Get the free Uniform Residential Loan Application - Tierra Capital

Show details

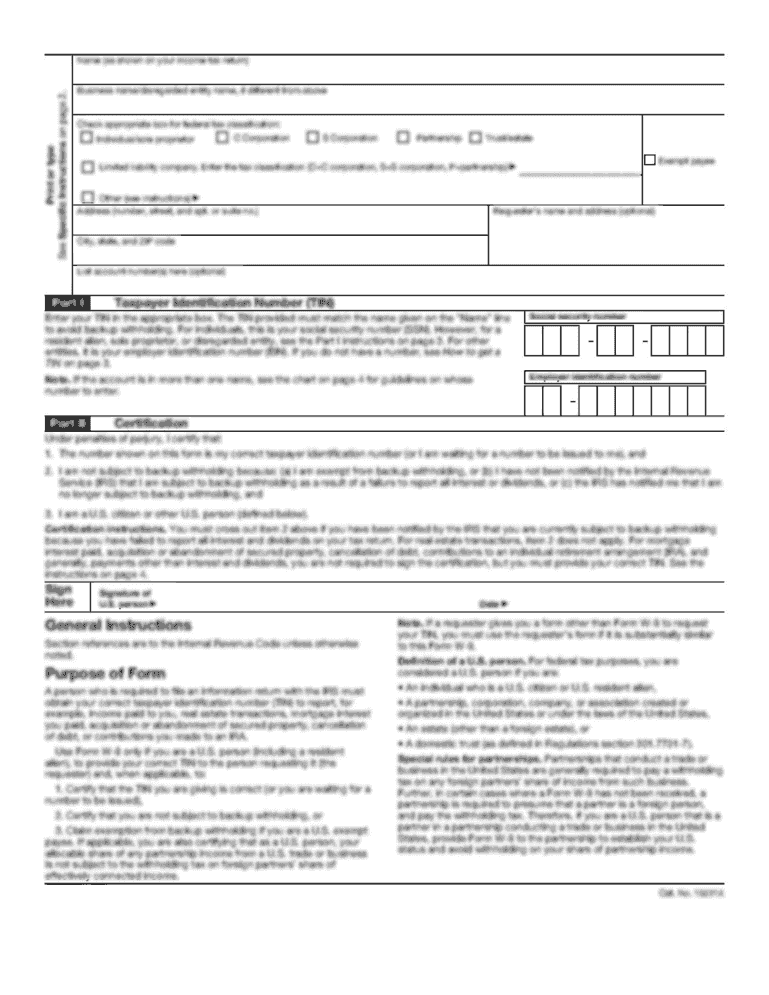

Uniform Residential Loan Application TERRA CAPITAL CORP. This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as Borrower

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your uniform residential loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform residential loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uniform residential loan application online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uniform residential loan application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out uniform residential loan application

How to Fill Out Uniform Residential Loan Application:

01

Start by gathering all the necessary information and documents. You will need details about your employment history, income, assets, liabilities, and personal identification.

02

Begin with the first section of the form, which requires basic information such as your name, address, and social security number. Double-check for any errors or missing information.

03

Proceed to the next section, which focuses on your employment history. Provide details about your current and previous employers, including their names, addresses, and dates of employment. Be thorough and accurate.

04

In the third section, you are required to disclose your income. This includes your salary, bonuses, commissions, and any other sources of income. Fill out the appropriate fields carefully and provide supporting documentation when required.

05

Move on to the assets and liabilities section. List all your assets such as bank accounts, investments, and real estate properties. Similarly, provide information about your liabilities, including loans, credit card debts, and mortgages. Again, ensure accuracy and provide relevant documentation if necessary.

06

The next section focuses on additional real estate owned. If you own any other properties besides your primary residence, you need to provide details about them, such as property addresses, current values, and any outstanding loans or mortgages on those properties.

07

If you are applying for a joint loan with another person, such as a spouse or business partner, you must complete the next section, which requires their personal and financial information.

08

Near the end of the form, you will encounter a section about loan details. Here, you need to specify the purpose of the loan, the type of mortgage you are applying for, and the amount you are requesting.

09

Once you have filled out all the necessary sections of the uniform residential loan application, carefully review the information you provided. Ensure that you have not skipped any sections or made any mistakes.

10

Finally, sign and date the application form to confirm its accuracy and completeness. If you are applying jointly, ensure that the other applicant(s) sign as well.

Who Needs Uniform Residential Loan Application:

The uniform residential loan application, commonly known as Form 1003, is required by most lenders in the United States. It is used by individuals or borrowers who are applying for a residential loan, such as a mortgage or home equity loan.

The application is needed by anyone seeking financing for a home purchase, refinancing an existing mortgage, or obtaining a loan against their property. Lenders use this application to assess the borrower's creditworthiness, income, assets, and liabilities to determine their eligibility for the loan.

Whether you are a first-time homebuyer, a seasoned homeowner, or a real estate investor, if you plan to secure a residential loan, you will likely be required to complete the uniform residential loan application. Make sure to provide accurate and complete information to increase your chances of loan approval.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uniform residential loan application?

The uniform residential loan application is a standardized form used by mortgage lenders to collect information about a borrower's financial situation in order to determine their eligibility for a home loan.

Who is required to file uniform residential loan application?

Anyone applying for a residential mortgage loan is required to file a uniform residential loan application.

How to fill out uniform residential loan application?

To fill out a uniform residential loan application, you will need to provide information about your income, assets, debts, and the property you are looking to purchase. The form can be completed online or in person with a mortgage lender.

What is the purpose of uniform residential loan application?

The purpose of the uniform residential loan application is to gather information about a potential borrower's financial situation so that a lender can assess their ability to repay a loan and make an informed lending decision.

What information must be reported on uniform residential loan application?

Information that must be reported on a uniform residential loan application includes personal details, employment history, income, assets, debts, and the property being purchased.

When is the deadline to file uniform residential loan application in 2023?

The deadline to file a uniform residential loan application in 2023 will depend on the specific lender and loan program. It is important to check with the lender for their specific deadlines.

What is the penalty for the late filing of uniform residential loan application?

The penalty for the late filing of a uniform residential loan application may vary depending on the lender. It is important to communicate with the lender as soon as possible if you anticipate missing a deadline.

How can I send uniform residential loan application to be eSigned by others?

When you're ready to share your uniform residential loan application, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out uniform residential loan application using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign uniform residential loan application and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out uniform residential loan application on an Android device?

Use the pdfFiller mobile app and complete your uniform residential loan application and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your uniform residential loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.