Get the free Lone Star XXVIII CLASSIC CHEVY CONVENTION

Show details

Lone Star XXVIII CLASSIC CHEVY CONVENTION May 1416, 2010 COMFORT SUITES STONE OAK AT NORTHWARDS SHOPPING CENTER 1754 N. LOOP 1604 E. San Antonio, TX.78232 2104955557 Tell Them Lone Star $79.99/Night

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lone star xxviii classic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lone star xxviii classic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lone star xxviii classic online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lone star xxviii classic. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out lone star xxviii classic

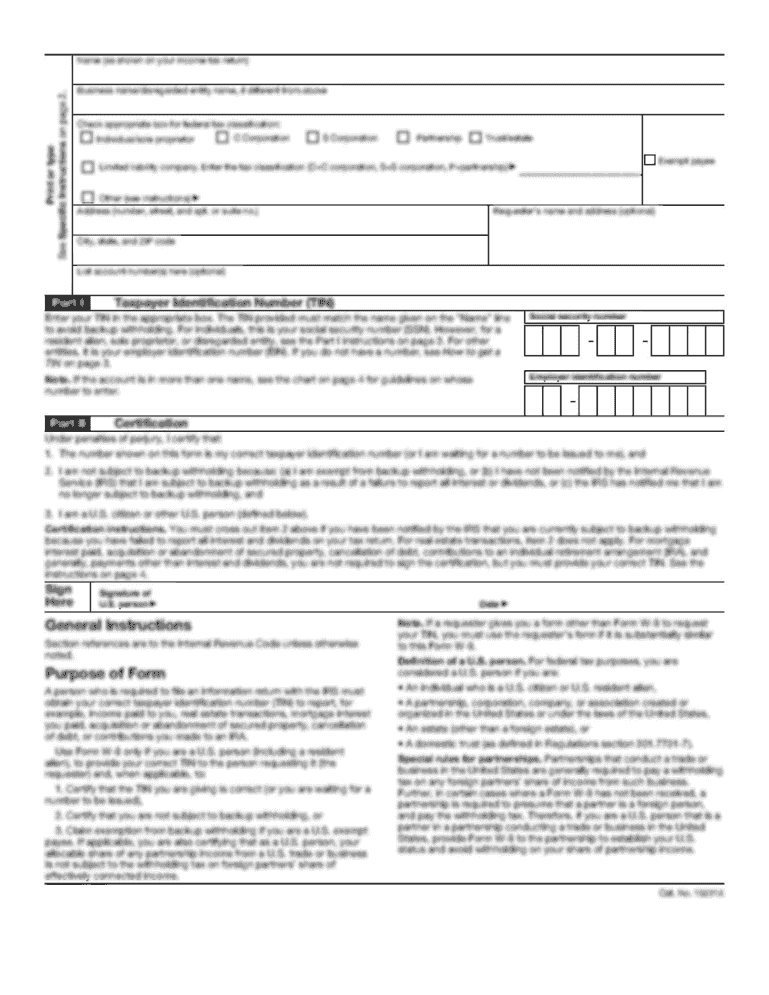

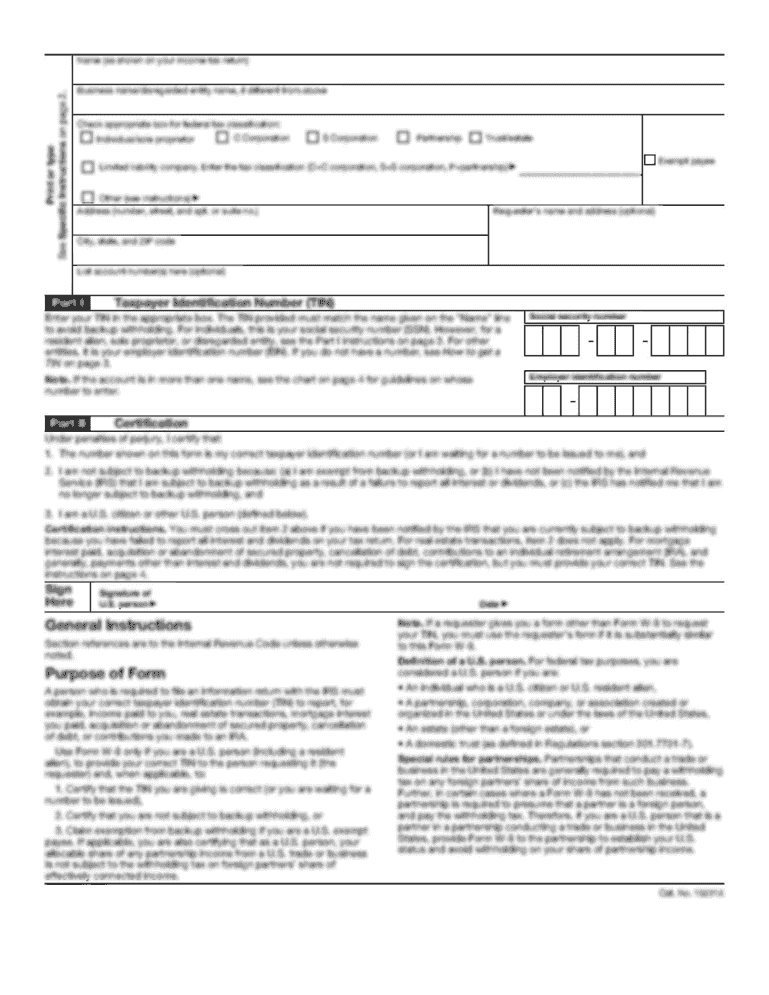

How to fill out Lone Star XXVIII Classic:

01

Start by gathering all necessary information and documents required for the Lone Star XXVIII Classic application. This may include personal identification, financial statements, and any other relevant information.

02

Carefully read and understand the instructions provided with the Lone Star XXVIII Classic application. This will ensure that you correctly fill out the required sections and provide accurate information.

03

Begin filling out the application form by entering your personal details such as your name, address, contact information, and social security number.

04

Provide information about your current employment status, including your employer's name, address, and contact details. If you are self-employed, you may need to provide additional documentation such as business registration details.

05

Enter details about your income, including your salary, any additional sources of income, and any outstanding debts or liabilities.

06

Provide information about your current assets and liabilities, including any real estate properties, vehicles, bank accounts, and outstanding loans or credit card debts.

07

Carefully review all the information you have entered before submitting the Lone Star XXVIII Classic application. Ensure that all the details provided are accurate and up to date.

Who needs Lone Star XXVIII Classic:

01

Individuals who are in need of financial assistance for various purposes, such as education, medical expenses, debt consolidation, or home improvements.

02

Those who are residing in the Lone Star XXVIII Classic eligible jurisdiction and meet the eligibility criteria set by the program.

03

Individuals who are interested in taking advantage of the benefits and features offered by the Lone Star XXVIII Classic program, such as low interest rates, flexible repayment plans, and personalized customer service.

Remember to consult the official Lone Star XXVIII Classic documentation and guidelines for the most accurate and up-to-date information regarding filling out the application and determining if you qualify for the program.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lone star xxviii classic?

Lone Star XXVIII Classic is a tax form filed by individuals or entities who have earned income or conducted business in the state of Texas.

Who is required to file lone star xxviii classic?

Individuals or entities who have earned income or conducted business in Texas are required to file Lone Star XXVIII Classic.

How to fill out lone star xxviii classic?

Lone Star XXVIII Classic can be filled out online or by mail with information about income, expenses, and other financial details.

What is the purpose of lone star xxviii classic?

The purpose of Lone Star XXVIII Classic is to report and calculate taxes owed to the state of Texas.

What information must be reported on lone star xxviii classic?

Information such as income, expenses, deductions, and tax credits must be reported on Lone Star XXVIII Classic.

When is the deadline to file lone star xxviii classic in 2023?

The deadline to file Lone Star XXVIII Classic in 2023 is April 15th.

What is the penalty for the late filing of lone star xxviii classic?

The penalty for late filing of Lone Star XXVIII Classic may include fines, interest on unpaid taxes, and potential legal action by the state of Texas.

How can I modify lone star xxviii classic without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including lone star xxviii classic. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit lone star xxviii classic online?

The editing procedure is simple with pdfFiller. Open your lone star xxviii classic in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete lone star xxviii classic on an Android device?

Use the pdfFiller mobile app and complete your lone star xxviii classic and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your lone star xxviii classic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.