Get the free VOLUNTARY INSURANCE PRODUCTS COVERAGE INFORMATION - ci laredo tx

Show details

CITY OF LAREDO PURCHASING DIVISION CITY OF LAREDO FINANCE DEPARTMENT PURCHASING DIVISION REQUEST FOR PROPOSALS VOLUNTARY INSURANCE PRODUCTS COVERAGE INFORMATION CITY OF LAREDO The City of Laredo invites

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your voluntary insurance products coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary insurance products coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit voluntary insurance products coverage online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit voluntary insurance products coverage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out voluntary insurance products coverage

How to fill out voluntary insurance products coverage:

01

Start by gathering all the necessary information and documents required for the application process. This may include personal details, contact information, and any relevant financial information.

02

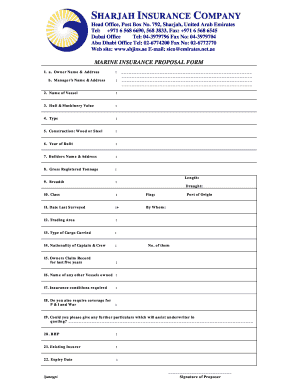

Research and compare different voluntary insurance products and their coverage options. Determine which type of coverage suits your needs and preferences.

03

Contact the insurance provider or use their online platform to start the application process. Provide the required information accurately and honestly.

04

Review the coverage options offered by the insurance provider and select the appropriate levels of coverage based on your personal circumstances and preferences. This may include selecting coverage for medical expenses, disability, life insurance, or other optional benefits.

05

Carefully read all the terms and conditions of the insurance policy before signing any agreements. Pay attention to any exclusions, limitations, or additional requirements.

06

Calculate the premium cost for your selected coverage and make the necessary payment. Ensure that you understand the payment schedule, frequency, and the available payment methods.

07

After submitting the application and payment, keep a copy of all the documents and communications for your records. It is also advisable to notify a trusted family member or beneficiary about your insurance coverage.

Who needs voluntary insurance products coverage?

01

Individuals who do not have access to employer-sponsored insurance plans may need voluntary insurance products coverage. This could be self-employed individuals, small business owners, freelancers, or individuals in industries that do not provide comprehensive insurance benefits.

02

People who want to supplement their existing insurance coverage may find voluntary insurance products beneficial. It allows them to customize their coverage options to meet their specific needs.

03

Individuals with dependents who rely on their income may consider voluntary insurance products coverage as a way to provide financial security for their loved ones in the event of unexpected circumstances.

04

Those who participate in high-risk activities or have hazardous occupations may also require voluntary insurance products coverage to protect themselves and their loved ones from potential financial burdens.

05

Individuals who want to have additional coverage for specific purposes such as critical illness, long-term care, or accidental death and dismemberment may find voluntary insurance products coverage suitable to meet their unique requirements.

It is essential to carefully assess your own circumstances, financial situation, and specific needs before deciding on voluntary insurance products coverage. Consulting with an insurance professional may also help in understanding the available options and making an informed decision.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

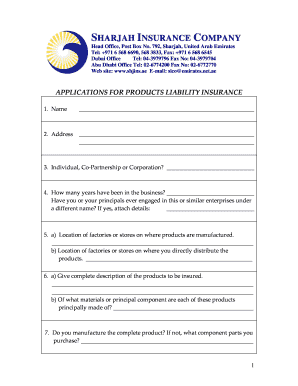

What is voluntary insurance products coverage?

Voluntary insurance products coverage refers to insurance plans or policies that are optional for individuals to purchase.

Who is required to file voluntary insurance products coverage?

Employers or insurance providers may be required to file voluntary insurance products coverage.

How to fill out voluntary insurance products coverage?

Voluntary insurance products coverage can be filled out by providing information about the insurance plans or policies being offered.

What is the purpose of voluntary insurance products coverage?

The purpose of voluntary insurance products coverage is to offer additional insurance options to individuals beyond what is required.

What information must be reported on voluntary insurance products coverage?

Information such as the types of insurance products offered, coverage amounts, and enrollment process may need to be reported on voluntary insurance products coverage.

When is the deadline to file voluntary insurance products coverage in 2023?

The deadline to file voluntary insurance products coverage in 2023 is typically by a certain date set by regulatory authorities or the employer.

What is the penalty for the late filing of voluntary insurance products coverage?

The penalty for late filing of voluntary insurance products coverage may vary depending on the jurisdiction, but could include fines or other consequences.

How can I send voluntary insurance products coverage to be eSigned by others?

Once you are ready to share your voluntary insurance products coverage, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out voluntary insurance products coverage using my mobile device?

Use the pdfFiller mobile app to fill out and sign voluntary insurance products coverage on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit voluntary insurance products coverage on an Android device?

With the pdfFiller Android app, you can edit, sign, and share voluntary insurance products coverage on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your voluntary insurance products coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.