Get the free form 866 part c

Show details

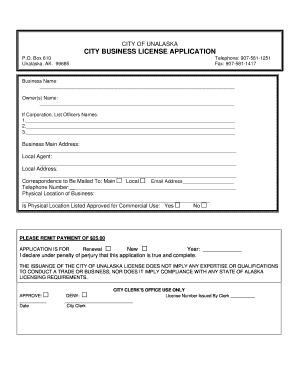

Form 866C Application for a protection visa PART C Personal details for each person included in this application Please use a pen, and write neatly in English using BLOCK LETTERS. PHOTOGRAPH Tick

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 866 part c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 866 part c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 866 part c online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 866c. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out form 866 part c

To fill out form 866 part c, follow these steps:

01

Start by providing your personal identification information, such as your name, address, and contact details.

02

Then, provide information about your immigration status, including your alien registration number and the basis of your application or petition.

03

Next, fill in the details of the foreign national for whom the application or petition is being filed, including their name, date of birth, and country of birth.

04

Specify the type of form being submitted and provide the relevant receipt number, if applicable.

05

If you are an attorney or accredited representative assisting with the application, provide your details in the corresponding section.

06

Follow the instructions for disclosing any criminal convictions or immigration violations, if applicable.

07

Finally, sign and date the form, and include any additional documentation or evidence required.

Form 866 part c is typically required for individuals who are filing applications or petitions with the U.S. Citizenship and Immigration Services (USCIS), such as those seeking to adjust their immigration status or apply for certain benefits. It is necessary to provide accurate and complete information on this form to ensure proper processing of the application or petition.

Fill form : Try Risk Free

People Also Ask about form 866 part c

Can I apply for another visa while on bridging visa A?

Can I have two US visa applications at the same time?

What visa options are available on bridging visa A?

Can you apply for 2 Australian visas at the same time?

Is subclass 866 a permanent visa?

How long can I stay on bridging visa A?

How do I change my bridging visa from A to B?

What is Australian visa number 866?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 866 part c?

Form 866 Part C is a document used by the United States Internal Revenue Service (IRS) during an audit or examination of an individual or business taxpayer. This form is specific to excise tax provisions and is used to show the IRS any primary changes or computational adjustments made to the taxpayer's Excise Tax Return (Form 720). It provides detailed information about the taxpayer's excise tax liabilities, adjustments, and any penalties or interest owed.

Who is required to file form 866 part c?

Form 866-C, also known as the Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code, is filed by organizations seeking tax-exempt status under section 501(c)(4) of the Internal Revenue Code. These organizations are typically social welfare nonprofits that are engaged in promoting community welfare and operate for the benefit of the general public. They are required to file Form 866-C with the Internal Revenue Service (IRS) to apply for tax-exempt status.

How to fill out form 866 part c?

Form 866, also known as the Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code, has several parts. Part C specifically pertains to the Narrative Description of Activities. Here are the steps to fill out Part C of Form 866:

1. Read the instructions: Familiarize yourself with the instructions provided with Form 866. It will provide you with guidance on how to complete Part C.

2. Understand the purpose: Part C requires you to describe the activities your organization will conduct to qualify for 501(c)(4) tax-exempt status. The IRS wants to know about the nature and extent of your organization's planned activities.

3. Enter the narrative description: In the space provided in Part C, write a detailed narrative description of your organization's activities. This should include information about the primary activities you will engage in to achieve your exempt purpose.

4. Provide specific details: Ensure your narrative description is comprehensive and specific. Describe the programs, services, or activities you plan to undertake in order to fulfill your organization's purpose. Include details about who will benefit from these activities and how they will benefit.

5. Support claims with evidence: If possible, provide evidence or supporting documents for the activities you mention in your narrative. This may include brochures, flyers, plans, or any other relevant materials that can validate the projected activities.

6. Be concise and clear: While being thorough, also make sure your narrative remains concise and clear. Use concise language, bullet points, and subheadings to make it easier to read and understand.

7. Review and revise: After completing Part C, review your narrative description for accuracy, clarity, and completeness. Make any necessary revisions or additions before submitting the form.

8. Keep a copy: Make a copy of the completed Form 866, including Part C, for your records before mailing or filing it with the IRS.

It's crucial to note that Form 866 is a complex document, and seeking professional assistance, such as from a tax attorney or certified public accountant, may be helpful to ensure accuracy and compliance with IRS regulations.

What is the purpose of form 866 part c?

Form 866 Part C is used for the authorization or consent to disclose information to the IRS by a taxpayer. The purpose of this form is to provide consent for the IRS to communicate and exchange information with third parties, such as tax practitioners or other representatives, on matters related to the taxpayer's tax return. This form allows the taxpayer to authorize the release of confidential tax information to designated parties, ensuring efficient communication and representation for tax matters.

What information must be reported on form 866 part c?

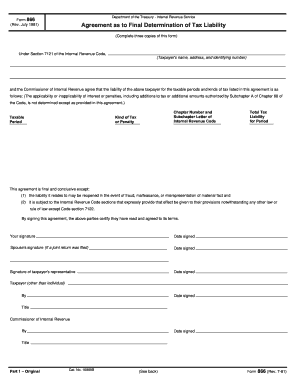

Form 866 (Acceptance of Extension of Time to Assess Tax) is used by taxpayers to extend the time the IRS has to assess tax liabilities.

Part C of Form 866 requires the filer to provide the following information:

1. Taxpayer details: This includes the taxpayer's name, business name (if applicable), address, Social Security Number (SSN) or Employer Identification Number (EIN).

2. Contact person details: If the taxpayer has a contact person authorized to discuss the extension request, their name, title, daytime phone number, and fax number should be provided.

3. Type of tax and period covered: Specify the type of tax (e.g., income tax, estate tax, gift tax, employment tax, excise tax) and the specific taxable period for which the extension is being requested.

4. Specific provisions: Indicate the specific provisions under which the extension request is being made. The options include:

a) Section 6501(c)(4) - For income, estate, or gift tax assessments related to an international transfer pricing agreement.

b) Section 6501(c)(8) - For income, estate, or gift tax assessments related to valuation misstatements.

c) Section 6501(c)(9) - For employment tax assessments related to employee remuneration.

d) Other provisions that may be applicable.

5. Description of adjustments: Provide a detailed explanation of the adjustments or reasons why the extension is being requested. This should include the taxable items affected, amounts involved, and any relevant supporting documentation.

6. Signature: The form must be signed by the taxpayer or an authorized representative.

It is important to note that specific instructions and requirements may change based on updated IRS guidelines and regulations. Therefore, it is advisable to refer to the most recent version of the Form 866 and consult with a tax professional or the IRS directly for accurate and up-to-date information.

What is the penalty for the late filing of form 866 part c?

Form 866 is a federal tax form used by small businesses to report their income, expenses, and deductions. However, there is no specific form 866 part c. Therefore, it is not possible to provide a penalty for the late filing of a form that does not exist. If you are referring to a different tax form or section, please provide more specific information so I can assist you better.

How do I edit form 866 part c in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form 866c and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the question 40 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form 866 part c right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit form 866c straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing question 40.

Fill out your form 866 part c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Question 40 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.