Get the free Payroll deduction form. - UC Riverside Athletics Association - athleticsassociation ucr

Show details

UC Riverside Foundation Payroll Deduction Authorization NAME: EMPLOYEE ID#: DEPARTMENT: I want to support our campus through the UC Riverside Foundation. I understand my Payroll Deduction will remain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your payroll deduction form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll deduction form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll deduction form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payroll deduction form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

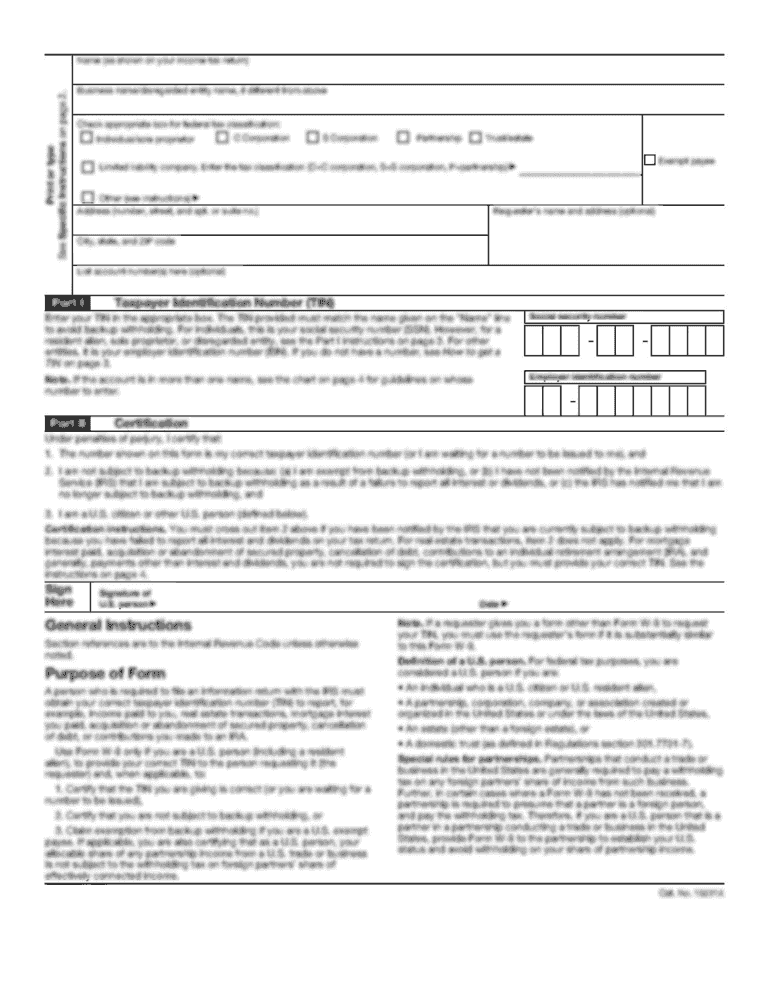

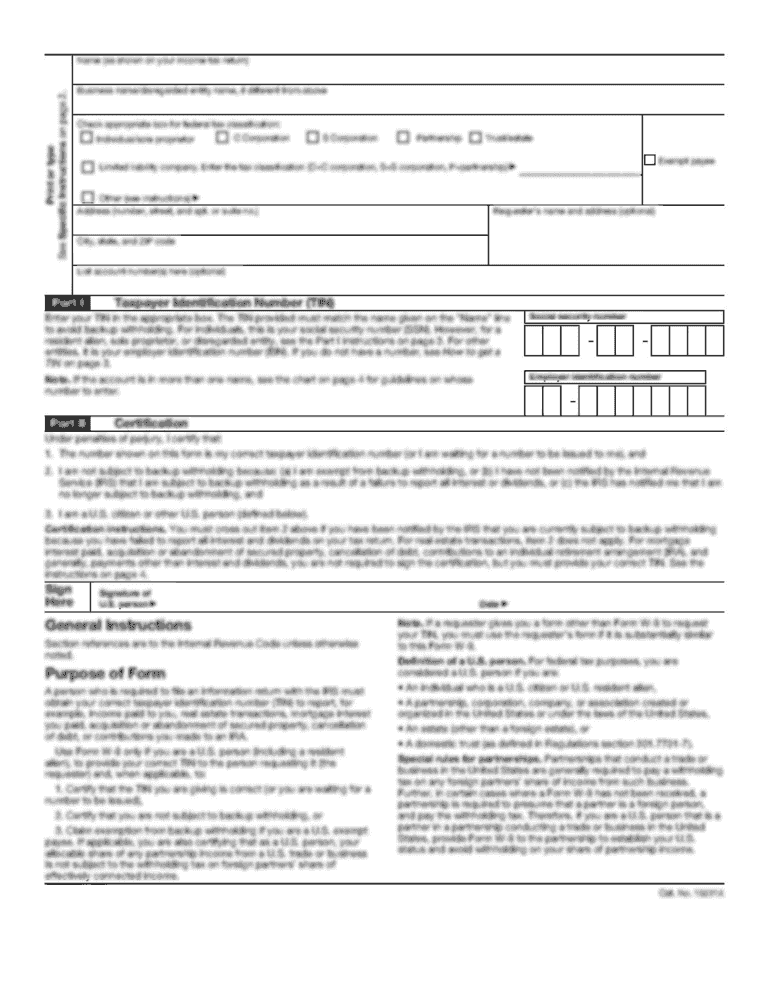

What is payroll deduction form?

A payroll deduction form is a document used by employers to authorize deductions from an employee's paycheck for things like taxes, insurance premiums, retirement contributions, or other authorized deductions.

Who is required to file payroll deduction form?

Employers are required to file payroll deduction forms for each employee who has authorized deductions from their paycheck.

How to fill out payroll deduction form?

To fill out a payroll deduction form, you typically need to provide information about the employee, the type of deduction, the amount or percentage to be deducted, and any necessary authorization signatures. The specific steps may vary depending on the form used by the employer.

What is the purpose of payroll deduction form?

The purpose of a payroll deduction form is to establish and authorize deductions from an employee's paycheck as agreed upon between the employee and the employer. It ensures accurate and consistent deductions are made.

What information must be reported on payroll deduction form?

The information reported on a payroll deduction form typically includes the employee's identification details, the type of deduction, the amount or percentage to be deducted, and any necessary authorization signatures.

When is the deadline to file payroll deduction form in 2023?

The deadline to file the payroll deduction form in 2023 may vary depending on the specific tax jurisdiction and employer's policies. It is recommended to consult the applicable tax regulations or employer guidelines for the exact deadline.

What is the penalty for the late filing of payroll deduction form?

The penalty for the late filing of a payroll deduction form may vary depending on the tax jurisdiction and applicable laws. It can include fines, interest charges, or other penalties imposed by the tax authorities. It is advisable to consult the specific tax regulations or consult a tax professional for accurate information on penalties.

How can I get payroll deduction form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific payroll deduction form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit payroll deduction form online?

With pdfFiller, the editing process is straightforward. Open your payroll deduction form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the payroll deduction form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign payroll deduction form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your payroll deduction form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.