Get the free I T I N E R A R Y - Yale University - ivy yale

Show details

To my fellow Yale Alumni, If I had to distill the essence of what I valued most about my experience at Yale, I'd say that it was learning to perceive and appreciate the interconnectedness of the world.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your i t i n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i t i n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit i t i n online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit i t i n. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

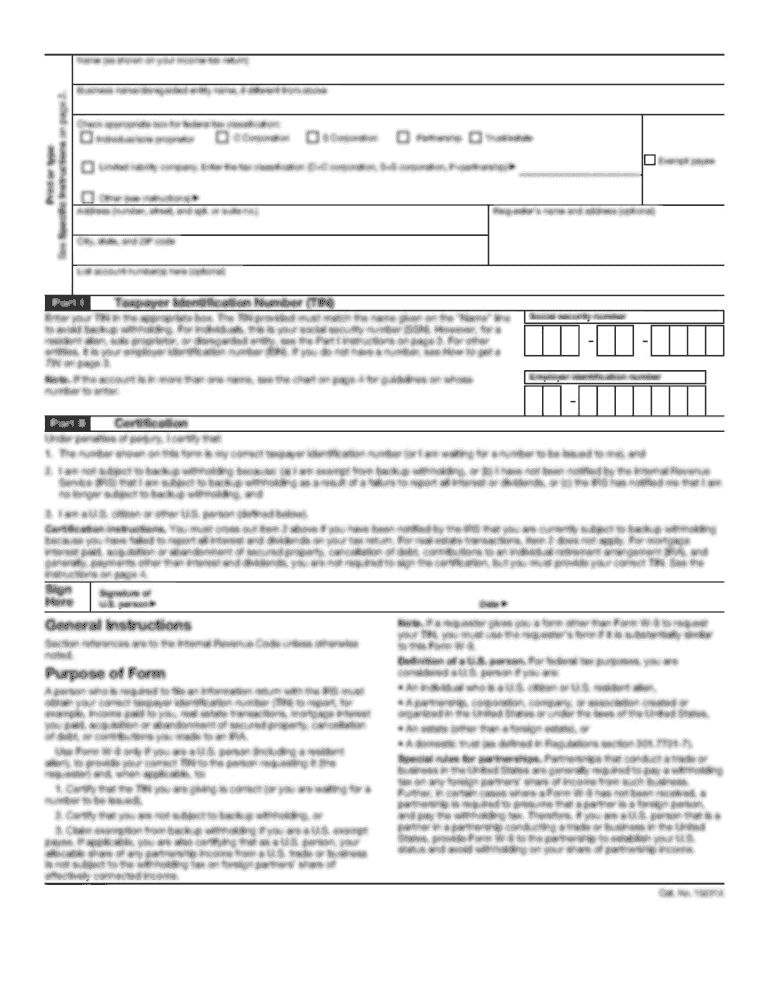

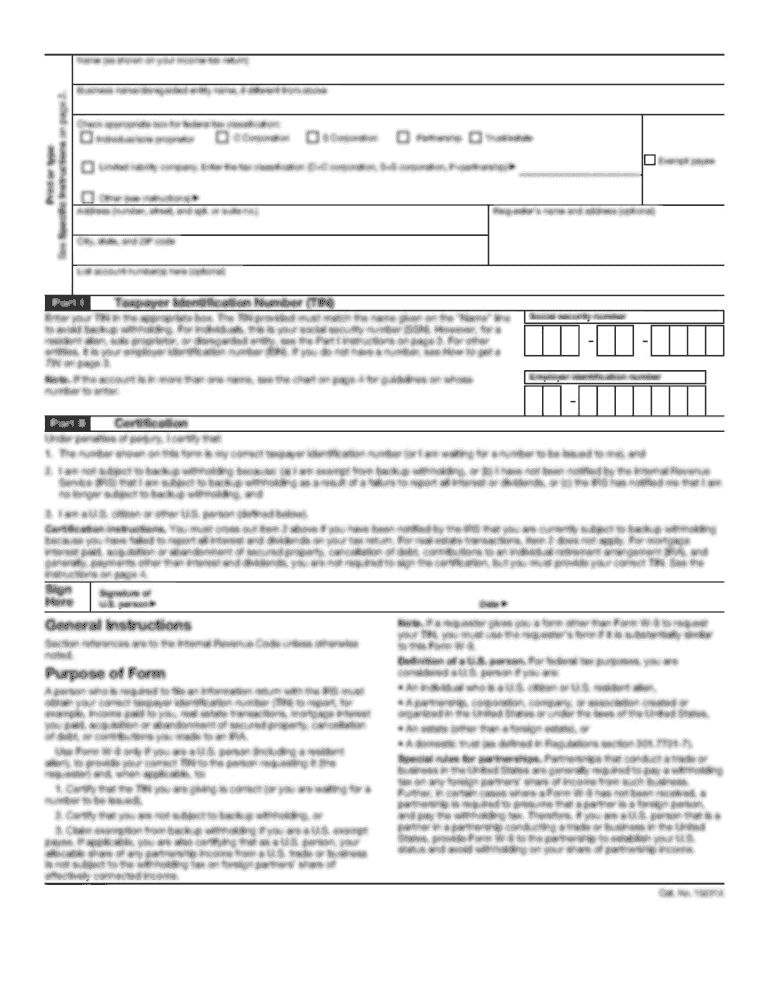

What is i t i n?

ITIN stands for Individual Taxpayer Identification Number. It is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are required to have a U.S. taxpayer identification number but are not eligible for a Social Security Number.

Who is required to file i t i n?

Individuals who do not have and are not eligible for a Social Security Number, but have a federal tax filing requirement or need to claim certain tax benefits, are required to file for an ITIN.

How to fill out i t i n?

To fill out an ITIN application, individuals need to complete Form W-7, Application for IRS Individual Taxpayer Identification Number. The form can be submitted by mail or in-person at an IRS Taxpayer Assistance Center or through an authorized Acceptance Agent.

What is the purpose of i t i n?

The purpose of ITIN is to provide individuals, who are not eligible for a Social Security Number, with a means to comply with the U.S. tax laws and properly fulfill their tax obligations.

What information must be reported on i t i n?

When applying for an ITIN, individuals are required to provide personal information such as their name, date of birth, mailing address, foreign status, and supporting documentation to prove their identity and foreign status.

When is the deadline to file i t i n in 2023?

The deadline to file for an ITIN in 2023 depends on the individual's tax filing requirements. It is recommended to check the IRS website or consult with a tax professional for the specific deadline.

What is the penalty for the late filing of i t i n?

The penalty for late filing of an ITIN application depends on the individual's tax situation. It is important to file the application as soon as possible to avoid potential penalties and ensure compliance with the tax laws.

How can I get i t i n?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the i t i n. Open it immediately and start altering it with sophisticated capabilities.

How do I execute i t i n online?

Completing and signing i t i n online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out i t i n on an Android device?

Use the pdfFiller app for Android to finish your i t i n. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your i t i n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.