Get the free Eardley at 401 p - washco utah

Show details

WASHINGTON COUNTY COMMISSION MEETING

MINUTES

January 3, 2006,

The Regular Meeting of the Board of the Washington County Commission was called to order by

Chairman James J. Yardley at 4:01 p.m. on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your eardley at 401 p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eardley at 401 p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eardley at 401 p online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit eardley at 401 p. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out eardley at 401 p

How to fill out Eardley at 401 p:

01

Start by gathering all the necessary information. You will need to know the purpose of filling out the form and have any relevant details or documentation ready.

02

Carefully read all instructions provided on the form. Understand the purpose of each section and what information needs to be provided.

03

Begin filling out the form step by step, starting with the personal information section. This typically includes your full name, contact information, and any other required identification details.

04

Move on to the next section, which may require you to provide specific details about your employment status or financial information. Make sure to double-check the accuracy of the information provided.

05

If there are any additional sections or fields on the form, follow the instructions and fill them out accordingly. Pay attention to any specific formatting or requirements.

06

Review the completed form once you have filled in all the necessary information. Make sure everything is filled out accurately and legibly. If possible, have someone else review it as well to catch any errors or omissions.

07

Sign and date the form as required. Some forms may also require additional signatures from other parties involved. Follow the instructions provided to ensure proper completion.

Who needs Eardley at 401 p:

01

Individuals or businesses involved in a legal or financial matter that requires the completion of Eardley at 401 p may need this form. It could be required for purposes such as tax filings, loan applications, or legal documentation.

02

Organizations or institutions that deal with personal or financial information of individuals may request individuals to fill out Eardley at 401 p. This could include banks, healthcare providers, government agencies, or educational institutions.

03

It is advisable to consult with a legal or financial professional to determine if you specifically need to fill out Eardley at 401 p based on your unique circumstances. They can provide guidance and ensure compliance with any necessary requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

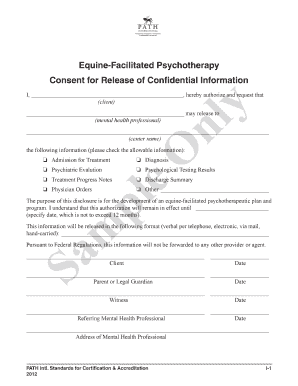

What is eardley at 401 p?

Eardley at 401 p refers to a specific tax form related to retirement savings.

Who is required to file eardley at 401 p?

Individuals who have a 401(k) retirement savings account are required to file eardley at 401 p.

How to fill out eardley at 401 p?

To fill out eardley at 401 p, you will need to provide information about your contributions, withdrawals, and any other relevant financial details.

What is the purpose of eardley at 401 p?

The purpose of eardley at 401 p is to report the activity within a 401(k) retirement savings account for tax purposes.

What information must be reported on eardley at 401 p?

Information such as contributions, withdrawals, gains, and losses must be reported on eardley at 401 p.

When is the deadline to file eardley at 401 p in 2023?

The deadline to file eardley at 401 p in 2023 is April 15th.

What is the penalty for the late filing of eardley at 401 p?

The penalty for late filing of eardley at 401 p can vary, but typically includes financial penalties and interest on any unpaid taxes.

How can I manage my eardley at 401 p directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your eardley at 401 p along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send eardley at 401 p to be eSigned by others?

Once your eardley at 401 p is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete eardley at 401 p on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your eardley at 401 p, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your eardley at 401 p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.