Get the free High-deductible, HSA-eligible

Show details

BlueEssentials

High deductible, HSA eligible

Health Plans

Blue Cross and Blue Shield of Nebraska is an Independent

Licensee of the Blue Cross and Blue Shield Association. About Us

For nearly 75 years,

Blue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your high-deductible hsa-eligible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your high-deductible hsa-eligible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit high-deductible hsa-eligible online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit high-deductible hsa-eligible. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

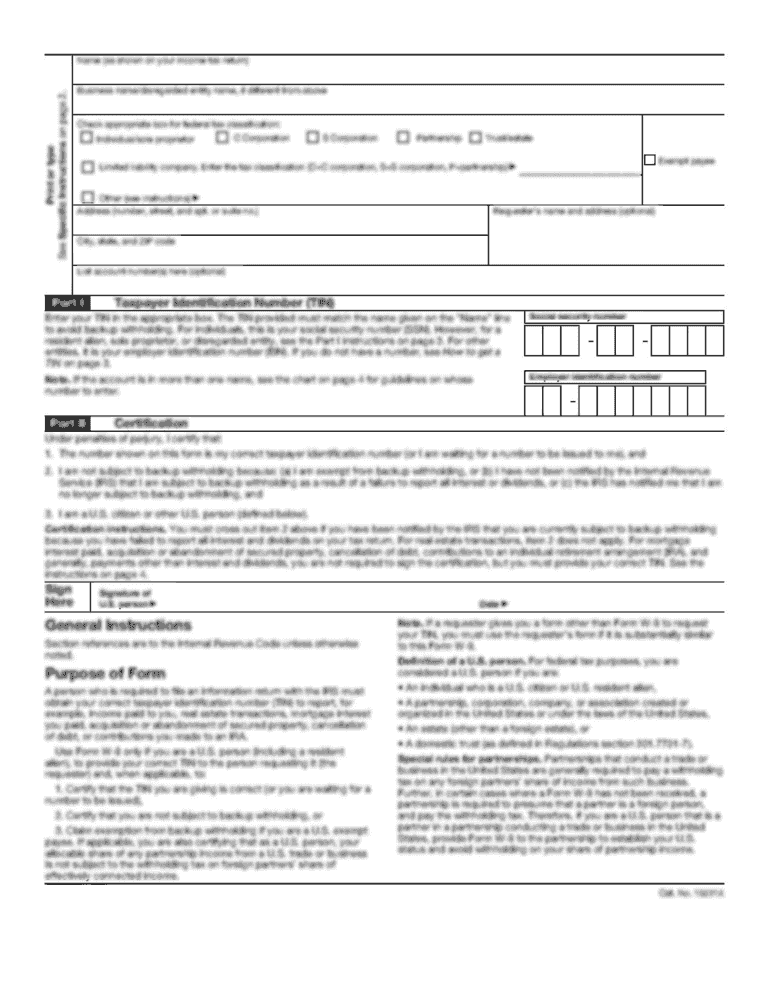

How to fill out high-deductible hsa-eligible

How to fill out high-deductible hsa-eligible:

01

Understand the requirements: Before filling out the high-deductible hsa-eligible form, it is crucial to have a clear understanding of the criteria for eligibility. Make sure you meet the high-deductible health plan requirements and are eligible to contribute to a health savings account (HSA).

02

Gather necessary information: Collect all the relevant documents and information needed to complete the form. This may include your personal details, employment information, insurance coverage details, and any other necessary supporting documentation.

03

Complete personal information: Start by filling out your personal information accurately, including your full name, date of birth, Social Security number, and contact information.

04

Provide employment details: If your high-deductible health plan is provided through your employer, you will need to provide information about your employment, such as your employer's name, address, and contact information.

05

Fill in insurance details: Provide the necessary information about your high-deductible health plan, including the name of the insurance company, policy number, effective dates, and coverage details. Make sure to review your health plan documents to ensure you have accurate information.

06

Declare HSA eligibility: Indicate on the form that you meet the requirements to contribute to a health savings account. This typically includes having a high-deductible health plan, not being covered by another health plan that disqualifies you from having an HSA, and not being enrolled in Medicare.

07

Review and submit: Once you have completed all the necessary sections of the form, take the time to review your answers for accuracy and completeness. Double-check all information before submitting the form to ensure there are no errors.

Who needs high-deductible hsa-eligible:

01

Individuals seeking lower premium costs: Those who are looking for more affordable health insurance options may consider a high-deductible hsa-eligible plan. These plans often have lower monthly premiums compared to traditional health insurance plans.

02

Individuals who want to save for medical expenses: A high-deductible health plan paired with a health savings account allows individuals to set aside funds for future medical expenses. This can be beneficial for those who anticipate higher healthcare costs or want to save for future healthcare needs.

03

Self-employed individuals and small business owners: High-deductible hsa-eligible plans can be attractive options for self-employed individuals or small business owners who are responsible for their own health insurance. These plans offer flexibility and potential tax advantages through contributions to the HSA.

In conclusion, anyone who meets the eligibility requirements and wants to save on premiums while having the ability to save for healthcare expenses may consider a high-deductible hsa-eligible plan. It is important to carefully consider your healthcare needs and financial situation before choosing this type of insurance coverage.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is high-deductible hsa-eligible?

High-deductible HSA-eligible refers to a health insurance plan with a high deductible that meets the requirements set by the IRS to be eligible for a Health Savings Account (HSA).

Who is required to file high-deductible hsa-eligible?

Individuals who have a high-deductible HSA-eligible health insurance plan and wish to contribute to a Health Savings Account (HSA) are required to file.

How to fill out high-deductible hsa-eligible?

To fill out high-deductible HSA-eligible forms, you will need to provide information such as your insurance plan details, contributions to your HSA, and other relevant financial information.

What is the purpose of high-deductible hsa-eligible?

The purpose of high-deductible HSA-eligible plans is to help individuals save money on healthcare costs by offering a tax-advantaged way to set aside funds for medical expenses.

What information must be reported on high-deductible hsa-eligible?

Information such as insurance plan details, contributions to the HSA, qualified medical expenses, and any withdrawals made from the HSA must be reported on high-deductible HSA-eligible forms.

When is the deadline to file high-deductible hsa-eligible in 2023?

The deadline to file high-deductible HSA-eligible forms in 2023 is typically April 15th, unless an extension has been applied for and granted.

What is the penalty for the late filing of high-deductible hsa-eligible?

The penalty for late filing of high-deductible HSA-eligible forms can vary, but may result in a fine or loss of tax benefits associated with the HSA.

Can I sign the high-deductible hsa-eligible electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your high-deductible hsa-eligible.

How do I fill out high-deductible hsa-eligible using my mobile device?

Use the pdfFiller mobile app to complete and sign high-deductible hsa-eligible on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit high-deductible hsa-eligible on an iOS device?

You certainly can. You can quickly edit, distribute, and sign high-deductible hsa-eligible on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your high-deductible hsa-eligible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.