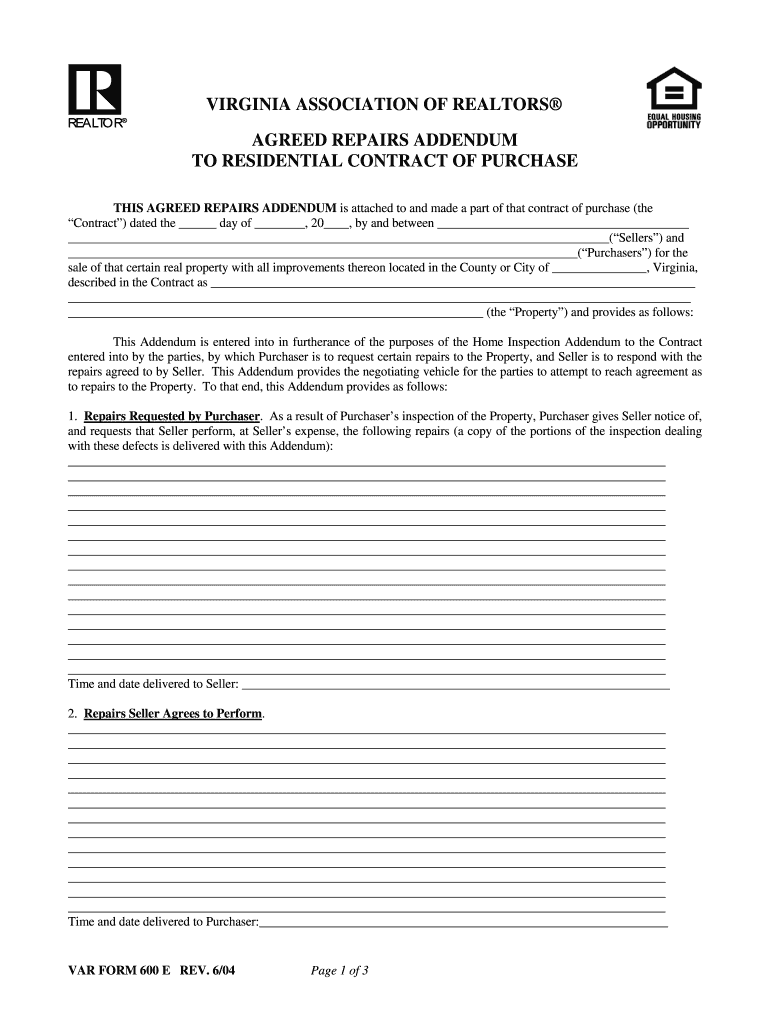

(a) At the time of filing this Agreement, the Seller has satisfied all of its obligations under the Contract. (b) The Seller is unable to cure this defect or is unable to afford all of its reasonable remedies for the defect. Notwithstanding the foregoing, the remedies available under this Agreement shall be limited to the payment of all expenses, costs, damages, and attorney fees due to the Seller, whether they can be recovered in the small claim action and without limiting any other remedies which are available to the Seller, as otherwise provided in the Agreement. © The provisions of this Agreement shall apply to the repair or replacement of all fixtures, parts, equipment, appliances, and the improvement at the expense of the Seller and shall govern the breach, termination, and failure to perform any other terms of this Agreement and shall be enforced by action against the person, firm, corporation, or association, and for its obligations and damages, or with the consent of Seller. (d) The Agreement does not authorize the payment or reimbursement of the expenses, costs, damages, or attorney fees under these terms. (e) The Agreement may not provide the Seller or Purchaser with such indemnity in the event of the failure of the Purchaser's or Seller's insurer to pay any amount due Seller or Purchaser. 3. (a) This Agreement is the entire agreement between the Sellers and the Purchasers for the repair of the Property and the obligation and acceptance of the obligation of the Purchasers hereunder and supersedes and shall not be in any way modified or terminated by any oral agreement hereunder between the Sellers and the Purchasers. (b) It is understood that the Contract or an assignment of the Contract by the Seller (or an assignment of the Contract entered into by Seller) does not affect the rights or obligations of either party. © Any failure by a party to perform the Contract is deemed a breach of the Contract and the breach remains binding and shall not be amended or modified except as required by law or to effect compliance with this Agreement and any laws or regulations applicable to the Seller or Purchaser which are not inconsistent with provisions of this Agreement. 4. The Seller warrants and represents to the Purchaser that it has the power and authority to make all repairs necessary to render the Property habitable after the date hereof and to make reasonable repairs necessary to secure the Seller's obligations under the Contract.

Get the free var form 600

Show details

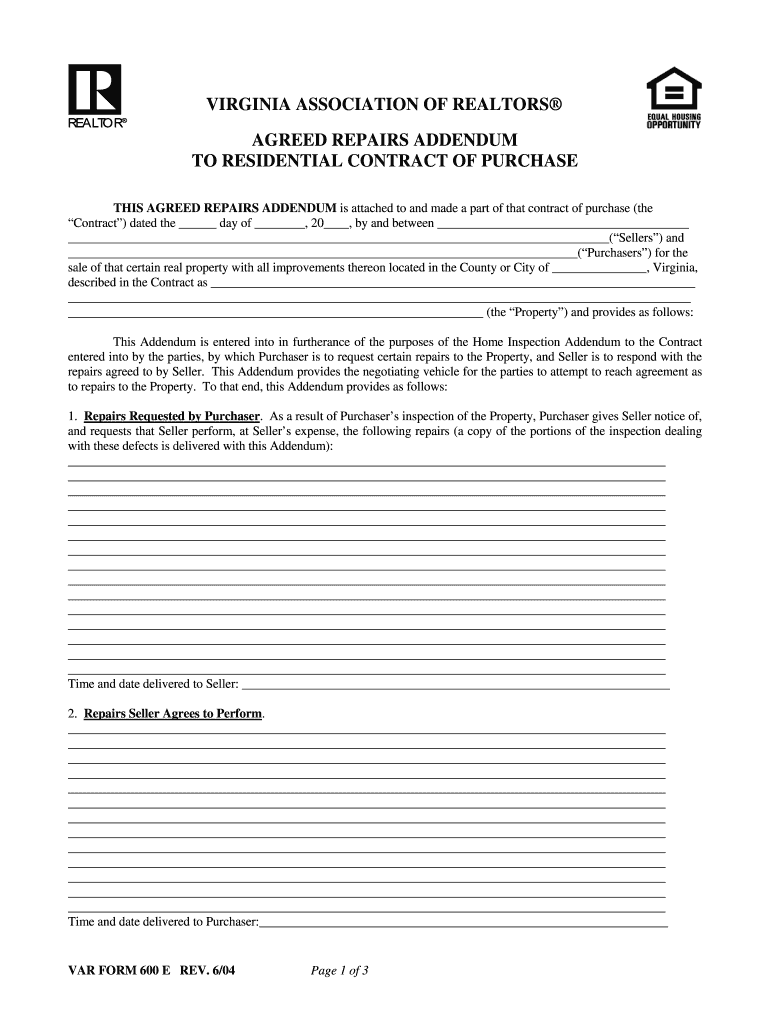

VIRGINIA ASSOCIATION OF REALTORS AGREED REPAIRS ADDENDUM TO RESIDENTIAL CONTRACT OF PURCHASE THIS AGREED REPAIRS ADDENDUM is attached to and made a part of that contract of purchase (the Contract)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your var form 600 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your var form 600 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing var form 600 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit var form 600. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Video instructions and help with filling out and completing var form 600

Instructions and Help about var form 600

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is var form 600?

Could you please provide more context or specify what you are referring to? "Var form 600" does not seem to correspond to any specific term or concept.

Who is required to file var form 600?

Form 600 is a California tax form used to report and pay sales and use tax. Generally, any individual, partnership, corporation, or other organization that engages in business in California and makes sales of merchandise subject to sales tax is required to file Form 600. Additionally, out-of-state sellers who meet certain economic nexus thresholds are also required to file Form 600. It is recommended to consult with a tax professional or the California Department of Tax and Fee Administration for specific guidance regarding the filing requirements for Form 600.

How to fill out var form 600?

To fill out the VAR Form 600, please follow these steps:

1. Start by downloading the VAR Form 600 from the official website of the relevant authority or organization that requires the form.

2. Read the instructions carefully to understand the purpose and requirements of the form. Make sure you have all the necessary information and supporting documents ready before you begin.

3. Begin filling out the form by providing your personal information, such as your name, contact details, and any identification numbers required.

4. Fill in the details of your business, including the legal name, address, and contact information.

5. Indicate the type of business you are engaged in by selecting the appropriate category from the options provided.

6. Provide information about your business activities, such as the products or services you offer, key markets, and any licenses or permits you hold.

7. If applicable, provide details of any business or trade agreements you have with other parties, including their names and contact information.

8. Fill in the financial information section, which may include details of your business's annual turnover, profits, and assets.

9. If required, provide details of any relevant qualifications, experience, or certifications you possess that are necessary for your business activities.

10. Review the completed form to ensure all information is accurate and complete. Make any necessary corrections before submitting it.

11. Sign and date the form as required. Some forms may also require additional signatures from other parties, such as business partners or authorized representatives.

12. Make copies of the completed form for your records.

13. Submit the filled-out form by the specified method, such as mailing it to the designated address or submitting it electronically through an online portal.

Please note that the specific requirements and sections of the VAR Form 600 may vary depending on the jurisdiction or organization for which the form is intended. It is always advisable to carefully review the instructions provided with the form and seek professional advice if needed.

What is the purpose of var form 600?

There is no specific purpose or meaning of "var form 600" as it is not a commonly known or standardized term or concept. Without more context or information, it is difficult to determine what exactly you are referring to and its purpose.

What is the penalty for the late filing of var form 600?

The penalty for the late filing of a VAR form 600 (which represents a California sales and use tax return) can vary depending on the specific circumstances and the amount of taxes owed. Generally, the penalty consists of a percentage of the unpaid tax due, typically ranging from 10% to 25% of the amount owed. Additionally, interest may accrue on the unpaid amount until it is fully paid. It is advisable to check with the California Department of Tax and Fee Administration or a tax professional for accurate and up-to-date information on penalties and interest rates.

How can I edit var form 600 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like var form 600, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send var form 600 for eSignature?

When you're ready to share your var form 600, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in var form 600 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing var form 600 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your var form 600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.