that the value of the qualified interest be, as applicable, calculated over a longer period than would otherwise be applicable, including a period of 5 years, if the taxpayer is treated as nonresident alien under section 7701(a) of the Internal Revenue Code and the taxpayer does not file Form 1041 at the beginning of such period.

Get the free T.D. 8899

Show details

T.D. 8899 ACTION: Final regulations. SUMMARY: This document contains DEPARTMENT OF THE TREASURY final regulations relating to the definition Internal Revenue Service of a qualified interest under

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your td 8899 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td 8899 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit td 8899 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit td 8899. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is td 8899?

TD 8899 is a tax form used for reporting certain financial transactions.

Who is required to file td 8899?

Certain individuals and businesses are required to file TD 8899, based on the nature of the financial transactions they have conducted.

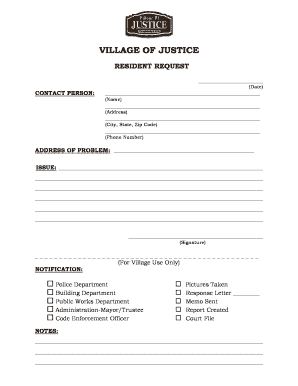

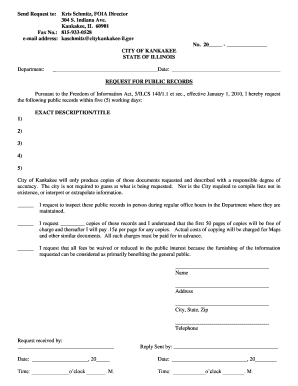

How to fill out td 8899?

To fill out TD 8899, you need to provide the necessary information about the financial transactions, including amounts, dates, and relevant parties. The form should be completed accurately and submitted according to the official instructions.

What is the purpose of td 8899?

The purpose of TD 8899 is to report specific financial transactions to the appropriate tax authorities for regulatory and compliance purposes.

What information must be reported on td 8899?

TD 8899 requires reporting of various information related to the financial transactions, such as amounts, dates, descriptions, and the parties involved.

When is the deadline to file td 8899 in 2023?

The deadline to file TD 8899 in 2023 is typically determined by the tax authority and may vary depending on the jurisdiction. It is recommended to consult the official guidelines or a tax professional for the specific deadline.

What is the penalty for the late filing of td 8899?

The penalty for late filing of TD 8899 may vary based on the tax regulations and the jurisdiction. It is advisable to review the official guidelines or consult a tax professional to understand the specific penalty that applies in a particular case.

Can I create an electronic signature for the td 8899 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your td 8899 in minutes.

How do I fill out td 8899 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign td 8899 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete td 8899 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your td 8899 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your td 8899 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.