Get the free Kiplinger39s Retirement Report - February 2013 - ETFcom

Show details

Your Guide to a Richer Retirement Downsize Your Debt Before You Retire CHRIS SHARP M ore and more Americans are stumbling through their final working years carrying a heavy debt burden. Those hoping

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kiplinger39s retirement report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kiplinger39s retirement report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kiplinger39s retirement report online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit kiplinger39s retirement report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out kiplinger39s retirement report

How to fill out Kiplinger's Retirement Report:

01

Begin by gathering all the necessary financial information you will need for the report. This includes details about your retirement accounts, such as 401(k), IRAs, pensions, and Social Security benefits.

02

Next, carefully review the instructions provided by Kiplinger's Retirement Report. These instructions will guide you through the process of filling out the report and ensure that you provide accurate and relevant information.

03

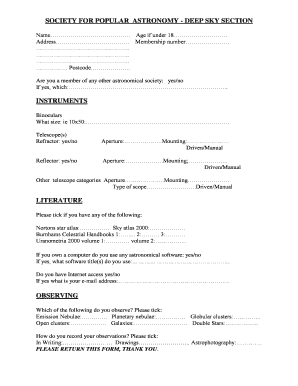

Start by providing your personal details, such as your name, address, and contact information. This is important for identification purposes and for Kiplinger's Retirement Report to reach out to you if needed.

04

Move on to inputting your financial information. This may include details about your retirement savings, investment portfolio, mortgage or rent payments, and any outstanding debts or loans.

05

Take the time to accurately assess and report your anticipated retirement income. This includes information about your Social Security benefits, any pension or annuity payments you expect to receive, and any other sources of income during retirement.

06

Consider any additional financial factors that may impact your retirement. This could include plans for downsizing your home, healthcare expenses, anticipated expenses for travel or leisure activities, and any other significant financial considerations.

07

Follow any additional instructions provided by Kiplinger's Retirement Report regarding specific sections or data entry requirements. It's important to carefully read and follow these instructions to ensure your report is complete and accurate.

08

Double-check your work before submitting the report. Review each section to verify that all the information provided is correct and up-to-date. This will help to ensure that you get the most accurate assessment of your retirement readiness.

Who needs Kiplinger's Retirement Report?

01

Individuals who are planning for retirement and want to make informed financial decisions can benefit from Kiplinger's Retirement Report. This report offers helpful insights and guidance on topics such as retirement savings, investment strategies, Social Security optimization, tax planning, and healthcare costs in retirement.

02

Those who are actively saving for retirement and want to ensure they are on track can use Kiplinger's Retirement Report to assess their progress and make any necessary adjustments to their retirement plan.

03

Pre-retirees who are approaching retirement age can utilize Kiplinger's Retirement Report to understand their current financial standing, estimate their retirement income, and make informed decisions leading up to their transition into retirement.

04

Current retirees can also find value in Kiplinger's Retirement Report. It offers insights into managing retirement income, maximizing Social Security benefits, minimizing taxes, and coping with unexpected expenses that may arise during retirement.

Overall, Kiplinger's Retirement Report is a valuable resource for individuals at various stages of retirement planning, offering them the necessary tools and knowledge to make informed financial decisions and achieve their retirement goals.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kiplinger39s retirement report?

Kiplinger's Retirement Report is a publication that provides retirement planning advice and insights to help individuals prepare for retirement.

Who is required to file kiplinger39s retirement report?

Individuals who are interested in retirement planning and seeking advice on how to prepare for retirement can benefit from reading Kiplinger's Retirement Report.

How to fill out kiplinger39s retirement report?

To access Kiplinger's Retirement Report, individuals can subscribe to the publication online or through a print subscription. The report contains valuable information on retirement planning and strategies.

What is the purpose of kiplinger39s retirement report?

The purpose of Kiplinger's Retirement Report is to help individuals understand the various aspects of retirement planning, including saving for retirement, investment strategies, and managing income during retirement.

What information must be reported on kiplinger39s retirement report?

Kiplinger's Retirement Report provides information on retirement planning, investment options, Social Security, Medicare, estate planning, and other relevant topics related to retirement.

When is the deadline to file kiplinger39s retirement report in 2023?

There is no specific deadline to file Kiplinger's Retirement Report as it is a publication that individuals can access at any time for retirement planning advice.

What is the penalty for the late filing of kiplinger39s retirement report?

There is no penalty for late filing of Kiplinger's Retirement Report as it is not a document that needs to be filed with any authority or government agency.

How can I edit kiplinger39s retirement report from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your kiplinger39s retirement report into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send kiplinger39s retirement report for eSignature?

When you're ready to share your kiplinger39s retirement report, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in kiplinger39s retirement report?

With pdfFiller, it's easy to make changes. Open your kiplinger39s retirement report in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your kiplinger39s retirement report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.