Get the free 2002 unincorporated business franchise tax booklet d-30 2002 ... - otr - otr cfo dc

Show details

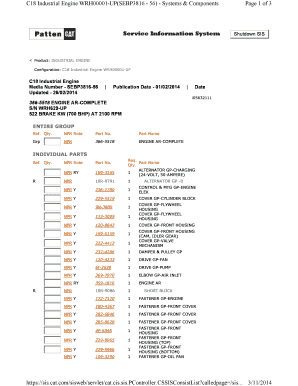

GOVERNMENT OF THE DISTRICT OF COLUMBIA Office of the Chief Financial Officer Office of Tax and Revenue 2002 UNINCORPORATED BUSINESS 2002 UNINCORPORATED BUSINESS FRANCHISE TAX BOOKLET FRANCHISE TAX

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2002 unincorporated business franchise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2002 unincorporated business franchise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2002 unincorporated business franchise online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2002 unincorporated business franchise. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unincorporated business franchise tax?

The unincorporated business franchise tax is a tax imposed on certain businesses that are not incorporated. It is a tax on the privilege of conducting business in a particular jurisdiction.

Who is required to file unincorporated business franchise tax?

The requirement to file the unincorporated business franchise tax varies depending on the jurisdiction. Generally, individuals or businesses that meet certain criteria, such as having a certain amount of income or conducting business activities within the jurisdiction, may be required to file.

How to fill out unincorporated business franchise tax?

Filling out the unincorporated business franchise tax typically involves completing the required tax forms and providing the necessary information, such as income from business activities, deductions, and credits. It is advisable to consult the relevant tax authority or a professional tax advisor for specific instructions.

What is the purpose of unincorporated business franchise tax?

The purpose of the unincorporated business franchise tax is to generate revenue for the jurisdiction imposing the tax. It helps fund government operations and services.

What information must be reported on unincorporated business franchise tax?

The specific information that must be reported on the unincorporated business franchise tax varies depending on the jurisdiction. Generally, it includes income from business activities, deductions, credits, and other relevant financial information.

When is the deadline to file unincorporated business franchise tax in 2023?

The deadline to file the unincorporated business franchise tax in 2023 may vary depending on the jurisdiction. It is important to refer to the instructions provided by the relevant tax authority or consult a professional tax advisor for the specific deadline.

What is the penalty for the late filing of unincorporated business franchise tax?

Penalties for late filing of the unincorporated business franchise tax also vary depending on the jurisdiction. Common penalties may include a percentage-based penalty on the amount of tax owed, interest on the late payment, and potential additional fees or penalties for prolonged non-compliance. It is advisable to consult the relevant tax authority or a professional tax advisor for specific information on penalties.

How can I send 2002 unincorporated business franchise to be eSigned by others?

When you're ready to share your 2002 unincorporated business franchise, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find 2002 unincorporated business franchise?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2002 unincorporated business franchise and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete 2002 unincorporated business franchise online?

pdfFiller makes it easy to finish and sign 2002 unincorporated business franchise online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Fill out your 2002 unincorporated business franchise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.