Get the free DESIGNATING BENEFICIARIES - hr okstate

Show details

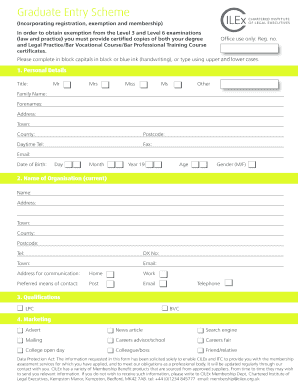

DESIGNATING BENEFICIARIES FOR YOUR TIAA-CREF ACCOUNTS DESIGNATING BENEFICIARIES FOR YOUR TIAA-CREF ACCOUNTS Page 1 of 3 GETTING STARTED Making sure your beneficiary designations for your TIAA-CREF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your designating beneficiaries - hr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your designating beneficiaries - hr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit designating beneficiaries - hr online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit designating beneficiaries - hr. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is designating beneficiaries - hr?

Designating beneficiaries is a process of identifying individuals who will receive certain benefits or assets upon the death of the policyholder or account holder. In the context of HR, it typically refers to selecting beneficiaries for various employee benefits such as life insurance, retirement plans, or health benefits.

Who is required to file designating beneficiaries - hr?

Employees who are eligible for HR benefits that have a beneficiary designation option are required to file designating beneficiaries. This includes employees who have life insurance coverage, retirement plans, or other benefit plans that allow for beneficiary designations.

How to fill out designating beneficiaries - hr?

To fill out designating beneficiaries for HR benefits, employees usually need to complete a beneficiary designation form provided by their employer or the HR department. The form typically requires personal information about the employee and the designated beneficiaries, such as their full names, relationships, and contact information.

What is the purpose of designating beneficiaries - hr?

The purpose of designating beneficiaries in HR is to ensure that the employee's benefits or assets are distributed according to their wishes after their death. By designating beneficiaries, employees can ensure that their loved ones or chosen individuals receive the benefits they are entitled to without undue delays or complications.

What information must be reported on designating beneficiaries - hr?

The information that must be reported on designating beneficiaries in HR typically includes the full name of the designated beneficiaries, their relationships to the employee, and their contact information, such as phone numbers and addresses. Some forms may also require the social security numbers or birthdates of the beneficiaries for identification purposes.

When is the deadline to file designating beneficiaries - hr in 2023?

The deadline to file designating beneficiaries in HR for 2023 may vary depending on the specific HR policies and benefit plans of the employer. Employees are advised to consult their employer or HR department to determine the exact deadline for filing beneficiary designations in 2023.

What is the penalty for the late filing of designating beneficiaries - hr?

The penalty for the late filing of designating beneficiaries in HR may also vary depending on the employer's policies and applicable laws. In some cases, a late filing may result in delays in the distribution of benefits to the designated beneficiaries. It is important for employees to adhere to the designated deadlines to avoid any potential penalties or complications.

How do I modify my designating beneficiaries - hr in Gmail?

designating beneficiaries - hr and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send designating beneficiaries - hr to be eSigned by others?

When you're ready to share your designating beneficiaries - hr, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete designating beneficiaries - hr on an Android device?

Use the pdfFiller mobile app to complete your designating beneficiaries - hr on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your designating beneficiaries - hr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.