Get the free power of attorney irs form

Show details

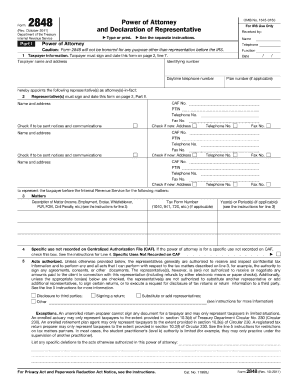

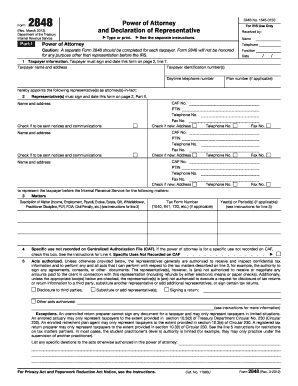

Instructions for Form 2848 Rev. July 2014 Department of the Treasury Internal Revenue Service Power of Attorney and Declaration of Representative Section references are to the Internal Revenue Code unless otherwise noted. inspect your confidential tax return information but do not want to authorize an individual to represent you before the IRS. General Instructions Future Developments For the latest information about developments related to Form ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your power of attorney irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your power of attorney irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing power of attorney irs online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit power of attorney irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out power of attorney irs

How to fill out power of attorney irs?

01

Start by downloading Form 2848, "Power of Attorney and Declaration of Representative" from the Internal Revenue Service (IRS) website.

02

Read the instructions carefully to understand the requirements, restrictions, and responsibilities of the power of attorney.

03

Fill out the taxpayer information section, including the name, address, Social Security number, and phone number of the individual or entity granting the power of attorney.

04

Provide the name, address, and phone number of the representative (attorney, accountant, etc.) who will be acting on behalf of the taxpayer.

05

Specify if the power of attorney is granted for all tax matters or only specific matters, such as filing returns, dealing with audits, or negotiating settlements.

06

Attach any additional information or documentation required by the IRS, such as a copy of the representative's credentials or previous power of attorney forms.

07

Have the taxpayer or the authorized representative sign and date the form. If there are multiple representatives, each one should sign and date a separate Form 2848.

08

Keep a copy of the completed and signed form for your records.

09

Submit the filled-out Form 2848 to the IRS by mail, fax, or electronically through the IRS e-Services program.

Who needs power of attorney irs?

01

Taxpayers who are unable or prefer not to handle their tax matters personally may need a power of attorney.

02

Individuals or businesses facing legal issues or audits from the IRS might require representation by an attorney or tax professional, thus needing a power of attorney.

03

Taxpayers who may be out of the country or otherwise unable to manage their tax affairs themselves can grant a power of attorney to someone they trust to handle their tax matters.

04

Executors or administrators of an estate may need a power of attorney to handle tax-related tasks on behalf of the deceased individual.

05

Businesses or organizations with multiple owners or members may consider granting a power of attorney to a designated representative to handle tax matters efficiently.

06

Those facing complex tax situations or expecting significant tax changes may seek assistance from a representative authorized through a power of attorney.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is power of attorney irs?

Power of attorney IRS is a legal document that grants someone the authority to act on behalf of a taxpayer in matters related to the Internal Revenue Service.

Who is required to file power of attorney irs?

Any taxpayer who wants to authorize another person to represent them before the IRS is required to file a power of attorney IRS form.

How to fill out power of attorney irs?

To fill out power of attorney IRS form, you need to provide your personal information, the tax matters you are authorizing the representative to handle, and sign the form to make it valid.

What is the purpose of power of attorney irs?

The purpose of power of attorney IRS is to give someone the legal authority to act on behalf of a taxpayer, such as representing them in IRS audits, negotiations, and other tax matters.

What information must be reported on power of attorney irs?

Power of attorney IRS form requires information such as the taxpayer's name, social security number, the representative's name and contact information, and the specific tax matters the representative is authorized to handle.

When is the deadline to file power of attorney irs in 2023?

The exact deadline to file power of attorney IRS in 2023 has not been specified yet. It is advisable to refer to the IRS website or consult a tax professional for the most up-to-date information on deadlines.

What is the penalty for the late filing of power of attorney irs?

The penalty for the late filing of power of attorney IRS may vary depending on the specific circumstances. It is recommended to review the IRS guidelines or consult a tax professional for precise information about penalties.

How can I manage my power of attorney irs directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign power of attorney irs and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in power of attorney irs?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your power of attorney irs to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit power of attorney irs on an iOS device?

Use the pdfFiller mobile app to create, edit, and share power of attorney irs from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your power of attorney irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.