Get the free vat301 form

Show details

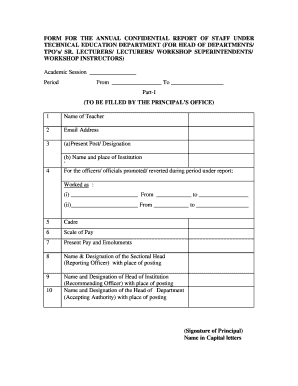

FORM VAT301 NOTICE FOR AUDIT VISIT See subrule (2) of rule 44 D 01. Office address M Y Y Y Y 02 TIN 03. Name and address of the dealer 04. To Sri Status Business Address Phone No. Reference Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat301 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat301 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat301 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit vat 301 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out vat301 form

How to fill out VAT301:

01

Start by gathering all the necessary information and documents required to complete the form. This may include income statements, expense records, and any relevant receipts or invoices.

02

Begin filling out the form by providing your business's name, address, and tax identification number. In some cases, additional information such as company registration details might be required.

03

Proceed to report the total sales or income generated during the specified reporting period. Be sure to calculate and enter this amount accurately.

04

Depending on your country's tax regulations, you may need to include additional details about exempt sales, zero-rated sales, or any other specific transactions.

05

Next, report your business expenses during the reporting period. This may include details such as purchases, overhead costs, and taxes paid on goods and services.

06

Calculate the total amount of input tax you are entitled to claim. This will be based on the tax paid on your business expenses.

07

Deduct the input tax from the output tax (sales or income tax) to determine the net tax payable or refundable.

08

Finally, review the completed VAT301 form thoroughly for any errors or discrepancies before submitting it to the relevant tax authority.

Who needs VAT301:

01

Businesses that are registered for Value Added Tax (VAT) in their respective countries or regions typically need to complete and submit the VAT301 form.

02

This form is usually required for reporting and paying VAT charges on taxable sales or income, as well as claiming input tax credits for eligible business expenses.

03

VAT301 is commonly used by businesses of various sizes and sectors, including sole traders, partnerships, corporations, and non-profit organizations, among others.

04

If a business's turnover exceeds the VAT threshold amount specified by the tax authority, they are typically required to register for VAT and subsequently file the VAT301 form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat301?

VAT301 is a form used to report value-added tax (VAT) information to tax authorities.

Who is required to file vat301?

Businesses registered for VAT are required to file VAT301.

How to fill out vat301?

VAT301 can be filled out electronically or manually, with information such as sales, purchases, and VAT calculations.

What is the purpose of vat301?

The purpose of VAT301 is to report VAT information to tax authorities accurately.

What information must be reported on vat301?

Information such as sales, purchases, output VAT, and input VAT must be reported on VAT301.

When is the deadline to file vat301 in 2023?

The deadline to file VAT301 in 2023 is usually the last day of the month following the end of the reporting period.

What is the penalty for the late filing of vat301?

The penalty for late filing of VAT301 may include fines or interest charges on the outstanding VAT amount.

How do I execute vat301 online?

Easy online vat 301 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my vat301 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your vat 301 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the vat301 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign vat 301 form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your vat301 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.