Get the free vancouver employee savings plan form

Get, Create, Make and Sign

Editing vancouver employee savings plan online

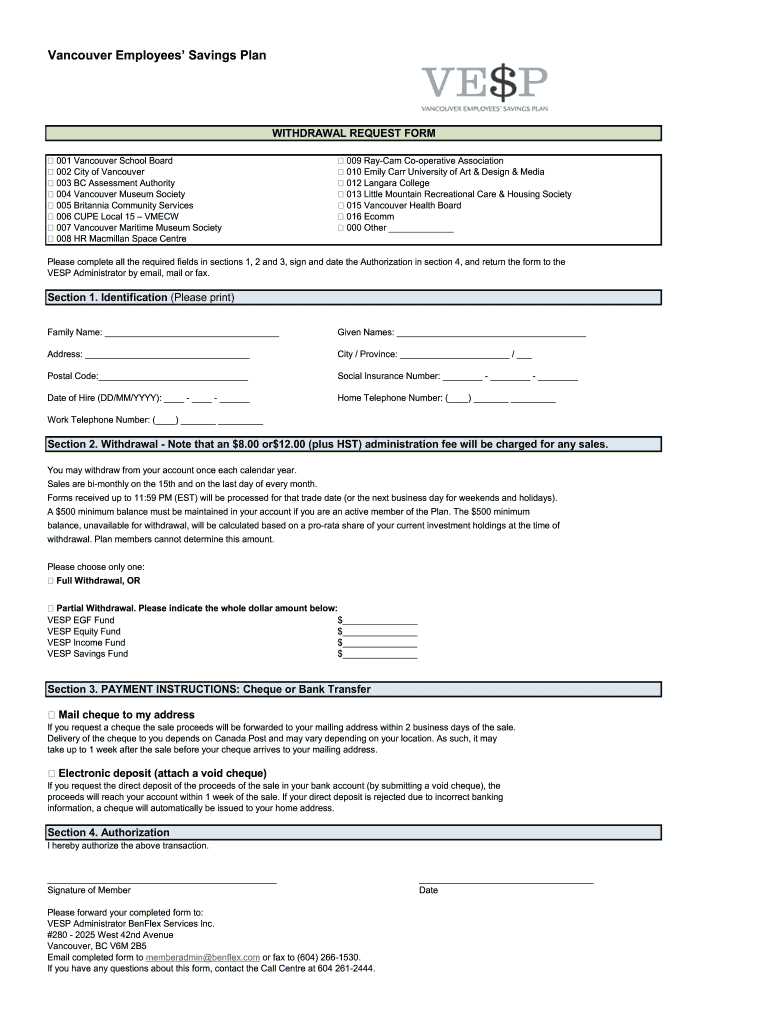

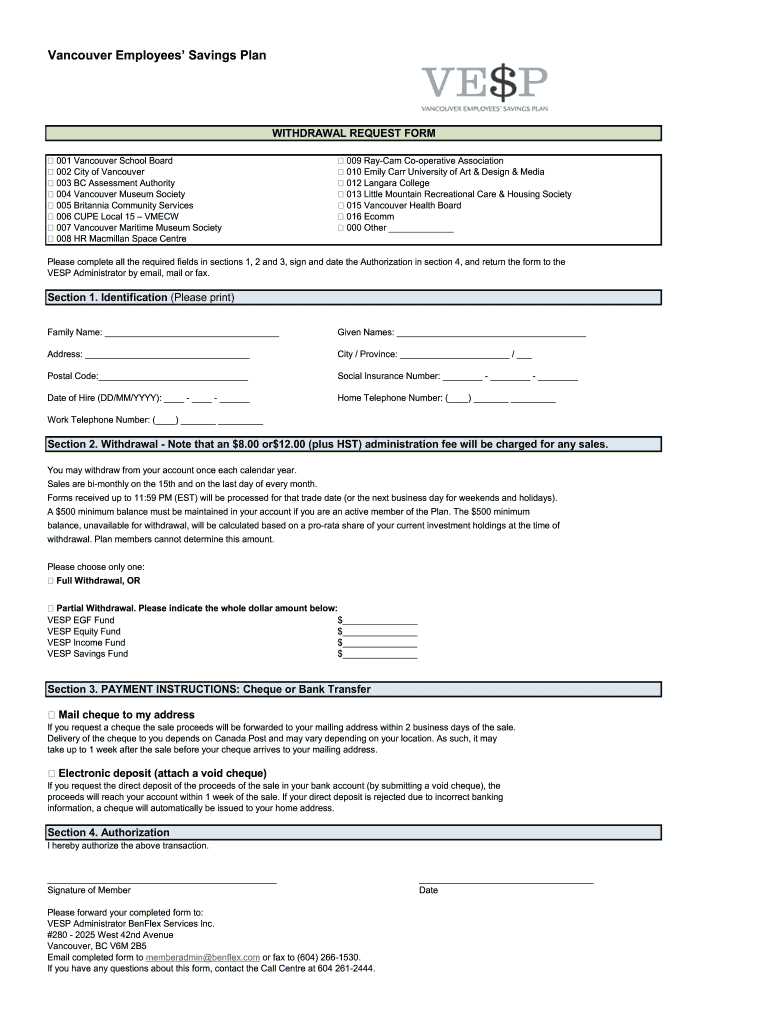

How to fill out vancouver employee savings plan

How to fill out Vancouver Employee Savings Plan:

Who needs Vancouver Employee Savings Plan?

Video instructions and help with filling out and completing vancouver employee savings plan

Instructions and Help about vesp vancouver form

Hey what's up its Alisa from extent money and welcome to my channel today I want to talk to you about retirement scary right I know it's not exactly the time of year you'd prefer to talk about saving money because its summer and its really fun to spend it, but that doesn't mean that it's not still important to focus on your finances no matter what time of year it is not really a seasonal thing you always have to be on top of your money so lets dive right in the first question I always get from people who are curious about their money is when should I start saving for retirement the answer is always always always right now is the best time to start saving for your retirement but why is it so important that you start as soon as possible compounding baby compounding is one an asset so let's say that asset is your retirement money invested in a tech sheltered account that asset gets earnings from capital gains or interests from there that money is reinvested to generate more earnings over a certain period of time typically annually this type of growth happens because your initial investment generates earnings from the original principal aka the original sum of money that you invested on top of the original principal as well as the earnings you accumulate just by investing your money pretty cool hey lets look at an example for all of our visual learners out there say you invest 10000 into an investment account that earns around 5 interest each year after the compounding period your total would be ten thousand five hundred dollars in the second period of time the investment would earn an additional five percent on the principal amount and the five hundred dollars earned an interest which means you would earn another five hundred and twenty-five dollars bringing your total earnings to eleven thousand twenty-five dollars this same pattern would continue as long as you have that money invested and that's without adding any more money each year we like to call that appreciation no not like I appreciate you helping me learn about money more like appreciate the growth because that's exactly what's happening this is just one of the reasons that investing for your retirement account is so amazing and extremely important now that you know when and why you should say for your retirement which is yesterday lets talk about where you should save your money because you need enough money in retirement to serve as your only source of income its important that you built a large enough nest egg which is what they call it to last you from the day that you retire until you pass away the Canadian governments typical standard age is 65, but you can choose whenever you want to retire regardless lets say that you probably want enough money to last you 30 years one of the best ways to ensure this happens is by investing your money into a tax sheltered account if that money is invested in stocks on average you'll earn about seven to eight percent annually which is awesome...

Fill vesp vancouver : Try Risk Free

People Also Ask about vancouver employee savings plan

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your vancouver employee savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.