Get the free Health Savings Account HSA Client TASC Id Payroll

Show details

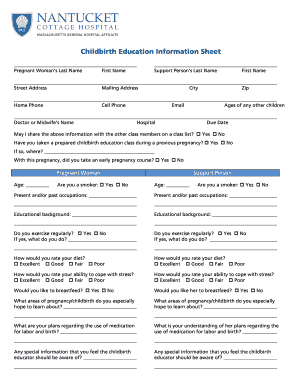

Health Savings Account (HSA) Payroll Contribution Form HSA Monthly Pay Schedule Return to: DEANNA SULLIVAN WITTENBERG UNIVERSITY P.O. BOX 720 SPRINGFIELD, OH 45501 Participant Last Name Participant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings account hsa online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit health savings account hsa. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

How to fill out health savings account hsa:

01

Research and compare different health savings account (HSA) providers to find the one that best suits your needs. Consider factors such as fees, investment options, and customer service.

02

Open an HSA account with the chosen provider. This usually involves completing an application form and providing personal information such as your name, address, and Social Security number.

03

Determine your HSA contribution amount for the year. You can contribute up to a certain limit set by the IRS, and this limit may vary depending on whether you have individual or family coverage.

04

Decide how you want to fund your HSA. You can contribute to your HSA through payroll deductions, direct deposits, or personal contributions. It's important to ensure you contribute within the IRS guidelines to receive the tax benefits associated with an HSA.

05

Familiarize yourself with the eligible medical expenses that can be paid for using HSA funds. These can include doctor visits, prescription medications, and certain medical procedures. Keep track of your expenses as you may need to provide documentation for tax purposes.

06

Use your HSA funds wisely. If you're unsure about an expense's eligibility, consult your HSA provider or a tax professional. Remember that HSA funds can be invested, so consider the potential for growth and long-term savings.

07

Keep records of your HSA contributions and withdrawals for tax reporting purposes. Your HSA provider should provide you with an annual statement summarizing your activity.

08

Regularly review your HSA account and make adjustments as necessary. Evaluate your healthcare needs, contribution amounts, and investment strategies to ensure you are maximizing the benefits of your HSA.

Who needs health savings account hsa:

01

Individuals and families with high deductible health plans (HDHP) can benefit from having an HSA. HDHPs typically have lower monthly premiums but higher deductibles, making an HSA a valuable tool to cover medical expenses.

02

Those who anticipate regular medical expenses or planned healthcare events can use an HSA to save and prepare for these costs. Having an HSA can provide peace of mind and financial stability in such situations.

03

Self-employed individuals and small business owners can use an HSA to help manage healthcare costs. It can serve as a tax-advantaged tool to save for medical expenses while also providing flexibility and control over healthcare decisions.

04

Employees offered an HSA through their employers, especially if the employer contributes to the account, can take advantage of the benefits provided by an HSA. This extra contribution can help offset healthcare costs and increase overall savings.

05

Individuals looking for a long-term savings vehicle can use an HSA as an additional retirement savings option. After age 65, HSA funds can be withdrawn for non-medical expenses without penalty, although taxes may apply.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is health savings account hsa?

A health savings account (HSA) is a tax-advantaged savings account that individuals can use to pay for qualified medical expenses if they have a high-deductible health plan.

Who is required to file health savings account hsa?

Individuals who have a high-deductible health plan and meet other eligibility criteria are required to file a health savings account (HSA).

How to fill out health savings account hsa?

To fill out a health savings account (HSA), individuals must provide information about their contributions, withdrawals, and qualified medical expenses. They can do this by completing Form 8889 and submitting it with their tax return.

What is the purpose of health savings account hsa?

The purpose of a health savings account (HSA) is to help individuals save money for medical expenses not covered by insurance. It also provides tax advantages, such as tax-deductible contributions and tax-free withdrawals for qualified medical expenses.

What information must be reported on health savings account hsa?

Information that must be reported on a health savings account (HSA) includes contributions, withdrawals, and any taxable distributions. Additionally, individuals must report any changes to their HSA, such as a change in account custodian or beneficiary.

How can I modify health savings account hsa without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your health savings account hsa into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send health savings account hsa to be eSigned by others?

When your health savings account hsa is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit health savings account hsa on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing health savings account hsa.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.