Get the free LOAN REQUEST FORM - Lincoln Memorial University - lmunet

Show details

Financial Aid Office 6965 Cumberland Gap Parkway Arrogate, TN 37752 Phone: 423.869.6336 Fax: 423.869.6347 fin aid amulet.edu LOAN REQUEST FORM Student Name: Date of Birth: Student ID or SS #: Academic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan request form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan request form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out loan request form

How to Fill Out a Loan Request Form:

01

Begin by gathering all the necessary information and documentation that may be required for the loan request form. This may include your personal identification details, employment information, financial statements, and any other supporting documents that the lender may require.

02

Carefully read through the loan request form and understand each section. It is crucial to ensure that you provide accurate and truthful information throughout the form. Be mindful of any specific instructions or requirements mentioned on the form.

03

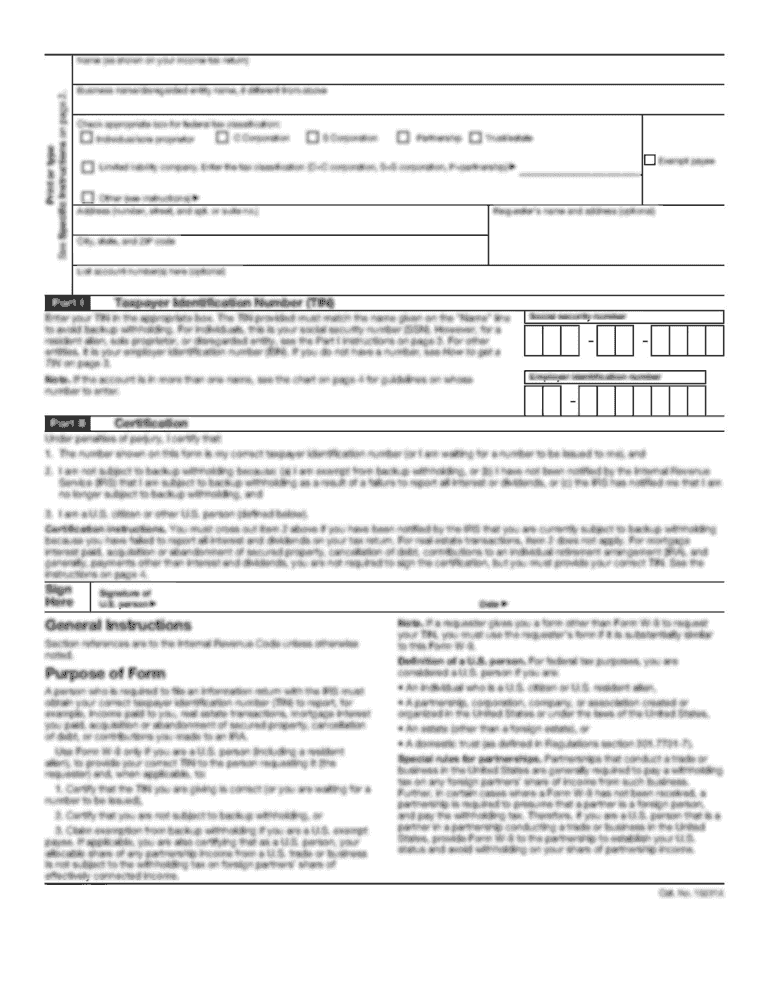

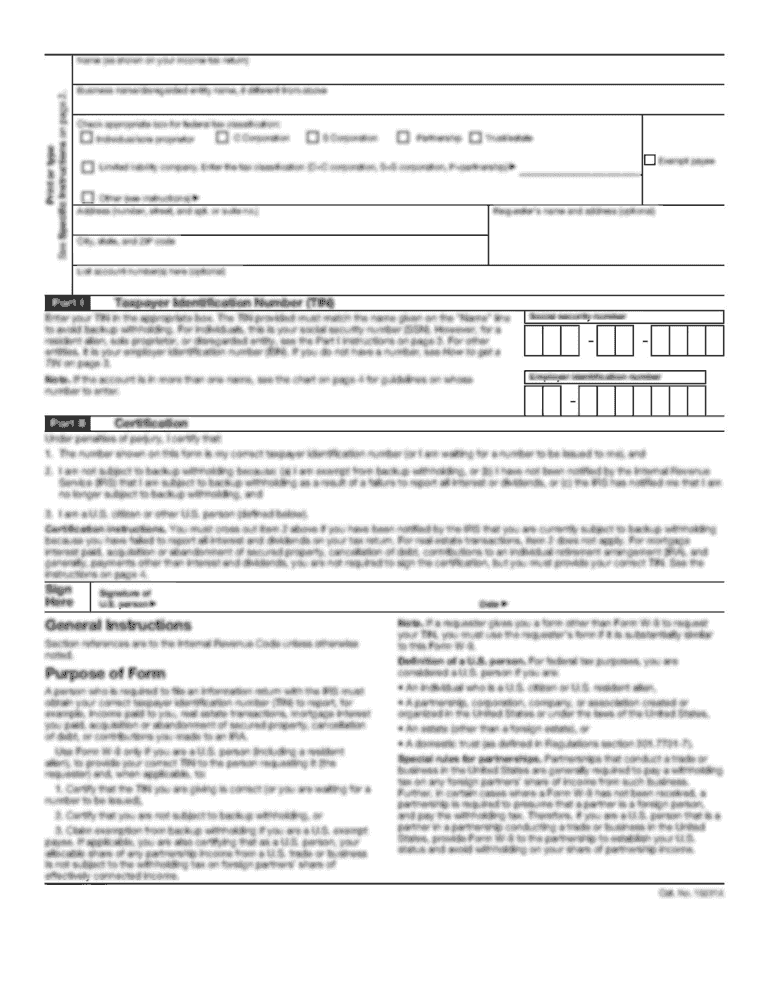

Start by filling out the basic personal information section of the form, which typically includes your full name, contact details, address, and social security number. Double-check the accuracy of the details entered to avoid any potential complications or delays in the loan processing.

04

Proceed to complete the employment section of the loan request form. This generally involves providing details about your current employment status, including your employer's name, your job title, duration of employment, and monthly income. Some forms may also require information about your previous employment history.

05

If applicable, provide information related to the loan you are seeking. This may include the loan amount requested, the purpose of the loan, and the desired repayment term. Additionally, you may be required to disclose any existing debts or financial obligations you have.

06

Carefully review the completed loan request form to ensure that all the information provided is accurate and complete. This is a crucial step as any incorrect or omitted details may lead to the rejection or delay of your loan application.

07

Sign and date the loan request form, as instructed. By doing so, you certify that all the information provided is true and accurate to the best of your knowledge.

08

If necessary, make a copy of the completed loan request form for your records before submitting it to the lender.

Who Needs a Loan Request Form?

01

Individuals who are looking to secure a loan from a financial institution or lender need a loan request form. Whether it is a personal loan, car loan, mortgage loan, or any other type of borrowing, lenders typically require applicants to complete a loan request form as part of the loan application process.

02

Small business owners or entrepreneurs who are seeking business financing may also need to fill out a loan request form. These forms often include additional sections specific to business details, such as the company name, nature of the business, financial statements, and future projections.

03

Individuals who have faced financial difficulties or have a low credit score may need to complete a loan request form if they are looking for alternative lending options or specialized loan programs that cater to their specific circumstances.

Remember, the specific requirements for a loan request form may vary depending on the lender and the type of loan being applied for. It is important to carefully read and follow the instructions provided on the form and provide accurate information to increase the chances of a successful loan application.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan request form?

A loan request form is a document used to formally request a loan from a financial institution or lender.

Who is required to file loan request form?

Individuals or businesses seeking a loan are required to file a loan request form with the lender.

How to fill out loan request form?

To fill out a loan request form, provide accurate and detailed information about your financial situation, purpose of the loan, and repayment plan.

What is the purpose of loan request form?

The purpose of a loan request form is to provide the lender with necessary information to assess the borrower's creditworthiness and ability to repay the loan.

What information must be reported on loan request form?

Information such as personal or business financial information, loan amount, repayment terms, and purpose of the loan must be reported on a loan request form.

When is the deadline to file loan request form in 2023?

The deadline to file a loan request form in 2023 will depend on the specific lender or financial institution.

What is the penalty for the late filing of loan request form?

The penalty for late filing of a loan request form may vary depending on the lender, but typically it could result in a delayed loan approval or additional fees.

How can I modify loan request form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your loan request form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the loan request form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your loan request form in minutes.

How do I fill out the loan request form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign loan request form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your loan request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.