Get the free PALM BEACH COUNTY TAX COLLECTOR

Show details

Governmental Center 301 N. Olive Avenue, 3rd Floor West Palm Beach, FL 33401 Mailing Address Post Office Box 3715 West Palm Beach, FL 334023715 www.pbctax.com Tel (561) 3552264 (561) 3554123 Downtown

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your palm beach county tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your palm beach county tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing palm beach county tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit palm beach county tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out palm beach county tax

How to fill out Palm Beach County tax?

01

Gather necessary documents: Before filling out your Palm Beach County tax, make sure you have all the required documents handy. This may include your W-2 forms, receipts for deductible expenses, and any other relevant financial statements.

02

Determine your filing status: You need to identify your filing status, whether you are filing as single, married, head of household, or any other applicable status. This will determine the tax brackets and deductions available to you.

03

Calculate your income: Add up all your sources of income, including wages, tips, investments, and any other taxable income. Ensure that you accurately report all your earnings on the appropriate lines of the tax form.

04

Claim deductions and credits: Palm Beach County tax forms provide opportunities for deductions and credits, which can help lower your tax liability. Determine which deductions and credits you are eligible for and ensure you claim them correctly to maximize your tax savings.

05

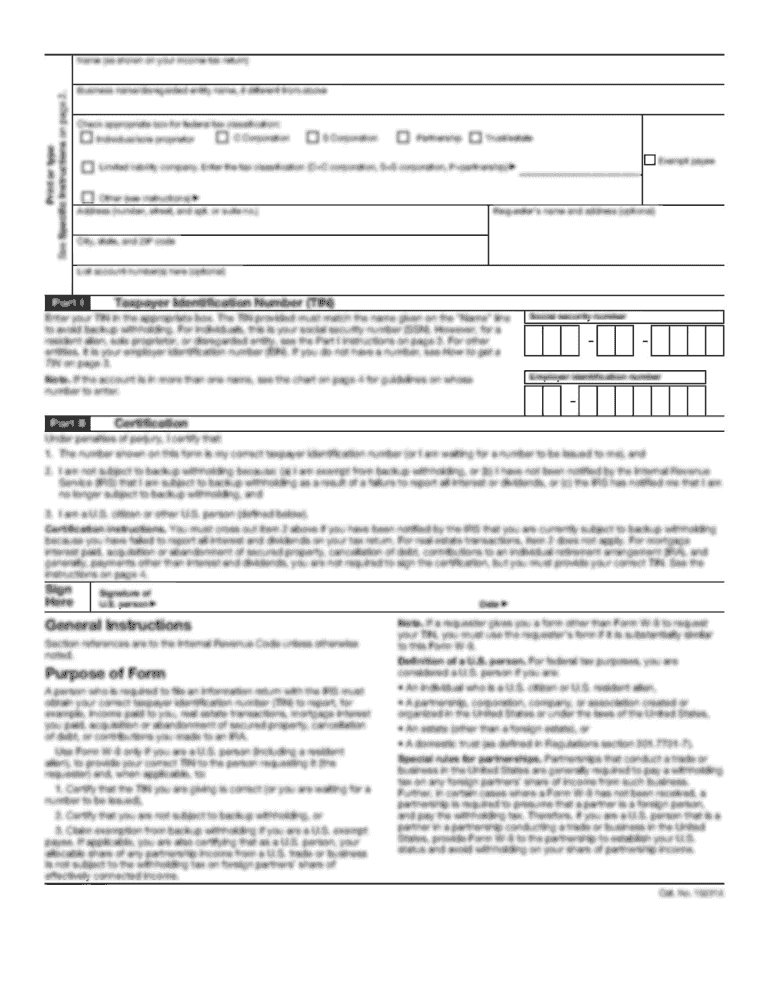

Fill out the tax form: Use the provided tax form, either a 1040 or the applicable Palm Beach County specific form, to report your income, deductions, and credits. Take your time to accurately fill out each section, as errors can lead to delays or complications.

06

Review and double-check: Once you have completed your tax form, review it thoroughly to ensure all the information is accurate and complete. Double-check your calculations and verify that you have reported everything correctly.

07

Sign and submit your tax form: Sign and date the tax form before submitting it. If you are filing electronically, follow the specific instructions provided by the tax authority. If you are mailing the form, make sure to include any necessary attachments and send it to the appropriate address.

Who needs Palm Beach County tax?

Residents of Palm Beach County who earn income above the federal tax filing threshold are required to file Palm Beach County tax. This applies to both individuals and businesses operating within the county. It is essential to understand the specific criteria and filing obligations set forth by the Palm Beach County tax authority to comply with the legal requirements. Failing to file taxes can result in penalties, fines, and legal consequences. Therefore, anyone meeting the established criteria should ensure they file their Palm Beach County tax returns accurately and on time.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is palm beach county tax?

Palm Beach County tax is a tax imposed on residents and businesses located within Palm Beach County.

Who is required to file palm beach county tax?

Any individual or business that meets the criteria set by Palm Beach County tax regulations is required to file Palm Beach County tax.

How to fill out palm beach county tax?

To fill out Palm Beach County tax, individuals and businesses must gather all necessary financial information and complete the appropriate forms provided by the county.

What is the purpose of palm beach county tax?

The purpose of Palm Beach County tax is to generate revenue for the county government to fund public services and infrastructure projects.

What information must be reported on palm beach county tax?

Information such as income, property holdings, and business earnings must be reported on Palm Beach County tax forms.

When is the deadline to file palm beach county tax in 2024?

The deadline to file Palm Beach County tax in 2024 is on April 15th.

What is the penalty for the late filing of palm beach county tax?

The penalty for late filing of Palm Beach County tax varies but generally includes additional fees and interest charges.

How can I edit palm beach county tax from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your palm beach county tax into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get palm beach county tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the palm beach county tax. Open it immediately and start altering it with sophisticated capabilities.

How do I complete palm beach county tax on an Android device?

On an Android device, use the pdfFiller mobile app to finish your palm beach county tax. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your palm beach county tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.