CA County Tax Sale Procedural Manual Volume IV: Internet Auction 2012-2026 free printable template

Show details

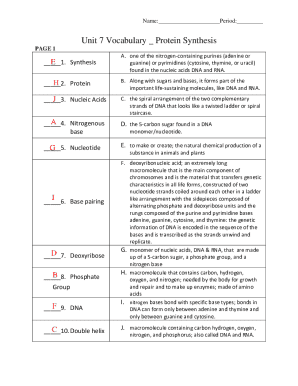

County Tax Sale Procedural Manual Volume IV: Internet Auction January 2012 Controller John Chiang California State Controller s Office Contents SECTION 1: INTRODUCTION .....................................................................................................................................

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA County Tax Sale Procedural Manual

Edit your CA County Tax Sale Procedural Manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA County Tax Sale Procedural Manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA County Tax Sale Procedural Manual online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA County Tax Sale Procedural Manual. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA County Tax Sale Procedural Manual

How to fill out CA County Tax Sale Procedural Manual Volume

01

Obtain a copy of the CA County Tax Sale Procedural Manual Volume from the county's website or office.

02

Review the introduction for an overview of tax sale procedures and policies.

03

Familiarize yourself with key terminology defined in the manual.

04

Follow the step-by-step instructions provided in the manual for each phase of the tax sale process.

05

Complete the required forms and documentation as outlined in the manual.

06

Ensure compliance with local deadlines and regulations specified in the volume.

07

Prepare for the tax sale event by organizing all necessary materials and information.

Who needs CA County Tax Sale Procedural Manual Volume?

01

County tax officials and employees involved in the tax sale process.

02

Property owners seeking to understand the tax sale procedures.

03

Investors interested in purchasing properties at tax sales.

04

Legal professionals advising clients on tax sale matters.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax deed sale in California?

The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years for residential properties and three years for commercial properties. Offering property at public auction achieves this by either selling the property or by forcing payment of the property taxes.

What is the redemption period for property tax sale in California?

Redemption Period Happens Before a California Tax Sale Again, in California, the five-year redemption period happens before the tax sale. Under state law, the tax collector usually can't sell your home until five years pass after the property becomes tax defaulted.

How do I buy a tax deed property in California?

You cannot buy a tax lien in California. A lien pays the delinquent tax for the homeowner and you receive interest for it. California sells tax deeds on properties with taxes delinquent for five or more years, or if the owner has not enrolled in the county's Five Year Payment Plan.

How to buy property tax liens in California?

You cannot buy a tax lien in California. A lien pays the delinquent tax for the homeowner and you receive interest for it. California sells tax deeds on properties with taxes delinquent for five or more years, or if the owner has not enrolled in the county's Five Year Payment Plan.

Who is a tax deed issued by in California?

Yes, California is a deed state. However, the state must collect property taxes. That translates to a process which was designed by the legislature and is implemented by the board of supervisors of each county. The supervisors authorize and the county directs after receiving a mandate to levy taxes and collect taxes.

What is the redemption period for California tax deed sale?

At the end of the 5 years for residential property and 3 years for non-residential commercial property, if the tax is not redeemed, the Treasurer and Tax Collector has the power to sell the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA County Tax Sale Procedural Manual?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CA County Tax Sale Procedural Manual in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the CA County Tax Sale Procedural Manual electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA County Tax Sale Procedural Manual in minutes.

Can I edit CA County Tax Sale Procedural Manual on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute CA County Tax Sale Procedural Manual from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CA County Tax Sale Procedural Manual Volume?

The CA County Tax Sale Procedural Manual Volume is a comprehensive guide outlining the procedures and regulations related to tax sales in California counties, including the processes for conducting tax sales, handling bids, and distributing funds.

Who is required to file CA County Tax Sale Procedural Manual Volume?

County tax officials, assessors, and treasurers are typically required to refer to and adhere to the CA County Tax Sale Procedural Manual Volume to ensure compliance with state laws and local ordinances.

How to fill out CA County Tax Sale Procedural Manual Volume?

To fill out the CA County Tax Sale Procedural Manual Volume, officials should follow the outlined instructions and forms provided within the manual, ensuring that all relevant data regarding tax parcels, sales, and bidders are accurately recorded.

What is the purpose of CA County Tax Sale Procedural Manual Volume?

The purpose of the CA County Tax Sale Procedural Manual Volume is to provide standardized procedures to streamline tax sale processes, promote transparency, and ensure equitable treatment of all participants in tax sale activities.

What information must be reported on CA County Tax Sale Procedural Manual Volume?

The information that must be reported on the CA County Tax Sale Procedural Manual Volume includes details on the properties involved, tax amounts owed, bidder information, sale outcomes, and any other pertinent documentation as required by county regulations.

Fill out your CA County Tax Sale Procedural Manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA County Tax Sale Procedural Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.