Get the free PROPERTY ASSESSMENT APPEAL BOARD FINDINGS OF FACT bb - paab iowa

Show details

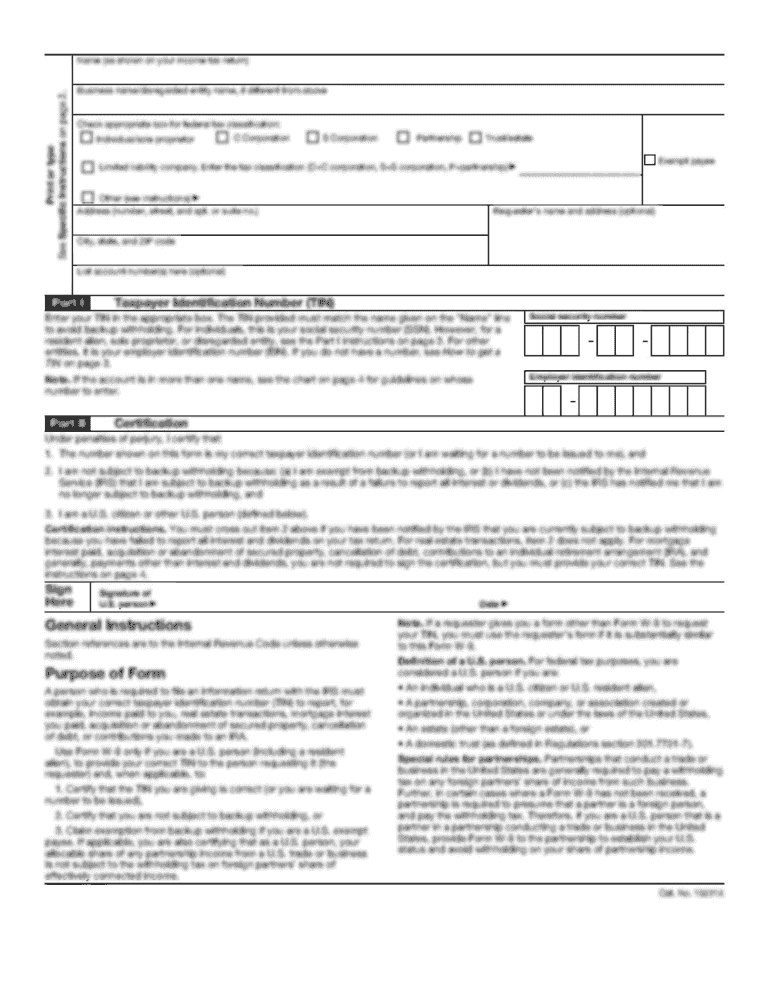

Electronically Filed 20160222 10:30:18 SAAB PROPERTY ASSESSMENT APPEAL BOARD FINDINGS OF FACT, CONCLUSIONS OF LAW, AND ORDER SAAB Docket No. 201503000472R Parcel No. 0703376011 SAAB Docket No. 201503000473R

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your property assessment appeal board form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property assessment appeal board form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property assessment appeal board online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property assessment appeal board. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out property assessment appeal board

How to fill out property assessment appeal board:

01

Gather all relevant documents: Make sure you have copies of your property assessment, any supporting documents, and any previous communication with the assessor's office.

02

Understand the appeal process: Familiarize yourself with the specific process for filing an appeal with the property assessment appeal board in your jurisdiction. This may involve submitting a formal appeal form, providing evidence to support your case, and attending a hearing.

03

Review your property assessment: Carefully examine your property assessment to identify any errors or discrepancies. Look for incorrect information about your property's size, characteristics, or any recent changes that may impact its value.

04

Collect evidence to support your appeal: Gather any relevant evidence that supports your claim. This could include recent sales data of similar properties in your area, a professional appraisal, or any documentation showing defects or issues with your property that may affect its value.

05

Complete the necessary forms: Fill out any required forms accurately and completely. Provide all the necessary information, including your contact details, property information, and reason for appeal.

06

Submit your appeal: Submit your completed appeal form and any supporting documents to the property assessment appeal board within the specified timeframe. Follow any specific instructions provided by the board, such as sending the documents via mail, email, or through an online portal.

07

Attend the hearing (if required): In some cases, the property assessment appeal board may schedule a hearing to allow you to present your case in person. Prepare any additional evidence, documents, or witnesses to support your appeal, and be ready to explain your reasoning to the board.

08

Await the board's decision: After your appeal has been submitted and any required hearings have taken place, you will need to wait for the property assessment appeal board to review your case and make a decision. This decision will typically be communicated to you in writing or through an official notification.

09

Take further action (if necessary): If you are not satisfied with the board's decision, you may have the option to further appeal or challenge it, depending on the laws and regulations in your jurisdiction. Consult with a legal professional to understand your rights and determine the best course of action.

Who needs property assessment appeal board:

01

Property owners: Property owners who believe that their property has been assessed inaccurately or unfairly may need to file an appeal with the property assessment appeal board to seek a reassessment or reduction in their property tax liability.

02

Business owners: Business owners who own commercial properties or rental properties may also need to use the property assessment appeal board to challenge their property assessments and ensure they are paying the correct amount of property taxes.

03

Real estate investors: Real estate investors who buy and sell properties regularly may need to use the property assessment appeal board to dispute the assessed values of their investment properties, especially if they believe the assessments are hindering their ability to generate rental income or sell the properties profitably.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property assessment appeal board?

The property assessment appeal board is a board that allows property owners to appeal their property tax assessments.

Who is required to file property assessment appeal board?

Property owners who believe their property tax assessments are incorrect or unfair are required to file a property assessment appeal board.

How to fill out property assessment appeal board?

Property owners can fill out the property assessment appeal board by providing information about their property, reasons for the appeal, and any supporting documentation.

What is the purpose of property assessment appeal board?

The purpose of the property assessment appeal board is to provide property owners with a process to challenge their property tax assessments and seek a fair and accurate assessment.

What information must be reported on property assessment appeal board?

Property owners must report information about their property, reasons for the appeal, and any supporting documentation on the property assessment appeal board.

When is the deadline to file property assessment appeal board in 2023?

The deadline to file property assessment appeal board in 2023 is typically set by the local tax authority and varies by jurisdiction.

What is the penalty for the late filing of property assessment appeal board?

The penalty for the late filing of property assessment appeal board may include a missed opportunity to appeal the property tax assessment for that year.

How can I edit property assessment appeal board from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including property assessment appeal board. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete property assessment appeal board online?

pdfFiller has made it easy to fill out and sign property assessment appeal board. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the property assessment appeal board form on my smartphone?

Use the pdfFiller mobile app to complete and sign property assessment appeal board on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your property assessment appeal board online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.