Get the free Large Cap Value Portfolio

Show details

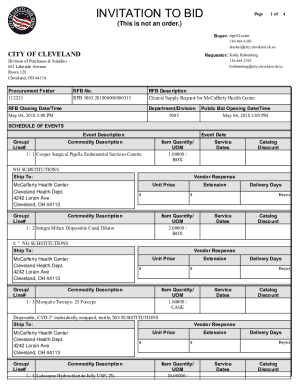

Large Cap Value PortfolioSchedule of Investments as of March 31, 2017

(unaudited)

Shares

Common Stock (97.3%)

Consumer Discretionary (10.3%)

1,181,100 Comcast Corporation

168,840 Delphi Automotive

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your large cap value portfolio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your large cap value portfolio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing large cap value portfolio online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit large cap value portfolio. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out large cap value portfolio

How to fill out large cap value portfolio:

01

Determine your investment goals: Before filling out your large cap value portfolio, it is important to clearly define your investment goals. Consider factors such as your risk tolerance, investment timeline, and desired returns. This will help you make informed decisions when selecting stocks for your portfolio.

02

Research and analyze large cap value stocks: Large cap value stocks are typically established companies with a stable track record and lower price-to-earnings ratios. Conduct thorough research on individual stocks, analyzing their financial performance, competitive position, and growth potential. Look for stocks that have a good value relative to their intrinsic worth.

03

Diversify your holdings: Diversification is key to reducing risk in any investment portfolio. As you fill out your large cap value portfolio, consider diversifying across different sectors and industries. This will help mitigate potential losses if a particular sector experiences a downturn. Aim for a mix of stocks from different industries such as technology, healthcare, finance, and consumer goods.

04

Consider dividend-paying stocks: Large cap value stocks often include companies that provide regular dividend payments. Dividends can provide a steady income stream and increase the overall return of your portfolio. Look for companies with a history of consistently paying dividends and with a healthy dividend yield.

05

Monitor and review your portfolio: It is important to regularly review and monitor your large cap value portfolio. Keep track of the performance of your stocks and evaluate if they are meeting your investment objectives. Adjust your portfolio as necessary, based on changes in the market or your investment goals.

Who needs a large cap value portfolio:

01

Investors seeking stability and long-term growth: Large cap value stocks are typically associated with stable companies that have a proven track record. Investors looking for steady growth with lower risks may find a large cap value portfolio suitable for their needs.

02

Investors with a longer investment horizon: Large cap value stocks are often more suitable for investors with a longer investment horizon, as these stocks tend to provide more stable returns over time. If you have a longer time horizon and are willing to wait for potential capital appreciation, a large cap value portfolio may be a good fit.

03

Risk-averse investors: Large cap value stocks generally have a lower risk profile compared to smaller companies or growth-oriented stocks. Investors who prioritize capital preservation and are more risk-averse may find a large cap value portfolio more suitable.

04

Income-focused investors: Large cap value stocks often pay dividends, making them attractive to income-focused investors. If you are seeking regular income from your investments, a large cap value portfolio may provide a consistent dividend stream.

In conclusion, filling out a large cap value portfolio requires careful analysis, diversification, and consideration of individual investment goals. This type of portfolio may be suitable for investors seeking stability, long-term growth, and a lower risk profile.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is large cap value portfolio?

A large cap value portfolio is a type of investment strategy that focuses on companies with larger market capitalizations and strong fundamentals, trading at a price below their intrinsic value.

Who is required to file large cap value portfolio?

Individuals or entities managing large amounts of assets are required to file large cap value portfolio.

How to fill out large cap value portfolio?

Fill out the large cap value portfolio by including detailed information about the holdings, performance, and valuation of the selected large cap value stocks.

What is the purpose of large cap value portfolio?

The purpose of a large cap value portfolio is to generate long-term capital appreciation by investing in undervalued large cap stocks.

What information must be reported on large cap value portfolio?

Information such as the name of the holdings, percentage of portfolio allocation, market value, and cost basis must be reported on the large cap value portfolio.

When is the deadline to file large cap value portfolio in 2023?

The deadline to file large cap value portfolio in 2023 is typically around the end of the first quarter of the year.

What is the penalty for the late filing of large cap value portfolio?

The penalty for the late filing of large cap value portfolio may include fines or sanctions imposed by regulatory authorities.

How do I complete large cap value portfolio online?

pdfFiller has made it simple to fill out and eSign large cap value portfolio. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit large cap value portfolio on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign large cap value portfolio. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit large cap value portfolio on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as large cap value portfolio. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your large cap value portfolio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.