OK OTC 215 2007-2024 free printable template

Show details

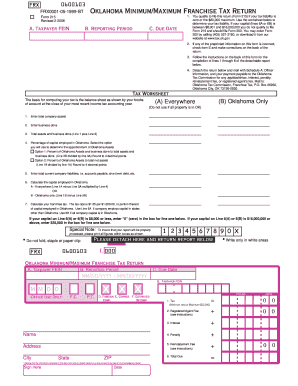

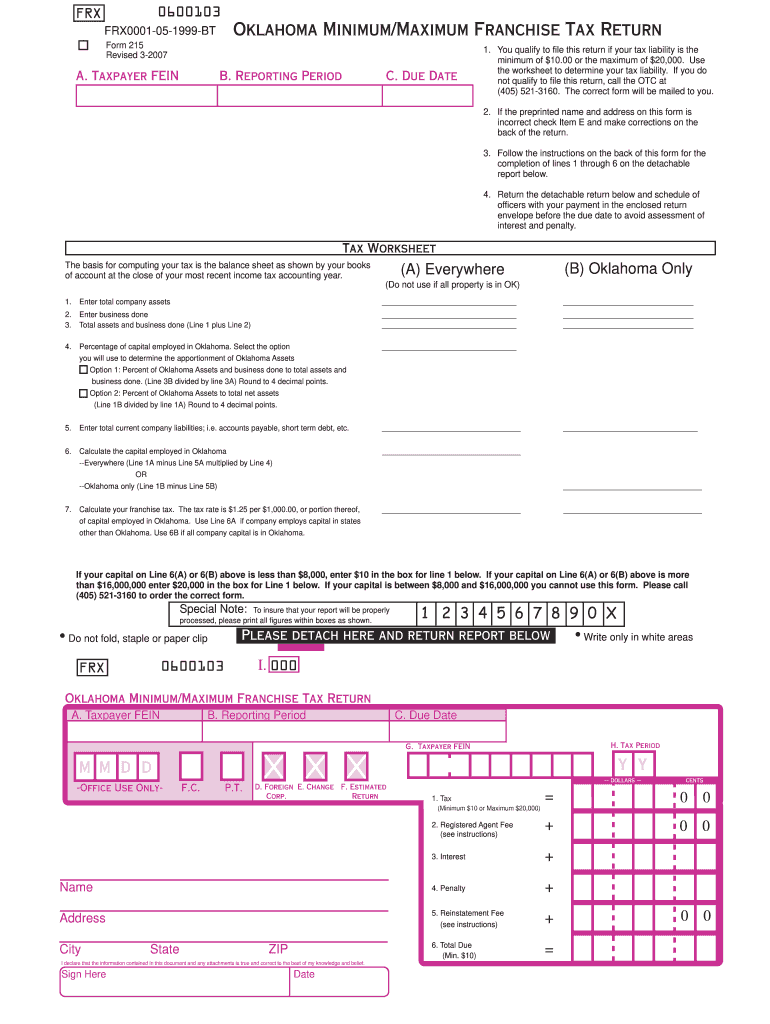

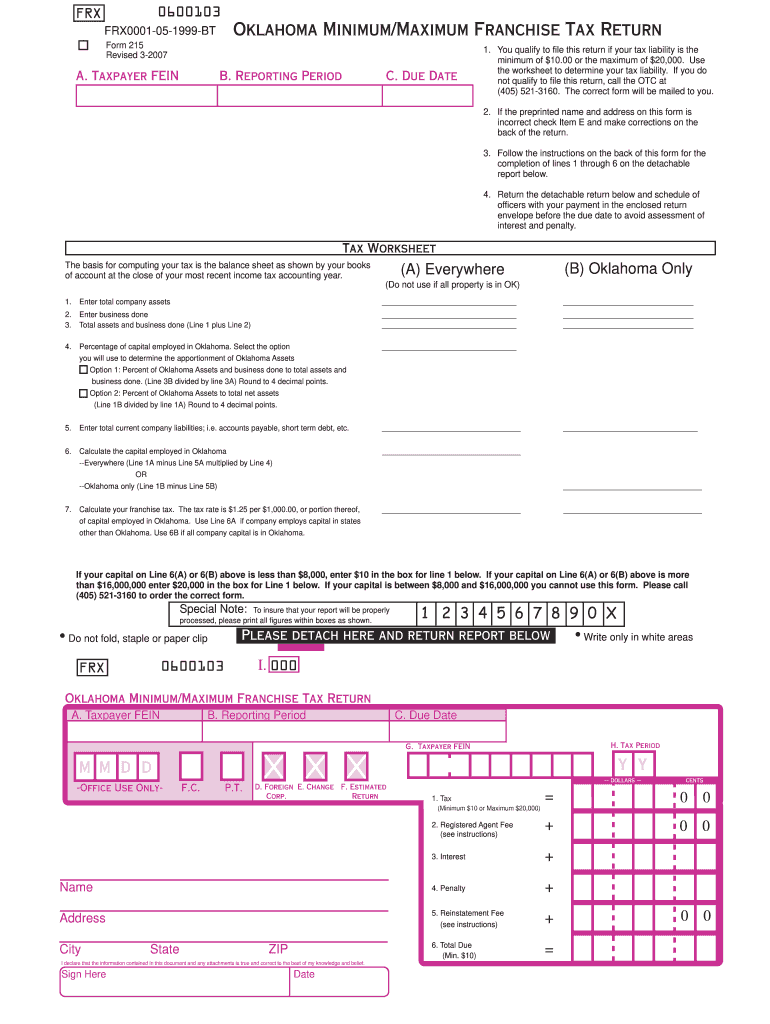

Oklahoma Tax Commission Oklahoma Minimum/Maximum Franchise Tax Return Form 215 Delinquent Filers Only This version of Form 215 is for delinquent filers only. Not for use for current reports. 0600103 FRX FRX0001-05-1999-BT Revised 3-2007 A. Taxpayer FEIN B. Reporting Period C. Due Date 1. You qualify to file this return if your tax liability is the minimum of 10. 00 or the maximum of 20 000. Use the worksheet to determine your tax liability. If you do not qualify to file this return call the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your oklahoma minimum franchise 2007-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma minimum franchise 2007-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma minimum franchise online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partnership oklahoma form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

OK OTC 215 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma minimum franchise 2007-2024

How to fill out form Oklahoma?

01

Start by downloading the form from the official Oklahoma government website.

02

Read the instructions carefully to understand the requirements and gather all the necessary information and documents.

03

Begin by filling out the personal information section, including your name, address, and contact details.

04

Provide any additional details requested, such as your social security number, driver's license information, or other identification numbers.

05

If the form requires you to provide information about your employment or income, make sure to fill in these sections accurately.

06

Double-check all the entered information for accuracy and completeness.

07

If there are any specific sections or parts of the form that you are unsure about, consult the provided instructions or seek assistance from the appropriate authority.

08

Sign and date the form as required. If the form requires notarization, make sure to have it properly notarized.

09

Submit the completed form according to the instructions provided, either by mail, in-person, or online if applicable.

Who needs form Oklahoma?

01

Residents of Oklahoma who need to file various official documents or applications may require form Oklahoma.

02

Individuals seeking to obtain a driver's license, state identification card, or other documents issued by the Oklahoma Department of Public Safety may need to complete form Oklahoma.

03

Employers in Oklahoma may also use form Oklahoma for tax reporting purposes or to provide necessary information about their employees.

04

Various state agencies, such as the Oklahoma Tax Commission or the Oklahoma Employment Security Commission, may require the use of form Oklahoma for specific purposes.

05

Always check the specific requirements or instructions for each form or application to determine if form Oklahoma is necessary.

Fill tax file : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form oklahoma?

There isn't a specific form called "form Oklahoma." Can you please provide more context or clarify your question?

Who is required to file form oklahoma?

Individuals who are residents of Oklahoma, nonresidents who derive income from Oklahoma sources, and part-year residents are required to file an Oklahoma tax return. Additionally, anyone who earned income from Oklahoma sources, such as wages, self-employment income, rental income, or gambling winnings, may be required to file a tax return in Oklahoma.

How to fill out form oklahoma?

To fill out a form in Oklahoma, follow these steps:

1. Read the instructions: Carefully read the instructions provided with the form to understand the purpose of the form and any specific requirements for filling it out.

2. Gather necessary information: Collect all the information and documents required to complete the form. This may include personal details, identification numbers, addresses, or employment information. It's important to have everything prepared before starting to fill out the form.

3. Use legible handwriting: If you are filling out a paper form, use legible handwriting to ensure accuracy. If available, it may be easier to fill out the form electronically on a computer.

4. Complete all sections: Fill out all sections of the form accurately and completely. Avoid leaving any blanks unless it specifically instructs you to do so.

5. Use black or blue ink: If you are filling out a paper form, use black or blue ink to ensure the information is visible and readable.

6. Double-check your entries: Review the form carefully to ensure all information is accurate and complete. Double-check important details such as your name, address, and contact information.

7. Attach required documents: If any additional documents are required to be submitted with the form, attach them as instructed. Make sure to photocopy any documents you submit for your own records.

8. Review and sign: Ensure you have reviewed the form thoroughly, then sign and date where required. If filling out an electronic form, follow the instructions to sign electronically.

9. Make copies: Make copies of the completed form for your own records before submitting it.

10. Submit the form: Send the completed form to the appropriate recipient as instructed. This could involve mailing it, submitting it online, or delivering it in person to the relevant agency or office.

Remember to keep copies of all forms and supporting documents for your records.

What is the penalty for the late filing of form oklahoma?

The penalty for the late filing of a form in Oklahoma depends on the specific form and the circumstances. In general, late filing penalties in Oklahoma can range from a flat dollar amount to a percentage of the tax due. The specific penalty amounts and rules can be found in the Oklahoma Tax Code and may vary depending on the type of form being filed (e.g., income tax, sales tax, etc.). It is recommended to refer to the instructions and guidelines provided with the specific form for accurate and up-to-date penalty information.

How can I send oklahoma minimum franchise to be eSigned by others?

When you're ready to share your partnership oklahoma form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit return tax in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing ok tax commission 215 online and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the oklahoma 215 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tax file filing form in seconds.

Fill out your oklahoma minimum franchise 2007-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Return Tax is not the form you're looking for?Search for another form here.

Keywords relevant to income filing form

Related to oklahoma 215 franchise return blank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.