Get the free l CIH - w3 health state ny

Show details

L CIH STATE OF NEW YORK DEPARTMENT OF HEALTH 433 River Street, Suite 303 Troy, New York 121802299 Antonia C. Novella, M.D., M.P.H., Dr. P.H. Dennis P. Whale Commissioner Executive Deputy Commissioner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your l cih - w3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l cih - w3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit l cih - w3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit l cih - w3. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

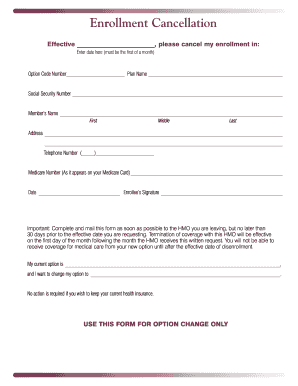

What is l cih - w3?

l cih - w3 refers to the form W-3, which is a transmittal form used to summarize the information on Forms W-2, Wage and Tax Statement, that are submitted to the Social Security Administration (SSA).

Who is required to file l cih - w3?

Employers are required to file Form W-3 if they are filing Forms W-2 for their employees.

How to fill out l cih - w3?

To fill out Form W-3, you need to provide the employer's information, total wage and tax information for all employees, and other relevant details requested on the form. It is recommended to carefully follow the instructions provided by the SSA when filling out the form.

What is the purpose of l cih - w3?

The purpose of Form W-3 is to summarize and transmit the wage and tax information reported on Forms W-2 to the SSA. It helps ensure that employees' wage and tax information is accurately reported to the SSA for income verification and Social Security benefit purposes.

What information must be reported on l cih - w3?

On Form W-3, you must report the total wages, taxes withheld, and other relevant information for all employees included on the associated Forms W-2.

When is the deadline to file l cih - w3 in 2023?

The deadline to file Form W-3 for the year 2023 is January 31, 2024.

What is the penalty for the late filing of l cih - w3?

The penalty for late filing of Form W-3 may vary depending on the delay. It is best to refer to the instructions provided by the SSA or consult a tax professional for specific penalty details.

Where do I find l cih - w3?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the l cih - w3 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit l cih - w3 online?

The editing procedure is simple with pdfFiller. Open your l cih - w3 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my l cih - w3 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your l cih - w3 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your l cih - w3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.