Get the free Under IRS regulations - Eide Bailly LLP

Show details

Dear Clients and Business Friends:

All employers who furnish vehicles to employees for the employees personal use are required to

add the personal use value of the vehicle to the employees W2. As

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign under irs regulations

Edit your under irs regulations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your under irs regulations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit under irs regulations online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit under irs regulations. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

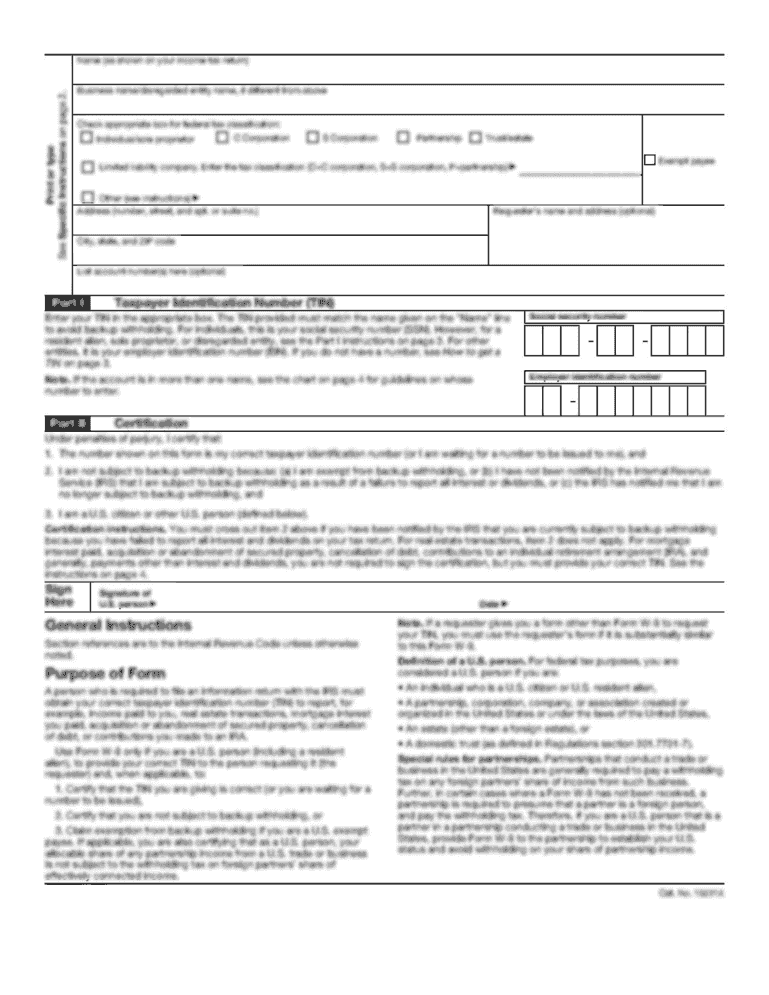

How to fill out under irs regulations

How to fill out under IRS regulations:

01

Gather all necessary documentation: Before starting to fill out any forms or paperwork, it is important to gather all relevant documentation that the IRS may require. This can include W-2 forms, 1099 forms, receipts, and any other relevant financial records.

02

Determine your filing status: Your filing status determines the tax rates and deductions you are eligible for. The IRS offers several filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Choose the filing status that best applies to your situation.

03

Use the correct form: Depending on your filing status and sources of income, you will need to choose the appropriate form. The most common forms used for individual taxpayers are Form 1040, Form 1040A, and Form 1040EZ. Make sure to download or request the right form from the IRS website or office.

04

Fill out personal information: Start by providing your personal information, including your name, Social Security number, address, and any other requested details. Make sure all information is accurate and up to date.

05

Report your income: The IRS requires you to report all sources of income. This can include wages, self-employment income, rental income, interest, dividends, and capital gains. Carefully enter each source of income and its corresponding amount.

06

Claim deductions and credits: Deductions and credits can help reduce your taxable income and potentially lower your tax liability. Common deductions include those for mortgage interest, student loan interest, and medical expenses. Credits, on the other hand, directly reduce your tax bill. Some popular credits include the Child Tax Credit, Earned Income Tax Credit, and education credits. Ensure that you are eligible for any deductions or credits you claim.

07

Review and double-check: Once you have filled out all the necessary sections and calculations, take the time to review your return for any errors or omissions. Mistakes on your tax return can potentially lead to penalties or delays in processing. It may be helpful to use tax software or consult with a tax professional to ensure accuracy.

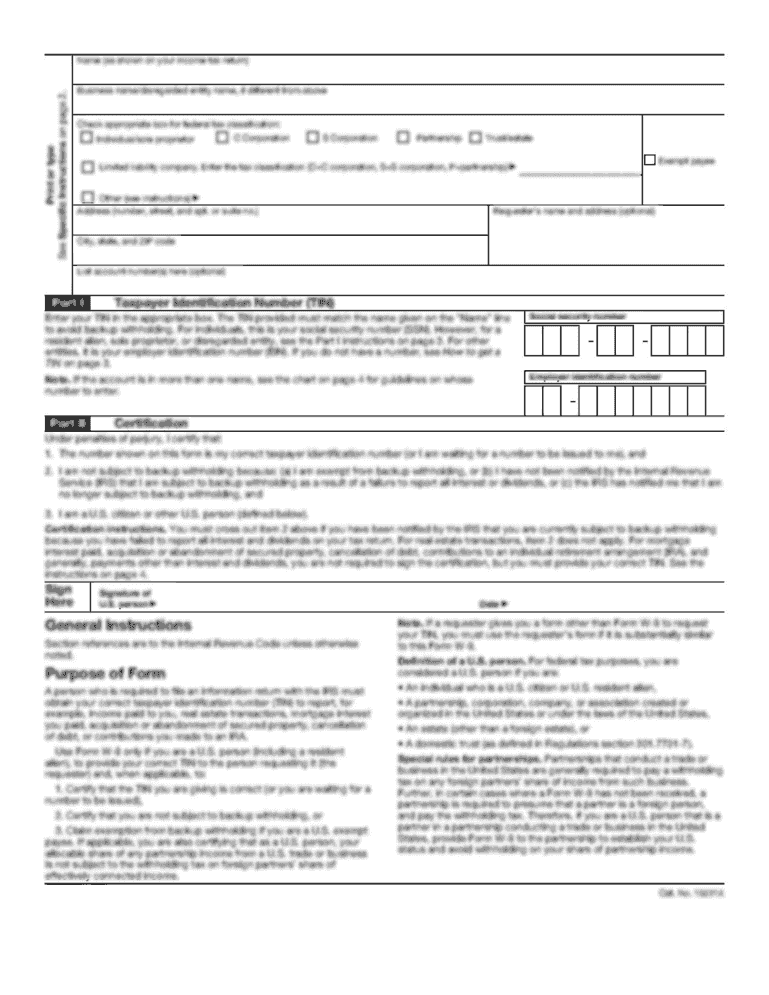

Who needs to follow IRS regulations:

01

Individuals: Every individual who earns income, regardless of the source, is required to follow IRS regulations and file a tax return if their income exceeds the threshold set by the IRS. This includes employees, self-employed individuals, freelancers, and those with rental or investment income.

02

Businesses: Different types of businesses have different tax related responsibilities under IRS regulations. Corporations, partnerships, sole proprietors, and LLCs are all subject to various tax rules and filing requirements. The size and structure of the business will determine the specific tax obligations.

03

Nonprofit organizations: Nonprofit organizations that meet certain criteria are also required to follow IRS regulations. They must apply for tax-exempt status and comply with specific reporting and filing requirements to maintain their tax-exempt status.

Overall, anyone who has an income or is involved in financial transactions that fall within the purview of the IRS must adhere to its regulations and fulfill their tax obligations. It is important to stay updated on any changes to the tax code and seek professional guidance when needed to ensure compliance with IRS regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send under irs regulations for eSignature?

To distribute your under irs regulations, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get under irs regulations?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific under irs regulations and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the under irs regulations in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your under irs regulations in seconds.

Fill out your under irs regulations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Under Irs Regulations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.