Get the free Rev 8-03 Medical Care Savings Account - revenue mt

Show details

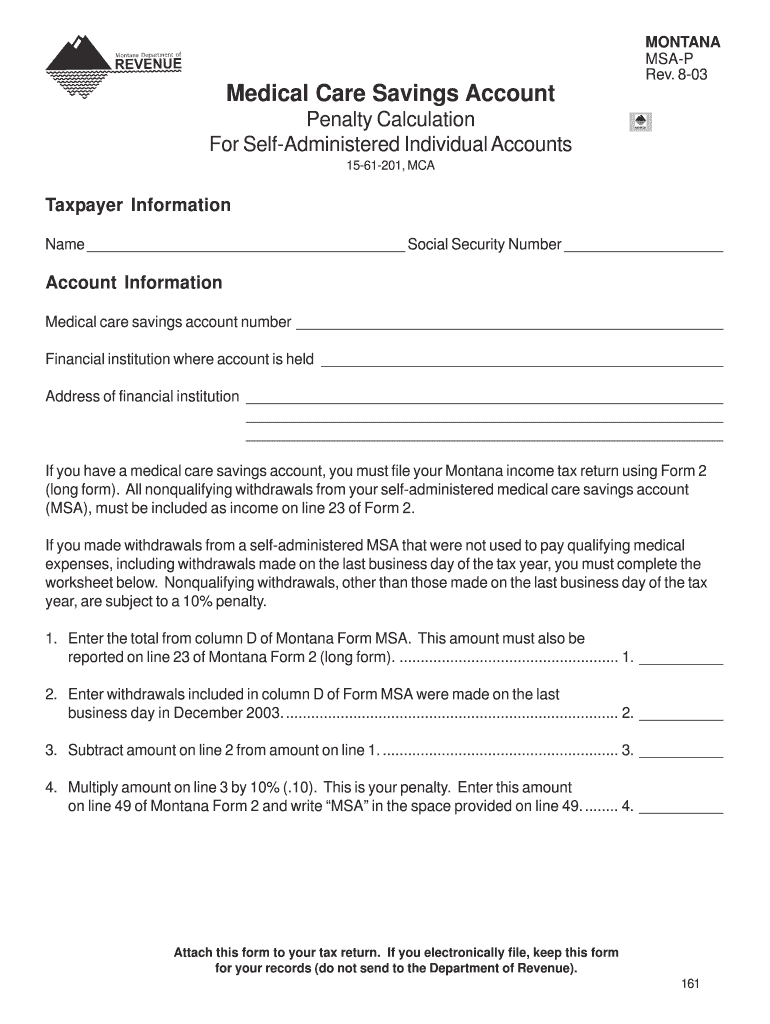

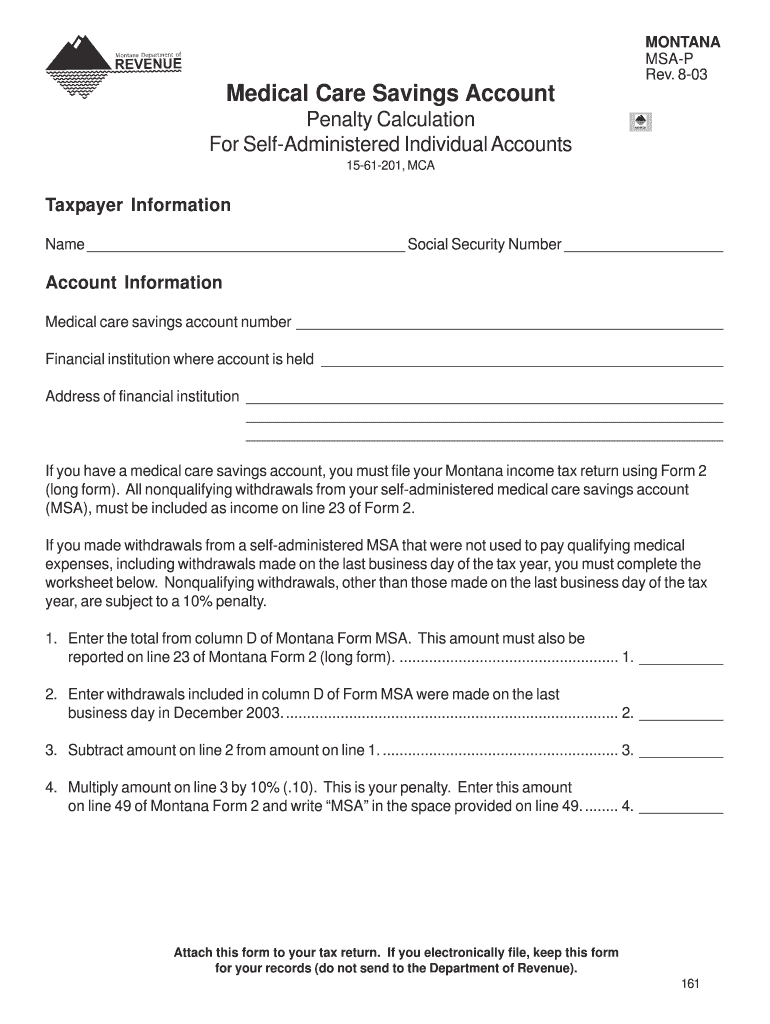

MONTANA MAP Rev. 803 Medical Care Savings Account Penalty Calculation For SelfAdministered Individual Accounts 1561201, MCA Taxpayer Information Name Social Security Number Account Information Medical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rev 8-03 medical care form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev 8-03 medical care form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev 8-03 medical care online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rev 8-03 medical care. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out rev 8-03 medical care

How to fill out rev 8-03 medical care:

01

Start by gathering all necessary information. This may include your personal identification details, such as name, address, and social security number, as well as any relevant medical history or documentation.

02

Read the instructions carefully. It's important to understand the specific requirements and guidelines for completing the rev 8-03 medical care form to ensure accuracy and completeness.

03

Begin by filling out the applicant information section. Provide your full name, date of birth, gender, and contact details as requested.

04

Move on to the medical information section. Here, you may need to provide details about any pre-existing conditions, allergies, medications, or treatments currently being received.

05

If applicable, complete the section regarding insurance coverage. Include information about your primary insurance provider, policy number, and any additional coverage that may apply.

06

Fill out the authorization section where necessary. This may involve providing consent for the release and use of medical information, as well as assigning benefits to healthcare providers.

07

Double-check your entries for accuracy and completeness. It's crucial to review all the information you have provided to ensure that it is correct and up-to-date.

08

Sign and date the form as required. Make sure that all necessary signatures are obtained, including your own and any other relevant parties.

09

Keep a copy of the completed form for your records and submit the original to the appropriate recipient. Follow any instructions provided on where and how to submit the rev 8-03 medical care form.

Who needs rev 8-03 medical care?

01

Individuals seeking medical care who are affiliated with an organization or program that requires the completion of rev 8-03 medical care forms.

02

Patients who are applying for certain medical benefits or services that necessitate the submission of rev 8-03 medical care documentation.

03

Healthcare providers and institutions that require patients to fill out rev 8-03 medical care forms for record-keeping and administration purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rev 8-03 medical care?

Rev 8-03 medical care is a form used to report medical expenses incurred during the tax year.

Who is required to file rev 8-03 medical care?

Individuals who have incurred medical expenses during the tax year are required to file rev 8-03 medical care.

How to fill out rev 8-03 medical care?

To fill out rev 8-03 medical care, you need to provide detailed information about each medical expense incurred during the tax year.

What is the purpose of rev 8-03 medical care?

The purpose of rev 8-03 medical care is to report and deduct qualified medical expenses on your tax return.

What information must be reported on rev 8-03 medical care?

You must report detailed information about each medical expense, including the date of service, type of service, and amount paid.

When is the deadline to file rev 8-03 medical care in 2023?

The deadline to file rev 8-03 medical care in 2023 is April 15th.

What is the penalty for the late filing of rev 8-03 medical care?

The penalty for the late filing of rev 8-03 medical care is a 5% penalty on the unpaid tax amount per month, up to a maximum of 25%.

How can I get rev 8-03 medical care?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the rev 8-03 medical care in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit rev 8-03 medical care in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing rev 8-03 medical care and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the rev 8-03 medical care in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your rev 8-03 medical care online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.