Get the free becu 1099 int form

Show details

To get started, bring this flyer into any BEAU location. Find a location near you call us at 206-439-5700 or 800-233-2328 or visit www.becu.org/locations. Promo Code: college0509 Visit any BEAU location

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

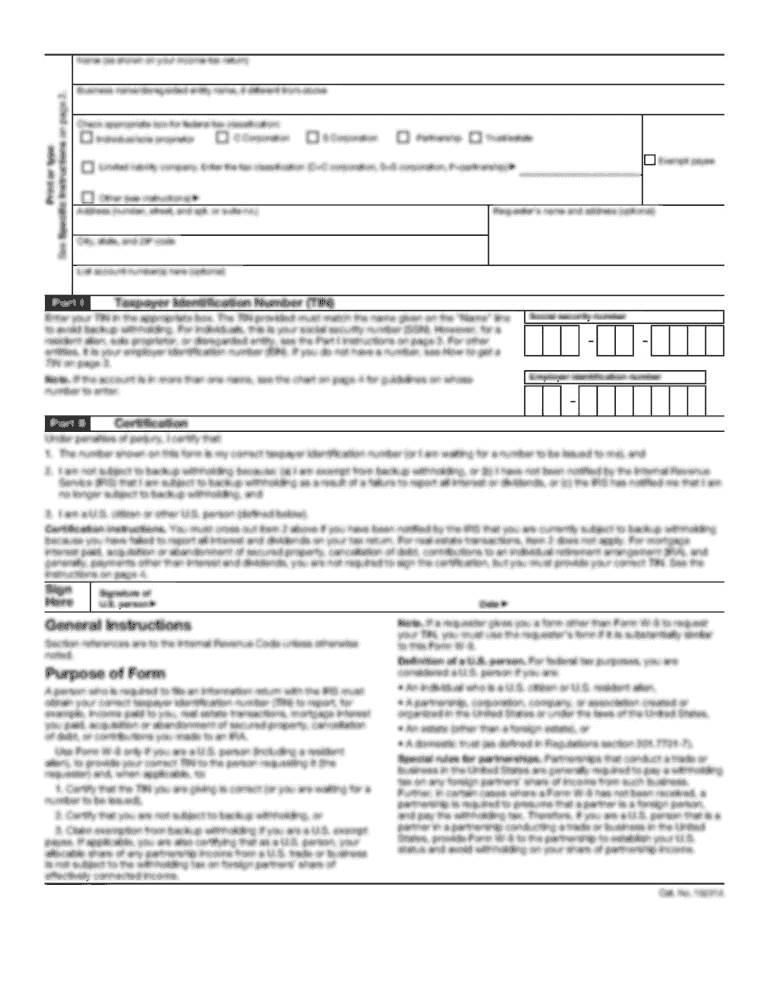

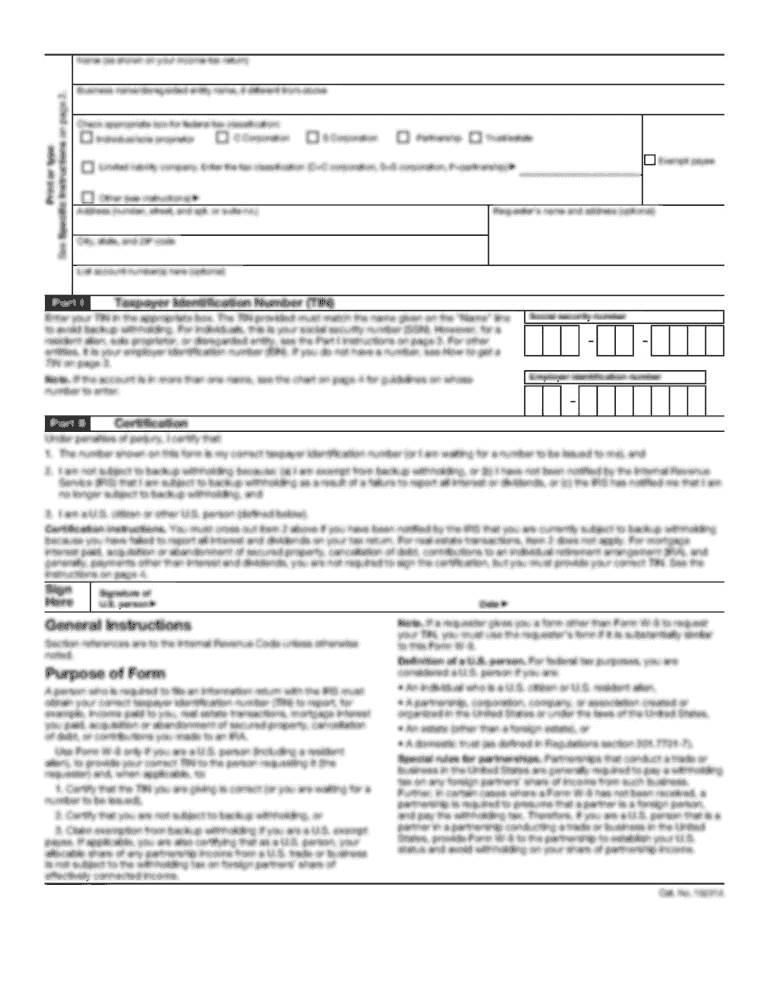

Edit your becu 1099 int form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your becu 1099 int form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit becu 1099 int online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1099 int becu form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out becu 1099 int form

How to fill out 1099 int becu:

01

Obtain the necessary form: Begin by requesting Form 1099-INT from the Bank Employees' Credit Union (BECU). This form is used to report interest income received from BECU.

02

Fill in the payer information: On the form, enter the name, address, and taxpayer identification number (TIN) of BECU as the payer. This information can usually be found on any statements or documents received from BECU.

03

Provide recipient information: Enter the recipient's name, address, and TIN in the designated sections. The recipient is the individual or entity who received the interest income from BECU. Ensure the information is accurate to avoid any issues.

04

Report interest income: Report the total interest income received from BECU in Box 1 of Form 1099-INT. This amount should be based on the information provided by BECU or any statements received.

05

Complete other relevant boxes: Depending on the specific details, you may need to fill out additional boxes on the form. This may include reporting any federal income tax withheld, foreign tax paid, or other special circumstances as required.

06

Review and submit: Once you have completed filling out the form, carefully review all the information entered to ensure accuracy. Make any necessary corrections before submitting the form to the Internal Revenue Service (IRS).

Who needs 1099 int becu:

01

Individuals who received interest income: Any individual who received interest income from BECU throughout the year may need Form 1099-INT. This includes both members and non-members of BECU who earned interest on their deposits or investments.

02

Businesses and organizations: In addition to individuals, businesses and organizations that earned interest income from BECU may also require Form 1099-INT. This includes corporations, partnerships, estates, trusts, and nonprofit organizations.

03

Taxpayers meeting reporting thresholds: The IRS has set specific thresholds for reporting interest income using Form 1099-INT. If the total interest income earned from BECU exceeds these thresholds, it is necessary to file the form. The current threshold for most individuals is $10 or more in interest income, while for certain types of entities it may be $600 or more.

Fill form : Try Risk Free

People Also Ask about becu 1099 int

Who is required to file a 1099-INT?

Do I have to report 1099 interest?

What is a 1099 interest income?

What happens if my bank doesn't send me a 1099-INT?

Do you get a 1099-INT from a credit union?

How do I get a 1099-INT from my bank?

How do I get my 1099 from BECU?

Do I need to attach 1099-INT to tax return?

Do I need to submit 1099-INT with my tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1099 int becu?

1099 int becu is a tax form issued by the BECU (Boeing Employees' Credit Union) that reports the interest income earned on an account.

Who is required to file 1099 int becu?

Individuals or businesses who have received $10 or more in interest income from BECU during the tax year are required to file 1099 int becu.

How to fill out 1099 int becu?

To fill out 1099 int becu, you need to provide your name, address, taxpayer identification number, and the amount of interest income received from BECU. This information can be found on the form provided by BECU.

What is the purpose of 1099 int becu?

The purpose of 1099 int becu is to report the interest income earned from BECU to the Internal Revenue Service (IRS). This information is used by the IRS to ensure that taxpayers are accurately reporting their income.

What information must be reported on 1099 int becu?

The information that must be reported on 1099 int becu includes the recipient's name, address, taxpayer identification number, and the amount of interest income received from BECU.

When is the deadline to file 1099 int becu in 2023?

The deadline to file 1099 int becu in 2023 is January 31, 2024.

What is the penalty for the late filing of 1099 int becu?

The penalty for the late filing of 1099 int becu can vary depending on the circumstances. The penalty can range from $50 to $530 per form, depending on how late the form is filed.

How do I edit becu 1099 int in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 1099 int becu form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit 206 439 5700 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing becu refer a friend, you need to install and log in to the app.

How do I fill out becu 1099 int on an Android device?

Complete 1099 int becu form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your becu 1099 int form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

206 439 5700 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.