Get the free huf certificate format

Show details

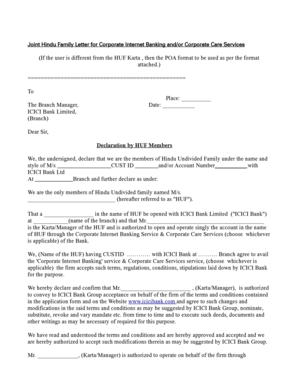

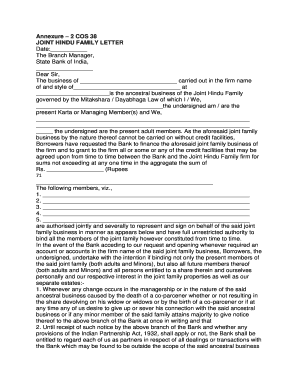

Joint Hindu Family Letter Date: The Branch Manager, ICICI Bank Limited, Branch Dear Sir, Declaration by HUF members 1. We, the undersigned, declare that we are the members of Joint Hindu Family (HUF)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your huf certificate format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your huf certificate format form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit huf certificate format online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit huf letter format. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out huf certificate format

How to fill out huf certificate format:

01

Obtain the HUF Certificate form from the appropriate authority or download it from their website.

02

Fill in the details of the HUF (Hindu Undivided Family) such as the name, address, and date of formation.

03

Mention the name and address of the Karta (the head of the family) along with their PAN (Permanent Account Number) details.

04

Include the names and addresses of all coparceners (members) of the HUF.

05

Provide the relationship details of all members with the Karta.

06

Mention the source of income, assets, and liabilities of the HUF.

07

Attach all necessary supporting documents such as PAN cards, address proofs, and identity proofs of all members.

08

Review the filled form for accuracy and completeness.

09

Submit the completed HUF Certificate form to the relevant authority along with any prescribed fees.

Who needs huf certificate format:

01

Hindu Undivided Families (HUFs) who wish to establish their identity and existence as a separate legal entity.

02

HUFs who want to avail of various tax benefits and exemptions.

03

Individuals who want to safeguard their ancestral property and assets under the HUF structure.

04

HUFs who want to open a bank account or conduct business transactions in the name of the family.

05

Authorities, government agencies, or financial institutions that require proof of the HUF's existence for legal or administrative purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is huf certificate format?

HUF (Hindu Undivided Family) certificate is a legal document that certifies the existence of a Hindu joint family, which has a separate legal entity or status for tax purposes. The format of HUF certificate may vary based on different jurisdictions, but it typically includes the following information:

1. Name of the Karta (head) of the Hindu Undivided Family

2. Name of the HUF

3. Address of the HUF

4. Date of establishment of the HUF

5. List of members in the HUF, including their names and relationships with the Karta

6. PAN (Permanent Account Number) of the HUF

7. HUF bank account details

8. Signature of the Karta and the issuing authority

The format may also include additional details or declarations required by the local tax authorities. It is important to consult with professionals or refer to specific guidelines provided by the concerned authority in your jurisdiction for the accurate format and requirements of an HUF certificate.

Who is required to file huf certificate format?

The Hindu Undivided Family (HUF) is required to file an HUF certificate format. The HUF is a separate taxable entity under Indian tax law, and it is mandatory to file income tax returns for an HUF if its income exceeds the basic exemption limit. The HUF certificate format is usually needed when applying for various tax-related registrations or for claiming tax benefits available to HUFs.

How to fill out huf certificate format?

To fill out a HUF (Hindu Undivided Family) certificate format, follow these steps:

1. Heading: Write "HUF Certificate" at the top of the page.

2. Identification: Provide the full name of the Karta (the head of the Hindu Undivided Family).

3. Family details: Mention the names of all family members who are part of the HUF, including their relationship to the Karta.

4. Date of formation: Indicate the date when the HUF was formed.

5. Property details: Provide the details of property/assets owned by the HUF, such as land, buildings, bank accounts, shares, etc.

6. Income details: Include information about the income sources of the HUF, such as businesses, investments, rent, etc.

7. Declaration: The Karta should sign and declare that the information provided is true and complete to the best of their knowledge.

8. Witness signatures: At least two witnesses need to sign and provide their full name, address, and occupation.

9. Date: Mention the date when the HUF certificate is being filled out.

Note: The format may vary depending on the specific requirements of the issuing authority or institution. It is advisable to check the guidelines or consult a legal professional to ensure compliance with all necessary regulations and formalities.

What is the purpose of huf certificate format?

The purpose of a HUF (Hindu Undivided Family) certificate format is to establish the existence and status of a Hindu joint family as per the Hindu law. It is required for availing various benefits, exemptions, and rights available to HUFs under the Indian Income Tax Act, such as filing taxes as a separate entity, inheriting ancestral property, claiming deductions, etc. The certificate validates the formation of the HUF and identifies the Karta (the head of the family) who manages its affairs. It serves as a legal document to prove the identity and existence of the HUF for taxation and financial purposes.

What information must be reported on huf certificate format?

The following information must be reported on a HUF (Hindu Undivided Family) Certificate format:

1. Name of the HUF: The certificate should contain the full name of the Hindu Undivided Family.

2. Address of the HUF: The complete postal address, including the city, state, and pin code, should be mentioned.

3. Father's Name and Address: The name of the Karta (head of the family) and his residential address need to be specified.

4. Date of Formation: The date of creation or establishment of the HUF should be mentioned.

5. Pan Card Number: The Permanent Account Number (PAN) of the HUF should be included.

6. HUF Bank Account Details: The details of the HUF's bank account, including the bank name, account number, and branch address, should be provided.

7. List of Coparceners: The names and details of all coparceners, i.e., the male members of the HUF, should be mentioned.

8. HUF's Sources of Income: The sources of income of the HUF, such as rental income, business profits, agricultural income, etc., need to be declared.

9. Property Details: The details of properties or assets owned by the HUF, including their addresses and market values, should be listed.

10. Declaration: The certificate should include a declaration stating that the information provided is true and accurate.

Note that the required information may vary in different jurisdictions, so it is advisable to consult with a legal or financial advisor to ensure compliance with the specific regulations and requirements applicable to the HUF certificate in your respective region.

What is the penalty for the late filing of huf certificate format?

The penalty for the late filing of HUF (Hindu Undivided Family) certificate format can vary depending on the jurisdiction and applicable laws. In India, for example, the penalty for late filing of HUF certificate is typically a late fee of Rs. 100 per day of delay, up to a maximum of Rs. 10,000. However, it is important to consult with a qualified professional or refer to the specific provisions of the relevant laws to determine the exact penalty applicable in a particular situation.

How do I modify my huf certificate format in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign huf letter format and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in huf deed format in word without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing joint hindu family letter format and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit huf letter format on an iOS device?

Use the pdfFiller mobile app to create, edit, and share huf certificate format from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your huf certificate format online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Huf Deed Format In Word is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill joint hindu family letter form

Related to huf letter format sbi

If you believe that this page should be taken down, please follow our DMCA take down process

here

.