Get the free apy full form

Show details

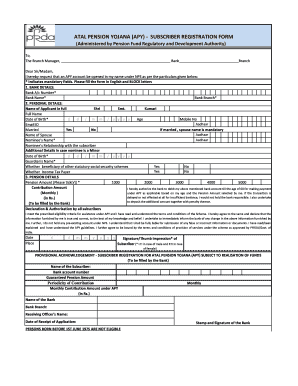

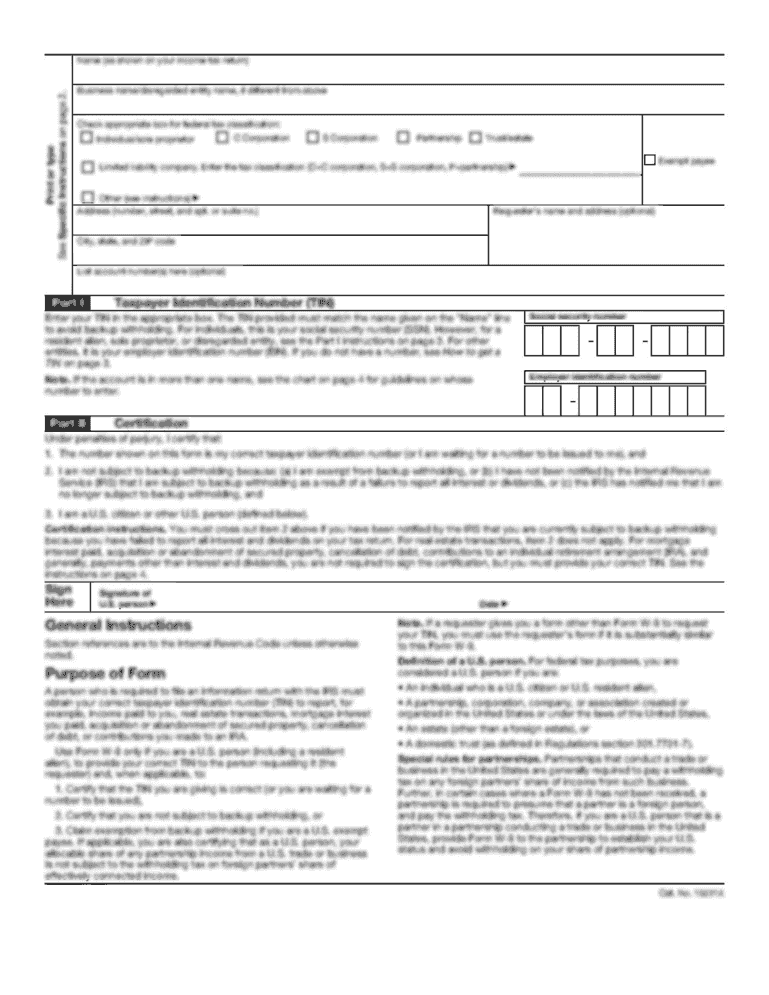

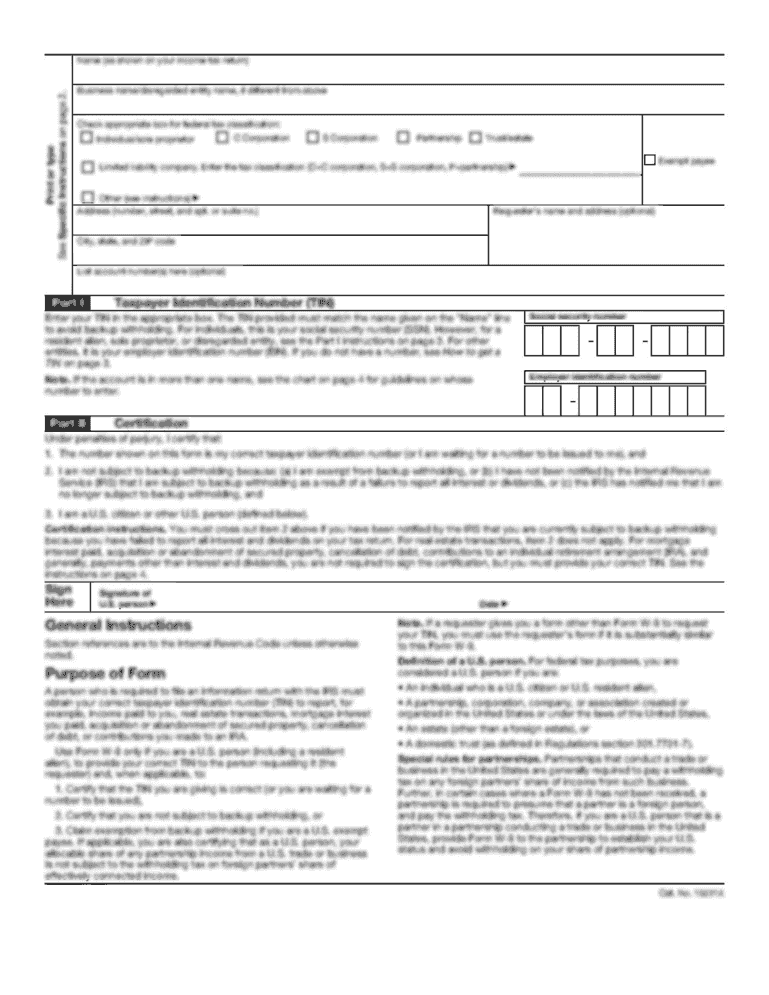

FATAL PENSION JANA (APY) SUBSCRIBER REGISTRATION FORM (Administered by Pension Fund Regulatory and Development Authority) To, The Branch Manager, Bank Branch Dear Sir/Madam, I hereby request that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your apy full form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apy full form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit apy full form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit atal pension yojana apy subscriber registration form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out apy full form

01

To fill out the Atal Pension Yojana (APY), you need to visit your nearest bank or post office that is offering APY services.

02

Approach the concerned bank or post office staff and request them to assist you with the APY enrollment process.

03

The staff will provide you with an APY application form. Fill out the form accurately and legibly.

04

Provide personal details such as your name, contact information, address, and date of birth in the designated sections of the form.

05

Indicate your preferred pension amount and the frequency of contribution. The available pension options are Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs. 4,000, and Rs. 5,000 per month.

06

Specify your nominee details, including their name, relationship, and contact information. A nominee is the person who will receive the pension in case of the subscriber's demise.

07

Attach the necessary supporting documents, which may include your Aadhaar card, proof of address, proof of identity, and a passport-sized photograph.

08

Double-check all the information provided in the form and make sure it is accurate and up-to-date.

09

Submit the filled-out form along with the supporting documents to the bank or post office staff.

10

The staff will verify the information and documents provided. They may ask for additional clarification or documentation if required.

11

Once the verification is complete, the staff will provide you with an APY acknowledgment receipt. Keep this receipt safe for future reference.

12

The APY scheme is available to all citizens of India between the ages of 18 and 40. Therefore, anyone within this age range and desiring a secured pension in the future can opt for the Atal Pension Yojana.

13

Individuals working in the unorganized sector or not covered by any statutory social security scheme are particularly encouraged to join APY and secure their retirement.

14

APY can be beneficial for those individuals who do not have a formal pension arrangement or want to augment their existing pension plans.

15

Students, self-employed individuals, small business owners, and others in the eligible age group can consider enrolling in APY to secure their financial future during retirement.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is atal pension yojana apy?

Atal Pension Yojana (APY), launched by the Government of India in 2015, is a pension scheme aimed at providing a regular source of income to individuals in their old age. It primarily targets workers in the unorganized sector who do not have access to formal pension schemes.

Under APY, individuals are required to contribute a certain amount of money on a monthly basis throughout their working life, and upon reaching the age of 60, they become eligible to receive a fixed minimum monthly pension ranging from ₹1,000 ($14) to ₹5,000 ($70) depending on their contribution amount and age of joining.

The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) and is open to all Indian citizens within the age group of 18 to 40 years. The government also contributes 50% of the subscriber's contribution or ₹1,000 ($14) per year (whichever is lower) for a period of 5 years for eligible subscribers who join between 1st June 2015 and 31st December 2015.

APY aims to ensure social security for the unorganized working class and encourage employees in the informal sector to save for their retirement.

Who is required to file atal pension yojana apy?

Any Indian citizen between the ages of 18 and 40 is eligible to enroll in the Atal Pension Yojana (APY). It is a voluntary pension scheme, and individuals in this age group can voluntarily choose to contribute to this scheme. However, it is particularly targeted towards the unorganized sector workers who do not have access to a formal pension scheme.

How to fill out atal pension yojana apy?

To fill out the Atal Pension Yojana (APY) application form, follow these step-by-step instructions:

1. Obtain the APY application form: You can either download the form from the official website of the Atal Pension Yojana or visit your nearest bank or post office to collect a physical copy.

2. Fill in the personal details: Enter your full name, gender, date of birth, Aadhaar number, contact details, and residence address in the appropriate sections of the form.

3. Choose the pension amount: Decide on the pension amount you wish to receive after the age of 60, selecting from the available options mentioned in the form.

4. Nominee details: Provide the necessary information of the nominee, including their name, relationship with you, and their contact details. Note that the nominee can be any family member.

5. Bank account details: Fill in details about your existing bank account, including the bank's name, branch, bank account number, and IFSC code.

6. Signature: Sign the form in the designated space, confirming that all the information provided is accurate.

7. Submit the form: Submit the completed form along with the required supporting documents to the concerned bank or post office.

8. Pay the first contribution: Pay the initial contribution amount, as specified by the bank or post office, through cash, cheque, or online transfer. This amount will be based on your age and the pension amount you have chosen.

Once your APY application is processed and approved, you will receive a confirmation message or receipt from the bank or post office.

Note: It is recommended to thoroughly read the instructions provided on the APY form and consult a bank representative for any clarification or guidance during the application process.

What is the purpose of atal pension yojana apy?

The purpose of Atal Pension Yojana (APY) is to provide a social security pension scheme for workers in the unorganized sector in India. It aims to address the old age income security needs of workers who are not covered by any formal pension scheme. APY encourages workers to voluntarily contribute towards regular pension income during their working years, and guarantees a fixed pension amount ranging from Rs. 1000 to Rs. 5000 per month, depending on the contributions and age at entry. The scheme helps individuals save for their retirement and ensures a dignified life after retirement.

What information must be reported on atal pension yojana apy?

When applying for the Atal Pension Yojana (APY) scheme, you will typically need to provide the following information:

1. Personal details: This includes your name, date of birth, gender, Aadhaar number, contact details, and address.

2. Bank account details: You will need to provide the bank account number, IFSC code, and branch details of the bank where you wish to open your APY account.

3. Choice of pension amount: You need to specify the desired pension amount you would like to receive on a monthly basis after retirement. The available options are Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs. 4,000, and Rs. 5,000.

4. Contribution frequency: You will need to choose whether you want to contribute the pension amount on a monthly, quarterly, or half-yearly basis.

5. Aadhaar number: Providing your Aadhaar number is mandatory for APY enrollment. If you don't have an Aadhaar number, you can provide a proof of application for Aadhaar.

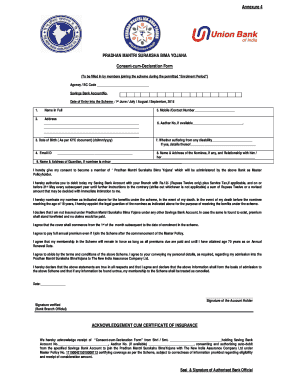

6. Consent for auto-debit: Since APY contributions are collected through auto-debit from your bank account, you must provide consent for this deduction.

7. Declaration of eligibility: You will need to declare that you meet the eligibility criteria for the APY scheme, such as being a citizen of India between the ages of 18 and 40.

It is important to note that the required information may vary slightly depending on the specific provisions and guidelines set by the Pension Fund Regulatory and Development Authority (PFRDA) and the associated financial institutions. Therefore, it is advisable to refer to the official APY documents or consult with the relevant authorities for accurate and up-to-date information.

When is the deadline to file atal pension yojana apy in 2023?

The deadline to file for Atal Pension Yojana (APY) in 2023 has not been officially announced yet. It is advisable to regularly check the official website of APY or contact the concerned authorities for the most up-to-date information regarding the deadline.

How do I modify my apy full form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your atal pension yojana apy subscriber registration form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an eSignature for the apy full form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your atal pension yojana apy subscriber registration form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete apy full form on an Android device?

Use the pdfFiller Android app to finish your atal pension yojana apy subscriber registration form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your apy full form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.