Get the free Federal Tax Credit for ENERGY STAR Cool Roof Colors

Show details

Federal Tax Credit for ENERGY STAR Cool Roof Colors

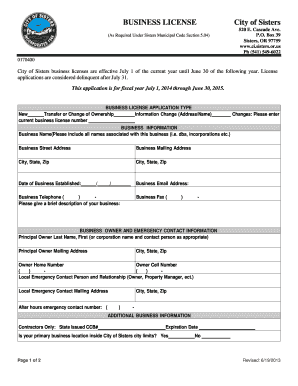

As part of the American Recovery and Reinvestment Act of 2009, a federal tax credit is

now available to SBS customers who install our ENERGY STAR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your federal tax credit for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal tax credit for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal tax credit for online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal tax credit for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out federal tax credit for

How to fill out federal tax credit for:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other relevant income statements.

02

Determine which tax credits you may be eligible for. This could include the Earned Income Tax Credit, Child Tax Credit, or Education Tax Credit, among others.

03

Use tax preparation software or consult with a tax professional to accurately fill out the appropriate tax forms. This may include Form 1040, Form 1040A, or Form 1040EZ.

04

Carefully review your completed tax return for accuracy, ensuring that all information is entered correctly.

05

Double-check that you have claimed all available tax credits that you qualify for.

06

Submit your completed tax return either by mail or electronically, depending on your preferred method and the guidelines provided.

07

Keep a copy of your completed tax return and all supporting documentation for your records.

Who needs federal tax credit for:

01

Individuals or families with low to moderate incomes who may be eligible for the Earned Income Tax Credit or other income-based tax credits.

02

Parents who may qualify for the Child Tax Credit or the Additional Child Tax Credit.

03

Students pursuing higher education who may be eligible for education-related tax credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

04

Homeowners who have made energy-efficient improvements to their residences and may qualify for the Residential Energy Efficient Property Credit or the Nonbusiness Energy Property Credit.

05

Small businesses or self-employed individuals who may be eligible for various tax credits, such as the Small Business Health Care Tax Credit or the Work Opportunity Tax Credit.

06

Individuals or families who have experienced certain life events, such as adoption, purchasing a home, or paying for dependent care, may be eligible for specific tax credits.

It's important to note that these points are general guidelines, and individual circumstances can vary. It's recommended to consult with a tax professional or use tax preparation software to ensure accurate and complete filing of federal tax credits.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is federal tax credit for?

Federal tax credits are financial incentives provided by the government to encourage certain behaviors or investments, such as renewable energy use or charitable donations.

Who is required to file federal tax credit for?

Individuals or businesses who meet the criteria for a specific tax credit are required to file for it on their tax return.

How to fill out federal tax credit for?

To fill out a federal tax credit, taxpayers must provide the necessary documentation and information required by the IRS for that specific credit.

What is the purpose of federal tax credit for?

The purpose of federal tax credits is to incentivize certain behaviors or investments that the government deems beneficial to society or the economy.

What information must be reported on federal tax credit for?

Taxpayers must report specific information relevant to the tax credit they are applying for, such as expenses incurred or investments made.

When is the deadline to file federal tax credit for in 2023?

The deadline to file federal tax credits for 2023 is typically April 15th, unless an extension is requested.

What is the penalty for the late filing of federal tax credit for?

The penalty for late filing of federal tax credits can vary, but may include fines or interest on the unpaid amount.

Where do I find federal tax credit for?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the federal tax credit for in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute federal tax credit for online?

pdfFiller has made it simple to fill out and eSign federal tax credit for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit federal tax credit for on an Android device?

You can edit, sign, and distribute federal tax credit for on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your federal tax credit for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.