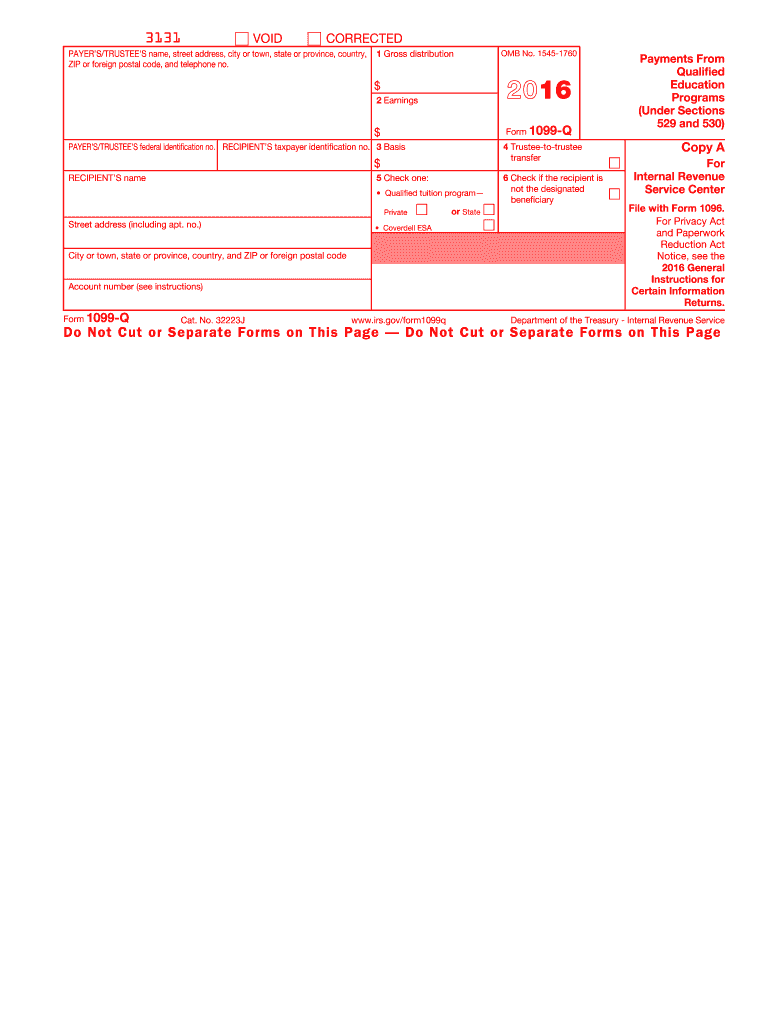

IRS 1099-Q 2016 free printable template

Get, Create, Make and Sign

Editing form 1099 q 2016 online

IRS 1099-Q Form Versions

Instructions and Help about form 1099 q 2016

All right so for this video I wanted to cover the IRS form 1099-q so what is it under what circumstances do you receive this and then do you have to do any kind of reporting on your form 1040 so a 1099-q is a cash distribution or payment from a qualified education program right so section 529 plans those are what people are most familiar with and 529 plans are basically college savings funds that are set up by parents for their kids, and you put the cash in there, and it can be invested in stocks and bonds interest bearing accounts and the income grows tax-free, so you don't have to pay taxes on it um so if we look at an example here um john creates a 529 plan for his son mark is going to be starting his first year of college, and he needs five thousand dollars for qualified tuition and other expenses so what john does is he goes to the 529 plan he goes into the account, and he requests a distribution of five grand, and then he uses that 5000 to pay for the first year's tuition okay that's perfectly normal...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 1099 q 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.