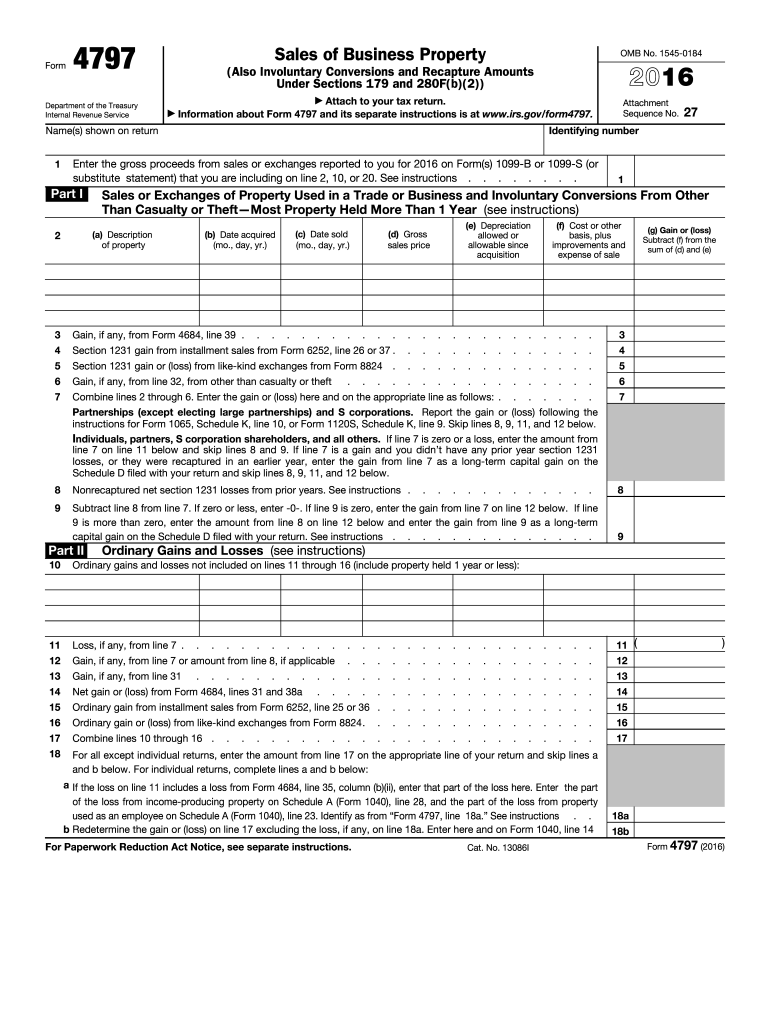

Who Needs Form 4797?

This form is used by the business owners to report the sale, exchange or disposition of a particular property that was used in trade or business. A detailed description of qualifying properties is listed in the instructions for the form.

What is the Purpose of Form 4797?

The main purpose of the form is to report the income or losses that the business entity had after selling or exchanging a business property. This income is taxable and all this information is verified by the IRS.

What other Documents Should be Attached to Form 4797?

The filer has to attach this form to their tax return forms. They also may have to use Form 4684, Casualties and Thefts, Form 6252, Installment Sale Income, Form 8824, Like-Kind Exchanges, Form 4255, Recapture of Investment Credit, or Form 8949. Choose the form that is applicable to your situation.

When is Form 4797 Due?

The Sales of Business Property form must be filed when a property is sold. The estimated time for completing the form is 30 minutes.

What Information Should be Provided in Form 4797?

This form has the following sections for completing:

- Name of the taxpayer and identifying number

- Description of the sold or exchanged property

- Ordinary gains and losses

- Gain from disposition of property under certain sections

- Recapture amounts under certain sections

What do I Do with a Completed Form 4797?

Once the form is completed, it’s attached to the tax return and forwarded to the IRS office. If you have any questions concerning the form follow the instructions or call the local IRS office.