Get the free For questions, call (302) 577-8780 - revenue delaware

Show details

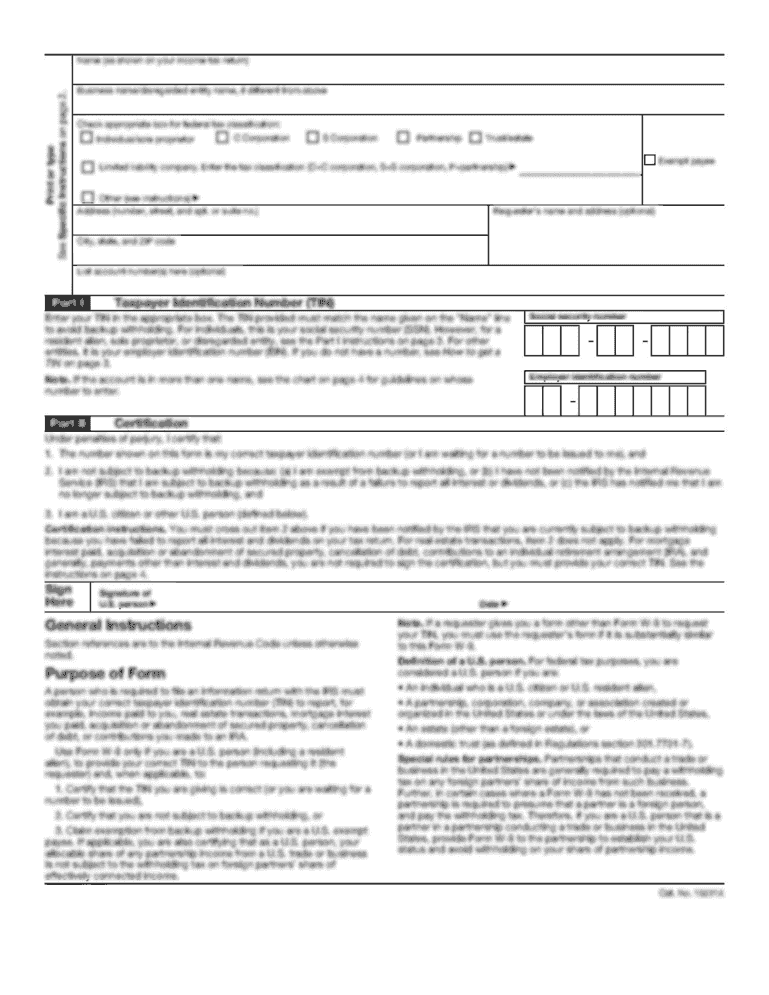

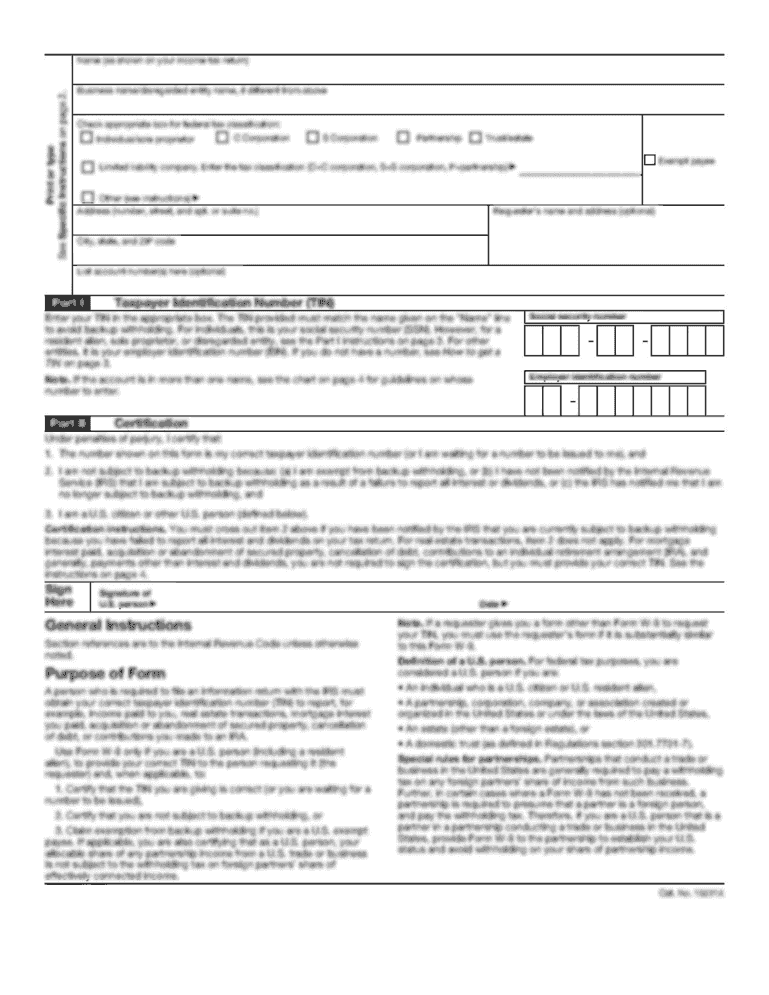

DELAWARE DIVISION OF REVENUE LA GROSS RECEIPTS TAX RETURN FORM LQ2 9501 ACCOUNT NUMBER TAX PERIOD ENDING DUE ON OR BE FORE BUSINESS CODE GROUP DESCRIPTION 0-000000000-000 03-31-07 04-30-07 356 MFG

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your for questions call 302 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for questions call 302 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing for questions call 302 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit for questions call 302. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is for questions call 302?

The term 'for questions call 302' does not have a specific meaning or context. More information is needed to provide an accurate answer.

Who is required to file for questions call 302?

There is no requirement for filing 'for questions call 302' as it is not a recognized filing or reporting process.

How to fill out for questions call 302?

Since 'for questions call 302' is not a recognized form or process, there are no specific instructions for filling it out.

What is the purpose of for questions call 302?

We cannot determine the purpose of 'for questions call 302' without further context or information.

What information must be reported on for questions call 302?

As 'for questions call 302' is not a recognized reporting requirement, there are no specific information to be reported.

When is the deadline to file for questions call 302 in 2023?

There is no specified deadline for filing 'for questions call 302' as it is not a recognized filing or reporting process.

What is the penalty for the late filing of for questions call 302?

Since 'for questions call 302' does not have any legal or regulatory implications, there are no penalties associated with late filing.

How can I get for questions call 302?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the for questions call 302 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my for questions call 302 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your for questions call 302 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out for questions call 302 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign for questions call 302 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your for questions call 302 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.