Get the free GARNISHMENT RELEASE

Show details

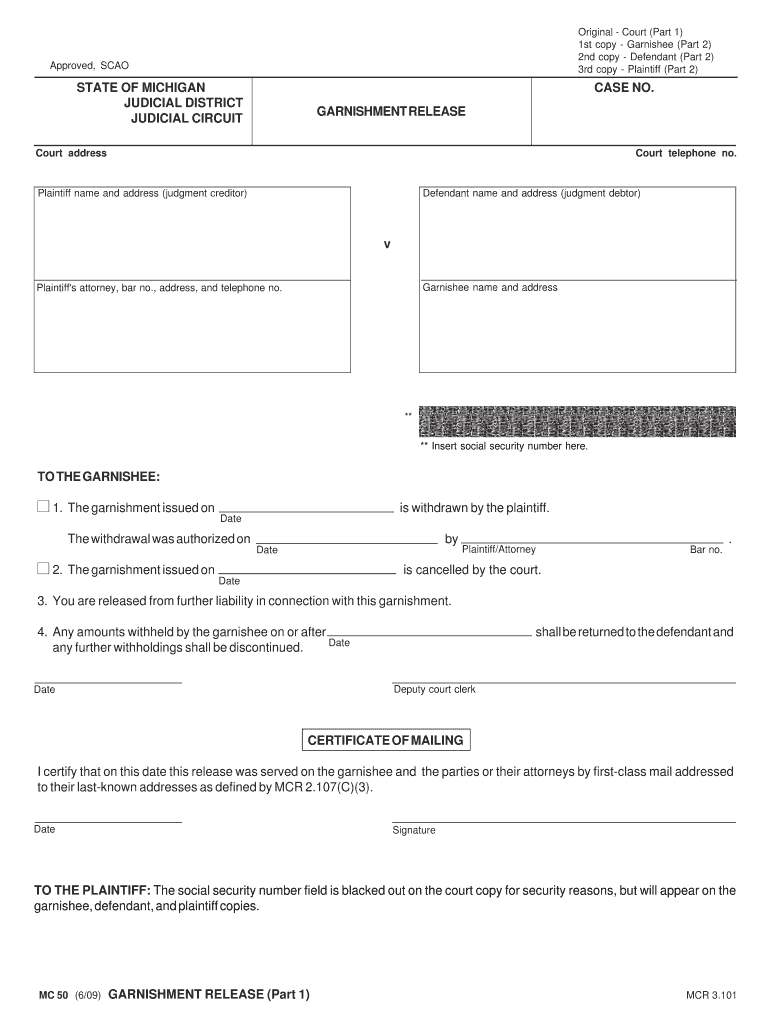

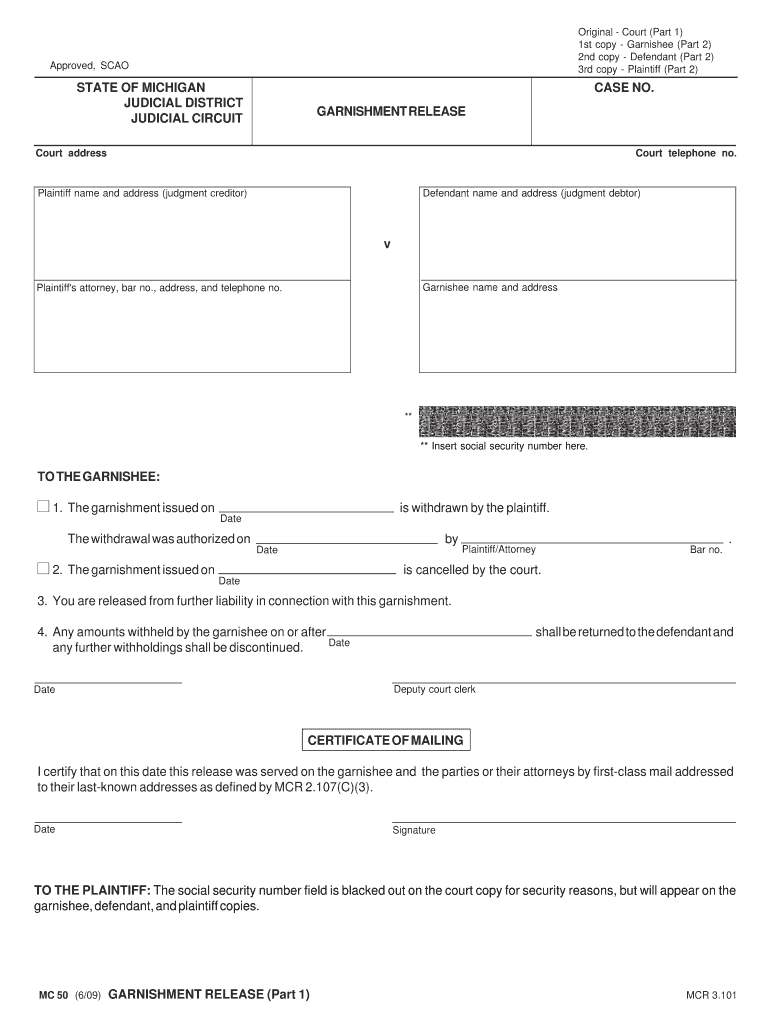

This document serves to officially withdraw or cancel a garnishment against a defendant's assets as authorized by the plaintiff and the court. It includes information regarding the court, parties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign garnishment release

Edit your garnishment release form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your garnishment release form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing garnishment release online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit garnishment release. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out garnishment release

How to fill out GARNISHMENT RELEASE

01

Obtain the GARNISHMENT RELEASE form from the court or relevant authority.

02

Fill in the case number at the top of the form.

03

Provide the name of the debtor who was garnished.

04

Include the name of the creditor or party that received the garnishment.

05

Indicate the amount that has been paid or released.

06

Sign and date the form at the designated area.

07

Submit the GARNISHMENT RELEASE form to the court or appropriate entity.

Who needs GARNISHMENT RELEASE?

01

Individuals who have had their wages or bank accounts garnished due to a court judgment.

02

Creditors who have successfully collected the owed amount and need to provide proof of release.

03

Legal representatives managing the financial affairs of a debtor.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to discharge and release garnishee?

The court may discharge the garnishee from the writ of criminal restitution if it appears from the garnishee's answer that the garnishee did not owe earnings to the defendant or have the defendant's indebtedness, monies, property or stock in the garnishee's possession and if no written objection to the answer is filed.

What does it mean when your pay is garnished?

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

What happens when your account is garnished?

When you owe money and do not pay, you risk having any money in an account at a bank or credit union automatically withdrawn to pay your debt. This is called bank account garnishment or bank account levy. Creditors trying to collect commercial debt must go to court to get an order of bank account garnishment.

What is a release of garnishment summons?

A release is a notification to the garnishee stating that they are no longer liable for answering the pending summons. Therefore, the clerk signs a release when the garnishment becomes expired or has been paid in full.

What is garnishment in simple words?

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.

What is garnishment in English?

1. : ornament, garnish. 2. : a legal summons or warning concerning the attachment of property to satisfy a debt.

What does a garnishment release letter mean?

A garnishment release letter is sent when the garnishment listed in the letter has been paid in full. The Department also send this notice when the taxpayer enters into an Installment Payment Agreement to pay off the garnishment. The garnishment release letter only applies to the garnishment detailed in the letter.

What is the translation of garnishment?

Garnishment refers to a court ordered process for collecting on a judgment , which takes money directly from the defendant's wages or other third party who owes the defendant a debt .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GARNISHMENT RELEASE?

Garnishment release is a legal document that officially terminates the garnishment of a debtor's wages or bank account, indicating that the creditor has received full payment or the debt has been resolved.

Who is required to file GARNISHMENT RELEASE?

Typically, the creditor or the garnishee (the entity that holds the debtor's assets) is required to file a garnishment release once the debt has been satisfied.

How to fill out GARNISHMENT RELEASE?

To fill out a garnishment release, one must provide details such as the debtor's name, the case number, the amount that has been paid, and the signatures of the relevant parties, including the creditor.

What is the purpose of GARNISHMENT RELEASE?

The purpose of a garnishment release is to formally notify that the debt obligation has been fulfilled and to prevent any further garnishment of the debtor's wages or assets.

What information must be reported on GARNISHMENT RELEASE?

The information that must be reported on a garnishment release includes the debtor's full name, any associated case or account numbers, the amount paid, the date of payment, and signatures from the creditor or authorized personnel.

Fill out your garnishment release online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Garnishment Release is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.