Get the free it 204 ll pdf form

Show details

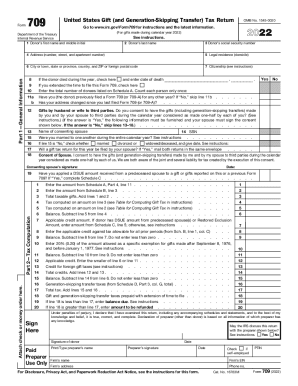

IT-204-LL Partnership, Limited Liability Company, and Limited Liability Partnership For calendar year 2012 or fiscal year beginning and ending Filing Fee Payment Form New York State Department of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 204 ll pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 204 ll pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it 204 ll pdf online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it 204 ll due date form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out it 204 ll pdf

01

To fill out the IT 204 LL PDF, you will need to have the form itself, which can be obtained from the appropriate source, such as the IRS website or a tax software provider.

02

Start by carefully reading the instructions provided with the form. These instructions will guide you through the process of filling out the different sections and provide important information about the specific requirements for the IT 204 LL.

03

Gather all the necessary information and documentation that is required to complete the form. This may include details about your business income, deductions, credits, and any other relevant financial information.

04

Begin filling out the form by entering your personal information, such as your name, address, and taxpayer identification number.

05

Proceed to the section dedicated to your business income, where you will need to provide details about the sources of your business income, such as revenue from sales or services.

06

Move on to the deductions section, where you can list any eligible expenses that can be deducted from your business income, such as operating expenses or depreciation.

07

If applicable, complete the credits section, where you can claim any tax credits that your business may be eligible for. These credits can help reduce your overall tax liability.

08

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or omissions could lead to delays or potential issues with your tax return.

09

If required, attach any additional schedules or forms that may be necessary to support the information provided on the IT 204 LL.

10

Finally, sign and date the form before submitting it to the appropriate tax authority, following the instructions provided.

Who needs the IT 204 LL PDF?

01

Small business owners who operate as a partnership or limited liability company in the state where the IT 204 LL form is required.

02

Individuals who are part of a partnership or limited liability company and are responsible for filing the tax return on behalf of the business.

03

Tax professionals who assist clients with their business tax returns and need the form to accurately prepare and file the return.

Fill form : Try Risk Free

People Also Ask about it 204 ll pdf

Who must file NYC partnership tax return?

What is a disregarded entity for tax purposes?

Who is subject to NYC tax?

What is NY 204 LL fee?

Who must file NYC 204?

What is an IT 204?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file it 204 ll pdf?

The specific requirements for filing Form 204 ll (PDF) can vary depending on the jurisdiction and the specific circumstances of the taxpayer. Therefore, it is important to consult the relevant tax authorities or a tax professional to determine if you are required to file this form. Generally, this form is used by partnerships in the United States to report their income, deductions, gains, losses, and other relevant tax information.

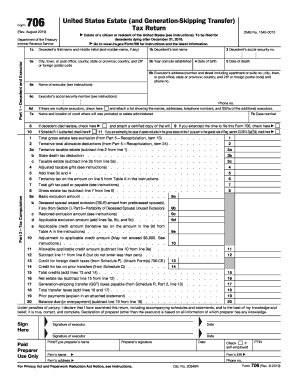

What is the purpose of it 204 ll pdf?

IT 204 LL is a tax form used by certain partnerships in the United States to report and calculate their New York State and City taxes. The purpose of the IT 204 LL PDF is to provide a fillable form that partnerships can use to accurately file their tax returns and fulfill their tax obligations to the state and city. The PDF format allows the form to be easily accessed and completed electronically.

What information must be reported on it 204 ll pdf?

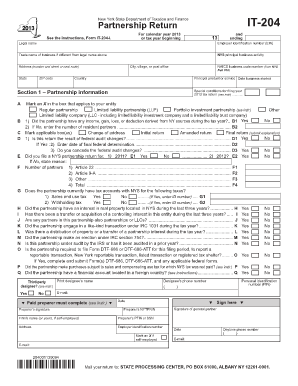

The IT-204-LL PDF form is used for reporting information about a partnership or a limited liability company classified as a partnership for New York State tax purposes. The following information must be reported on this form:

1. Taxpayer identification number: The federal employer identification number (EIN) or social security number (SSN) of the partnership or LLC.

2. Partnership or LLC information: The legal name, address, and type of entity (partnership or LLC) must be provided.

3. Filing status: Indicate whether the partnership/LLC is filing as a general partnership, limited partnership, limited liability partnership (LLP), or limited liability company (LLC).

4. Additional entities: If the partnership has subsidiary entities or is a member of a consolidated group, information about those entities must be reported.

5. Tax year: Report the beginning and ending dates of the tax year for which the form is being filed.

6. Ownership information: Report the names, addresses, and ownership percentages of each partner or member in the partnership or LLC. In case of changes in ownership during the tax year, provide information regarding those changes.

7. Allocation of income: Report the partner's or member's share of partnership income, deductions, credits, and modifications.

8. Tax credits: Report any tax credits allocated to partners/members, including the name and identification number of each tax credit.

9. Schedule C/E-1: Attach this schedule if the partnership/LLC has federal Schedule C or E income or loss.

10. Schedule K: Provide a copy of this schedule if it was filed with the partnership/LLC's federal tax return.

11. Tax paid or payable: Report the amount of tax paid or payable to the New York State Tax Department.

12. Certification: At the end of the form, the authorized person must sign and date the certification.

Note that this information is a general overview and may not cover all specific requirements. It is always recommended to consult the official instructions or seek professional assistance while completing tax forms.

When is the deadline to file it 204 ll pdf in 2023?

The deadline to file Form 1024 LL (Application for Recognition of Exemption under Section 501(a)) in 2023 is not specified in your query. Could you please provide the specific IRS form or clarify your question?

How can I edit it 204 ll pdf from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your it 204 ll due date form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit it 204 ll due date in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your how to file it 204 ll online, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit when is the it 204 ll due on an iOS device?

Create, modify, and share it204 ll form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your it 204 ll pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It 204 Ll Due Date is not the form you're looking for?Search for another form here.

Keywords relevant to file it 204 ll online form

Related to it 204 ll

If you believe that this page should be taken down, please follow our DMCA take down process

here

.