Get the free TAX CLIENT LETTER IN THIS ISSUE - National Society of Tax - nstp

Show details

A PUBLICATION OF THE NATIONAL SOCIETY OF TAX PROFESSIONALS TA X Volunteer Tax Preparer Accuracy Rates News Items Page 3 Worker Classification Amnesty IRS Action News Page 4 Adjunct Professor is Employee

We are not affiliated with any brand or entity on this form

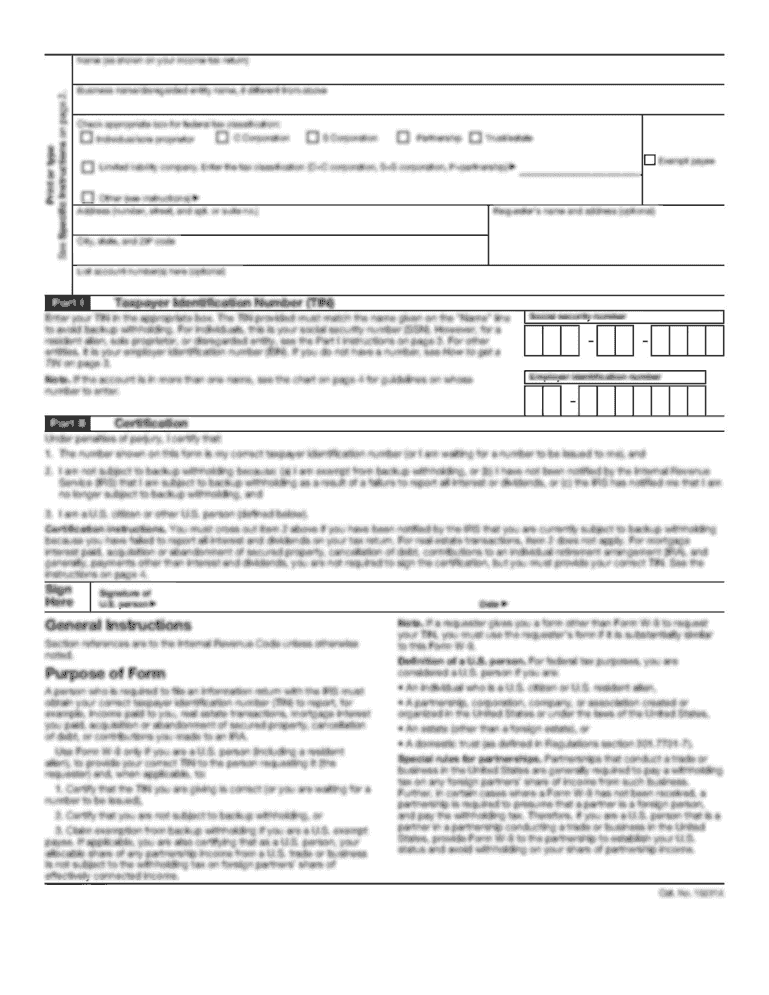

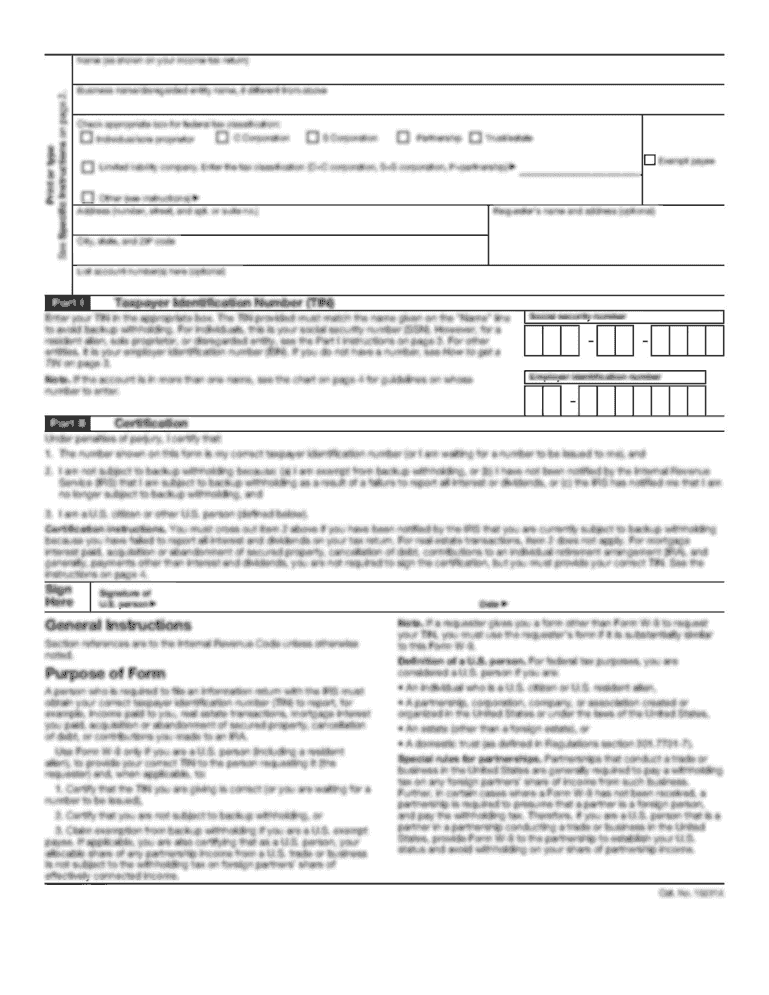

Get, Create, Make and Sign

Edit your tax client letter in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax client letter in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax client letter in online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax client letter in. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out tax client letter in

How to fill out a tax client letter:

01

Begin by addressing the letter to the appropriate client. Include their full name, address, and any other relevant contact information.

02

Clearly state the purpose of the letter, which is to inform the client about their tax situation and provide any necessary instructions or documentation.

03

Include a brief introduction about yourself or your company, stating your expertise in tax matters and why you are qualified to assist the client.

04

Provide a summary of the client's tax situation, highlighting any key points or concerns that need to be addressed.

05

Explain any supporting documents or forms that need to be included with the letter. This may include copies of W-2 forms, 1099s, or other tax-related documents.

06

Clearly outline any actions that the client needs to take, such as signing and returning specific forms, gathering additional information, or scheduling an appointment.

07

Provide a deadline for the client to respond or complete the requested actions. It is important to set a reasonable timeframe to ensure timely processing of their tax matters.

08

Offer any additional assistance or resources that the client may find helpful. This could include contact information for a tax professional, relevant websites or publications, or any other relevant information.

Who needs a tax client letter:

01

Individuals who have hired a tax professional or accounting firm to handle their tax matters.

02

Small businesses or self-employed individuals who require tax assistance.

03

Any individual or business that has complex tax situations, such as owning multiple properties or having significant investments.

In conclusion, filling out a tax client letter requires clear and concise communication, providing necessary information and instructions for the client. This letter is essential for individuals or businesses who need professional help with their taxes or have complex tax situations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax client letter in?

Tax client letter is a document provided by a tax professional to a client, summarizing information about the client's tax situation for the year.

Who is required to file tax client letter in?

Any individual or business who has received tax services from a tax professional during the year may be required to file a tax client letter.

How to fill out tax client letter in?

To fill out a tax client letter, the client should provide their personal information, income details, deductions, and any other relevant tax-related information requested by the tax professional.

What is the purpose of tax client letter in?

The purpose of a tax client letter is to provide a summary of the client's tax situation and assist both the client and the tax professional in preparing and filing their tax return accurately.

What information must be reported on tax client letter in?

Information such as income, deductions, credits, and any other relevant tax-related details must be reported on a tax client letter.

When is the deadline to file tax client letter in in 2023?

The deadline to file tax client letter in 2023 is typically by April 15th, unless an extension is requested.

What is the penalty for the late filing of tax client letter in?

The penalty for late filing of a tax client letter may vary depending on the circumstances, but it could result in fines or other consequences imposed by the tax authorities.

How do I make changes in tax client letter in?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your tax client letter in and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my tax client letter in in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax client letter in and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit tax client letter in on an iOS device?

You certainly can. You can quickly edit, distribute, and sign tax client letter in on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your tax client letter in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.