Get the free Get Your Taxes Reduced

Show details

BOE-30S-A REV. 02 (08-09) Humboldt County Assessor 825 Fifth Street, Room 300 Eureka, CA 95501-1153 707-445-7663 Toll Free 866-240-0485 Fax 707-445-7410 2012-2013 INFORMAL ASSESSMENT REVIEW California

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your get your taxes reduced form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your get your taxes reduced form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit get your taxes reduced online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit get your taxes reduced. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out get your taxes reduced

How to Fill Out Get Your Taxes Reduced?

01

Gather all necessary documents: Start by collecting all relevant financial documents such as W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant paperwork. This will help you accurately report your income and deduct eligible expenses.

02

Understand tax exemptions and deductions: Familiarize yourself with the various tax exemptions and deductions that apply to your situation. This could include deductions for mortgage interest, educational expenses, medical expenses, or business-related expenses. Knowing what deductions you qualify for can significantly reduce your tax burden.

03

Consider hiring a tax professional: If you find taxes confusing or overwhelming, it may be beneficial to hire a tax professional. They can help ensure that you accurately fill out your tax forms, maximize your deductions, and take advantage of any available tax credits.

04

Use tax software or online platforms: Alternatively, you can utilize tax software or online platforms to guide you through the tax-filing process. These tools often provide step-by-step instructions and ensure that you don't miss any important information.

05

Review and double-check your forms: Before submitting your tax forms, review them carefully to avoid any errors or omissions. Even small mistakes can lead to potential penalties or delays in processing your return. Double-checking your forms will help ensure their accuracy and increase the chances of successfully reducing your taxes.

Who needs to get their taxes reduced?

01

Individuals with high taxable income: High-income earners often face higher tax liabilities. Therefore, it is crucial for them to find ways to reduce their taxes through legal deductions, exemptions, and tax planning strategies.

02

Small business owners: Business owners can benefit from various tax deductions available for expenses related to their business operations. These deductions can significantly reduce their taxable income and lower their overall tax liability.

03

Homeowners and real estate investors: Owning a home or real estate can provide several tax advantages. Deductions for mortgage interest, property taxes, and even depreciation can help reduce the overall tax burden of homeowners and real estate investors.

In summary, learning how to fill out your tax forms accurately and understanding the available tax deductions is essential for reducing your taxes. It is beneficial for individuals with high taxable income, small business owners, and homeowners/real estate investors to explore strategies to minimize their tax liability. Seeking assistance from professionals or using tax software can also be beneficial in navigating through the tax-filing process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

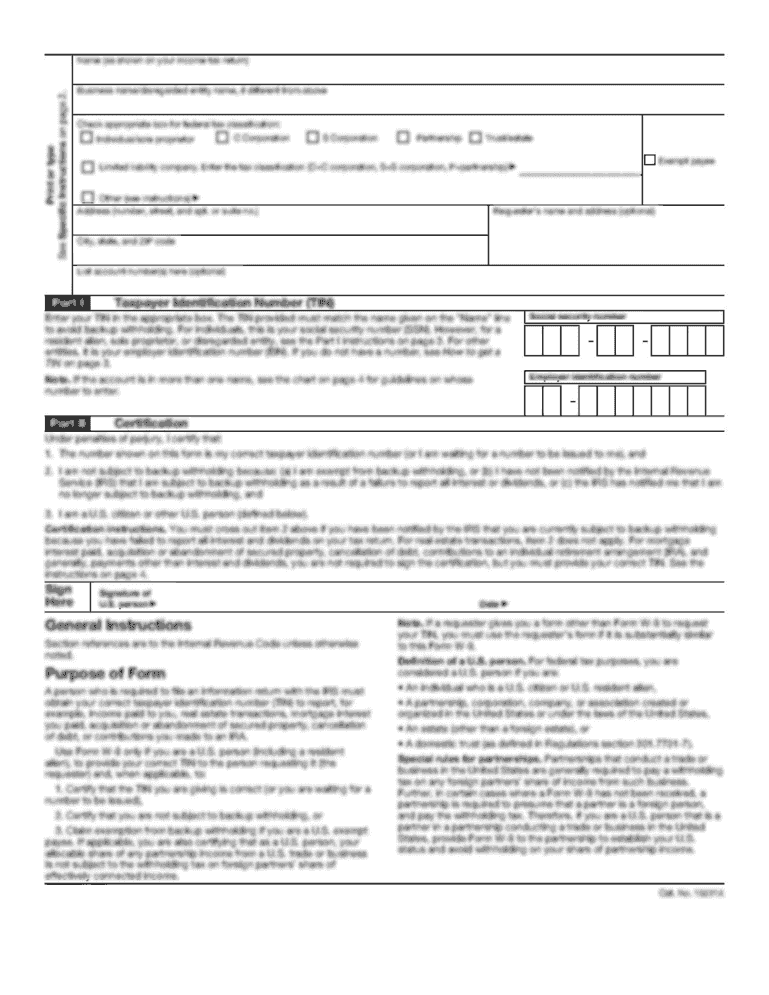

What is get your taxes reduced?

Get your taxes reduced is a tax strategy where individuals or businesses utilize legal methods to lower the amount of taxes they owe to the government.

Who is required to file get your taxes reduced?

Any individual or business can choose to explore tax reduction strategies to potentially lower the amount of taxes they owe, but it is not a mandatory filing requirement.

How to fill out get your taxes reduced?

Filling out get your taxes reduced involves analyzing your financial situation, identifying possible deductions and credits, and implementing strategies that can reduce your taxable income. It is important to consult with a tax professional or utilize tax software to ensure accurate completion.

What is the purpose of get your taxes reduced?

The purpose of get your taxes reduced is to help individuals and businesses minimize their tax liability legally. By reducing the amount of taxes owed, individuals and businesses can potentially keep more of their income or profits.

What information must be reported on get your taxes reduced?

The specific information required to be reported on get your taxes reduced depends on the tax jurisdiction and applicable tax laws. Generally, it involves reporting income, deductions, credits, and any other relevant financial information.

When is the deadline to file get your taxes reduced in 2023?

The deadline to file get your taxes reduced in 2023 varies depending on the tax jurisdiction and type of taxes being filed. It is important to consult the specific tax authority or a tax professional to determine the exact deadline.

What is the penalty for the late filing of get your taxes reduced?

The penalty for the late filing of get your taxes reduced also depends on the tax jurisdiction and applicable tax laws. It can include monetary fines, interest charges, or other consequences. It is advisable to consult the specific tax authority or a tax professional to understand the penalties for late filing.

How can I send get your taxes reduced for eSignature?

get your taxes reduced is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the get your taxes reduced in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the get your taxes reduced in Gmail?

Create your eSignature using pdfFiller and then eSign your get your taxes reduced immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your get your taxes reduced online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.